On 23 Oct 2024, Tesla Inc. (NASDAQ: TSLA) released its Q3 2024 Financial Results.

Financial Overview

In Q3 2024, Tesla reported a total revenue of $25.2 billion, marking an 8% year-over-year increase. This rise was attributed to higher vehicle deliveries and enhanced revenue from energy generation, storage solutions, and service-related operations. Notably, the company achieved $2.7 billion in GAAP operating income, with net income reaching $2.2 billion. On a non-GAAP basis, net income stood at $2.5 billion. Tesla’s gross margin improved to 19.8%, up from 17.9% in Q3 2023, signaling better cost efficiency despite economic headwinds.

Tesla’s free cash flow for Q3 was robust at $2.7 billion, contributing to a $2.9 billion sequential increase in cash reserves, now totaling $33.6 billion. This financial resilience comes as the company continues to focus on cost reductions, even as it invests heavily in new technology and production capabilities.

Vehicle and Production Insights

The quarter saw a year-on-year increase in vehicle deliveries, with a total of 462,890 units delivered. This includes a notable surge in deliveries of the Cybertruck, now ranking as the third best-selling electric vehicle in the U.S., following the Model Y and Model 3. Production capacity continues to expand across multiple locations, with Tesla hitting the milestone of its 7-millionth vehicle in October 2024.

The refreshed Model 3 saw higher production, benefiting from reduced production costs, while Model Y remained a top performer in Europe, even becoming the best-selling EV of all time in Norway. Additionally, the Shanghai factory’s production costs per vehicle hit their lowest levels, further boosting profitability.

Energy Business and Technology Developments

Tesla’s Energy division had a record-breaking quarter, achieving a gross margin of 30.5%. The Megafactory in Lathrop reached a significant milestone, producing 200 Megapacks in a single week. Powerwall deployments also reached new heights for the second consecutive quarter. With the Shanghai Megafactory poised to ship Megapacks in early 2025, Tesla continues to strengthen its position in the energy storage sector.

AI and software advancements were key focuses in Q3. Tesla increased its AI training compute capacity by over 75%, paving the way for future software innovations. A notable achievement was the introduction of the “Actually Smart Summon” feature, allowing vehicles to navigate autonomously within parking lots.

Future Outlook

Looking ahead, Tesla plans to introduce more affordable vehicle models in the first half of 2025, targeting broader market segments. The company remains committed to expanding its product lineup and production capabilities while maintaining cost efficiency. In addition, Tesla is gearing up for the next phase of its growth, driven by advancements in autonomy and new product offerings.

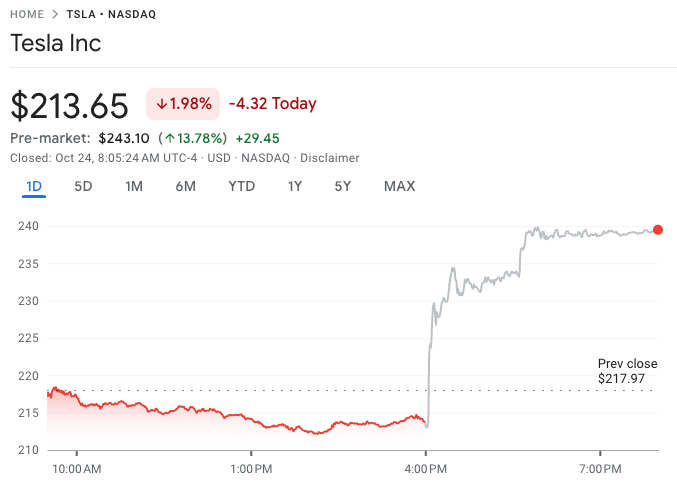

Despite macroeconomic challenges, Tesla’s focus on technological innovation, cost management, and expanding its vehicle and energy product portfolio has set a positive trajectory for the upcoming quarters. This outlook has generated investor optimism, reflected in the 13.48% rise in Tesla’s stock price in after-hours trading, reaching $242.46 per share.