While October is a traditionally bullish month for the cryptocurrency space that between 2010 and 2023 saw an average gain of 28.7% for the cryptocurrency according to CCData, this year the month started with an aggressive sell-off.

Market data shows that Bitcoin is at the time of writing trading at $61,350 after falling nearly 4% in the last 24-hour period, erasing the cryptocurrency’s gains over the past week and bringing its 30-day performance down to 5% after it defied its historically poor performance in September.

The cryptocurrency’s price dropped after Iran fired around 180 ballistic missiles at Israel in what Iran’s Revolutionary Guard Corps said was a retaliation for the assassinations of Hamas’s political leader and an Iranian commander.

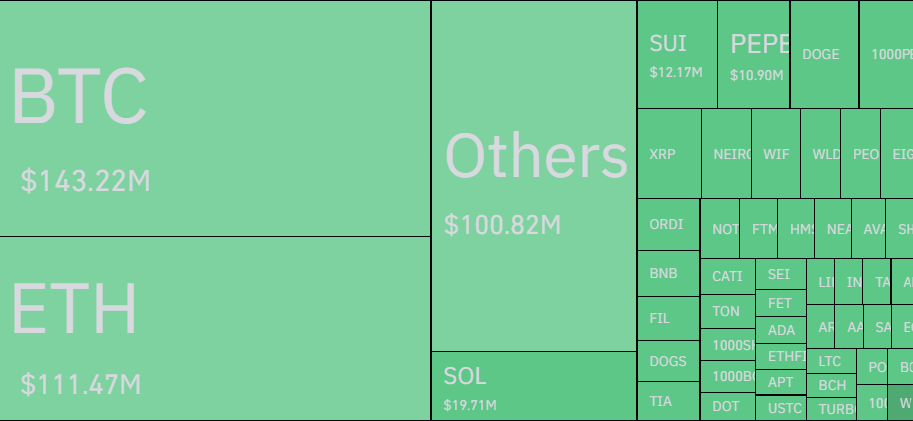

The market turmoil has led to significant liquidations, with Coinglass data showing that over $540 million worth of crypto positions were liquidated in the past 24 hours alone. Long positions were particularly hard hit with over $468 million worth of longs being liquidated, as investors rushed to unwind their bets amid the rising uncertainty.

The broader crypto market has also been impacted, with the fear and greed index dropping to a “fear” level after seeing a “neutral” lever yesterday and “greed” late last month. The index, it’s worth noting, is based on emotional behavior in the market. When fear sets in, some investors may see a buying opportunity, while greed may be a sign the market is due for a correction.

As CryptoGlobe reported, Bitcoin’s short-term holders have seen their holdings move into a state of profit with the recent price rise, and as a result started selling their coins to the point the amount of Bitcoin held by short-term holders to the tune of 1.31 million BTC, worth around $83 billion, which to the analyst indicates “that fewer BTC are circulating among STHs,” a sign of “growing confidence in the market.”

Featured image via Unsplash.