U.S. authorities are scrutinizing Tether for potential breaches of anti-money-laundering laws and sanctions, according to sources cited by The Wall Street Journal (WSJ) in a report written by Angus Berwick, Vivian Salama, and Ben Foldy and published earlier today.

The WSJ says that sources familiar with the matter told them the probe, which is apparently being led by the Manhattan U.S. Attorney’s Office, is investigating whether third parties have utilized Tether’s stablecoin to finance illegal activities or to launder the money generated from such activities. The Treasury Department is also purportedly contemplating sanctions against Tether due to its cryptocurrency’s popularity among groups and individuals under U.S. sanctions. If imposed, such sanctions would prevent Americans from doing business with Tether.

Per the WSJ report, Tether’s stablecoin, USDT, which maintains a 1-to-1 peg with the U.S. dollar, has become a central concern for U.S. regulators and enforcement agencies. Unlike more volatile digital currencies, Tether’s value stability has made it an attractive substitute for the dollar in areas where U.S. currency is restricted. With daily trading volumes reaching approximately $190 billion, Tether remains the world’s most traded cryptocurrency, playing a crucial role in several national security challenges, according to the Journal’s previous reporting.

The WSJ article also mentioned that the U.S. Justice Department’s inquiry into Tether has been ongoing for several years, initially focusing on allegations that some Tether backers may have falsified documents to gain access to the global banking system. Tether has stated that it has no indication of a broader investigation, dismissing accusations of involvement in criminal activities as unfounded.

According to the WSJ report, Tether said in a statement:

“To suggest that Tether is somehow involved in aiding criminal actors or sidestepping sanctions is outrageous. We work actively with U.S. and international law enforcement to combat illicit activity, as we’ve publicly demonstrated many times.”

Tether has also intensified its efforts to monitor the usage of its stablecoin. The company’s executives emphasize that the transparency of blockchain records, which track tether transactions, makes it unsuitable for illicit use and assists authorities in tracing funds.

Tether has recently bolstered its monitoring capabilities, collaborating with analytics firms Chainalysis and TRM Labs to enhance transaction oversight. The company also froze 1,850 wallets and recovered $114 million in assets last month.

In response to this story, Tether CEO Paolo Ardoino said on social media platform X that this was fake news:

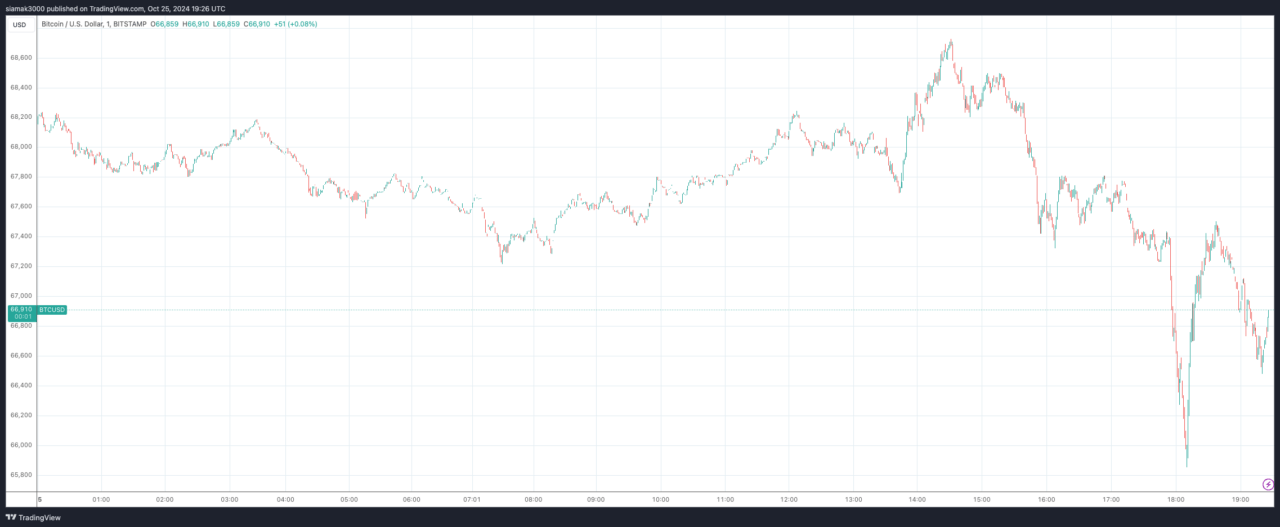

This news seems to have negatively affected the price of Bitcoin. As of 7:25 p.m. UTC on November 25, Bitcoin was trading at around $66,697, down 1.6% in the past 24-hour period.

In its Q2 2024 Attestation Report, released on 31 July 2024, Tether Holdings Limited, audited by BDO, affirmed the accuracy of its financial and reserve reports. The report highlights Tether’s continued financial strength, showcasing a record net operating profit of $1.3 billion for Q2 2024, contributing to a remarkable $5.2 billion profit for the first half of the year. This performance underscores the robustness of Tether’s revenue base, primarily driven by investments in traditional asset classes like U.S. Treasuries.

A key achievement noted in the report is Tether’s unprecedented ownership of U.S. Treasuries, which surpassed $97.6 billion by June 30, 2024. This positions Tether among the top global holders of U.S. debt, ranking 18th overall and 3rd in purchases of 3-month U.S. Treasuries, trailing only the United Kingdom and the Cayman Islands. The growing adoption of Tether’s USDt token suggests that it could soon become the largest holder of U.S. Treasuries.

The Group’s equity rose by $520 million in Q2 despite a $653 million unrealized loss due to declining Bitcoin prices, which was partially offset by a $165 million gain from gold investments. As of June 30, 2024, Tether’s consolidated net equity stood at an impressive $11.9 billion.

Tether also emphasized its commitment to transparency and stability, maintaining excess reserves of $5.3 billion to support its token’s stability. The report detailed that Tether’s assets exceed its liabilities by over $5.3 billion, affirming its strong financial position. The company issued over $8.3 billion in USDt during the quarter and continues to invest profits in strategic projects to bolster its ecosystem, further solidifying its leadership in the stablecoin industry.

Update at 6:15 a.m. UTC on October 26:

Featured Image via Unsplash