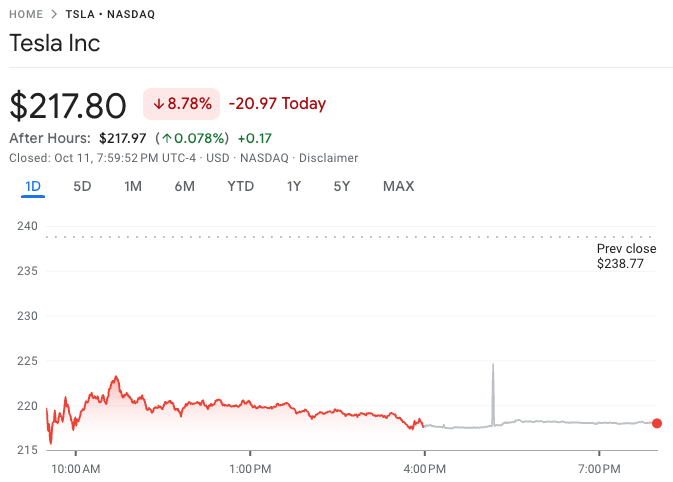

Tesla’s highly anticipated robotaxi event on Thursday night left Wall Street investors disappointed, sending Tesla shares plunging 8.8% on Friday, wiping out $67 billion in market value.

The event was expected to detail Tesla’s evolution into a leader in robotics and artificial intelligence, but attendees and analysts felt it lacked the business specifics they were hoping for.

At the event, CEO Elon Musk unveiled the Cybercab, a two-seat autonomous vehicle without a steering wheel or pedals. Musk arrived at the event in the driverless car, which navigated through a dark parking lot. Tesla also introduced the Robovan, an autonomous shuttle capable of transporting up to 20 people, and a new battery-charging technology using an inductive method, where cars recharge simply by driving over a pad.

Despite these reveals, the lack of detailed business strategies—particularly concerning Tesla’s robotaxi fleet—disappointed many. The company announced that the Cybercab would be in production by 2027, with a price tag under $30,000, but analysts expressed skepticism about Tesla’s ability to meet these targets. Paul Miller, an analyst at Forrester, told CNBC that offering the Cybercab at that price within the stated timeframe was unlikely and would require either subsidies or Tesla absorbing losses on each unit.

Musk also promised that Tesla’s Full-Self Driving (FSD) technology would be available without supervision in California and Texas next year. However, many analysts doubted this timeline, given Musk’s history of delayed promises. According to a report by The Wall Street Journal, Deutsche Bank analysts who attended the event noted the short length of the Cybercab demo ride and the absence of details about Tesla’s business model for fully autonomous robotaxis. The lack of updates on Tesla’s previously previewed ride-hailing app also contributed to investor disappointment.

Tesla’s event failure also provided a boost for competitors. Shares of ride-hailing companies Uber and Lyft surged by around 10% as investors turned their focus to alternative players in the autonomous driving space. The event also sparked concerns about Tesla’s lofty market valuation, which stood at $763 billion prior to the announcement.

CNBC’s report also mentioned that analysts from Morgan Stanley pointed out that Musk missed an opportunity to solidify Tesla’s status as an artificial intelligence company. The absence of updates on the development of Tesla’s FSD system, as well as any potential collaboration with xAI, Musk’s AI venture, left many unconvinced of Tesla’s leadership in this field. Similarly, Barclays analysts criticized the lack of data regarding FSD’s progress, underscoring the event’s focus on vision over concrete details.