The price of the native token of smart contract platform Cardano ($ADA) has surged by more than 43% over the past week and over 140% in the last 12-month period amid a wider cryptocurrency market rally. ADA’s surge was notably accompanied by a rise in whale transactions.

The cryptocurrency, as CoinDesk reported, has recently briefly surpassed the $0.9 mark on various exchanges – its highest level since May 2022 – amid the rise, to have a market capitalization of over $30 billion.

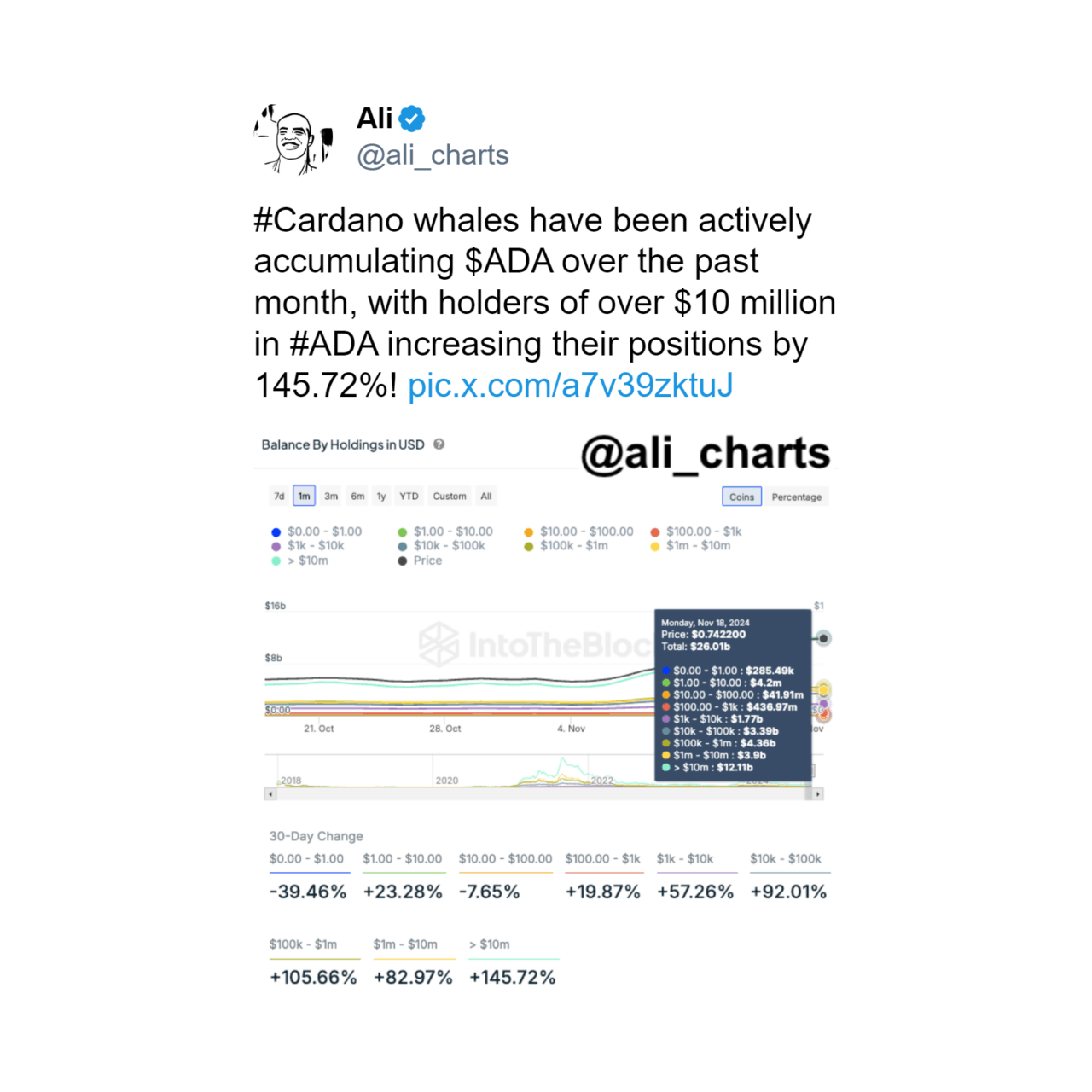

The rally has been fueled by whale accumulation, with popular cryptocurrency analyst Ali Martinez noting that over the past month holders of over $10 million in ADA have increased their positions by over 145%.

As reported, on-chain analysis firm Santiment has noted that “Cardano is decoupled from the altcoin pack” as it moved to a near 8-month high. The firm added that ADA’s price ratio against BTC is also at a similar high, with the last time the whale volume was similar being ahead of a significant 26% price jump.

The cryptocurrency bull run has been benefiting the Cardano Foundation as well. As reported, the nonprofit organization supporting the Cardano ecosystem has revealed in a recent report that as of Dec.31, 2023, it held $478.24 million in assets, with 82.5% of those being held in ADA, 10.1% in BTC, and the rest in cash and cash equivalents.

The value of these assets has likely grown significantly since, given the crypotocurrency market’s recent price rally. Its ADA holdings, for example, are up more than 100% over the past year, if the Foundation didn’t sell any.

The report details that the Cardano Foundation’s main income stream comes from the staking rewards generated by delegating the ADA tokens it holds on the Cardano network. Last year, it notes, its 668.8 million ADA tokens generated 20.9 million additional ADA, a 3.1% return.

Featured image via Unsplash.