While the prices of most digital assets endured a significant correction over the past week Sui, a Layer-1 cryptocurrency network boasting high-performance and “infinite scaling” has seen the price of its native token surge to a new all-time high of $2.16.

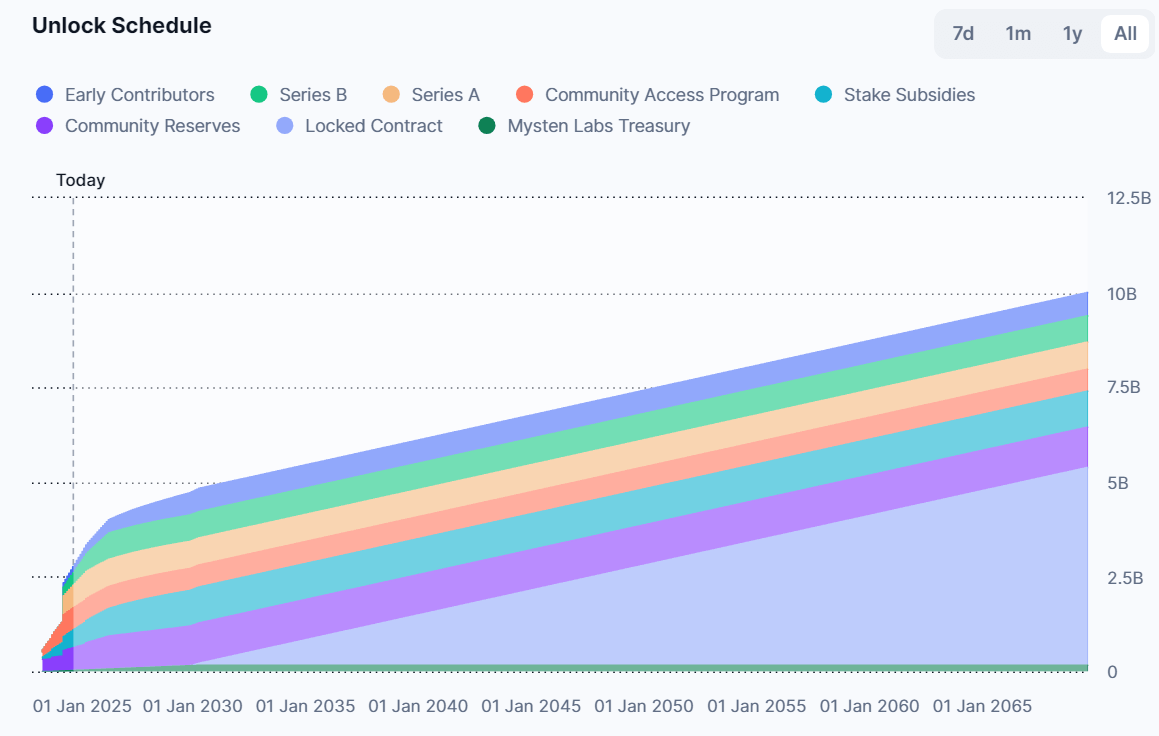

According to available market data, SUI’s market capitalization when accounting for coins in smart contracts or escrow, and with tokens held by team members and the protocol, is now at $19 billion according to data from CryptoCompare. It’s worth noting over 52% of SUI’s supply is locked in smart contracts, 10% is in community reserves, and early contributors hold 6%.

Data also shows that Series A and Series B investors hold 7.14% and 6.95% of SUI’s tokens, while 1.64% are in the Mysten Labs Treasury. 7.24 billion SUI tokens are currently locked, with unlocking set to occur over time according to CoinMarketCap.

The daily trading volume across the SUI ecosystem has consistently exceeded $6 billion, primarily driven by SUI and FDUSD, a stablecoin with most of its trading volume occurring on leading cryptocurrency exchange Binance.

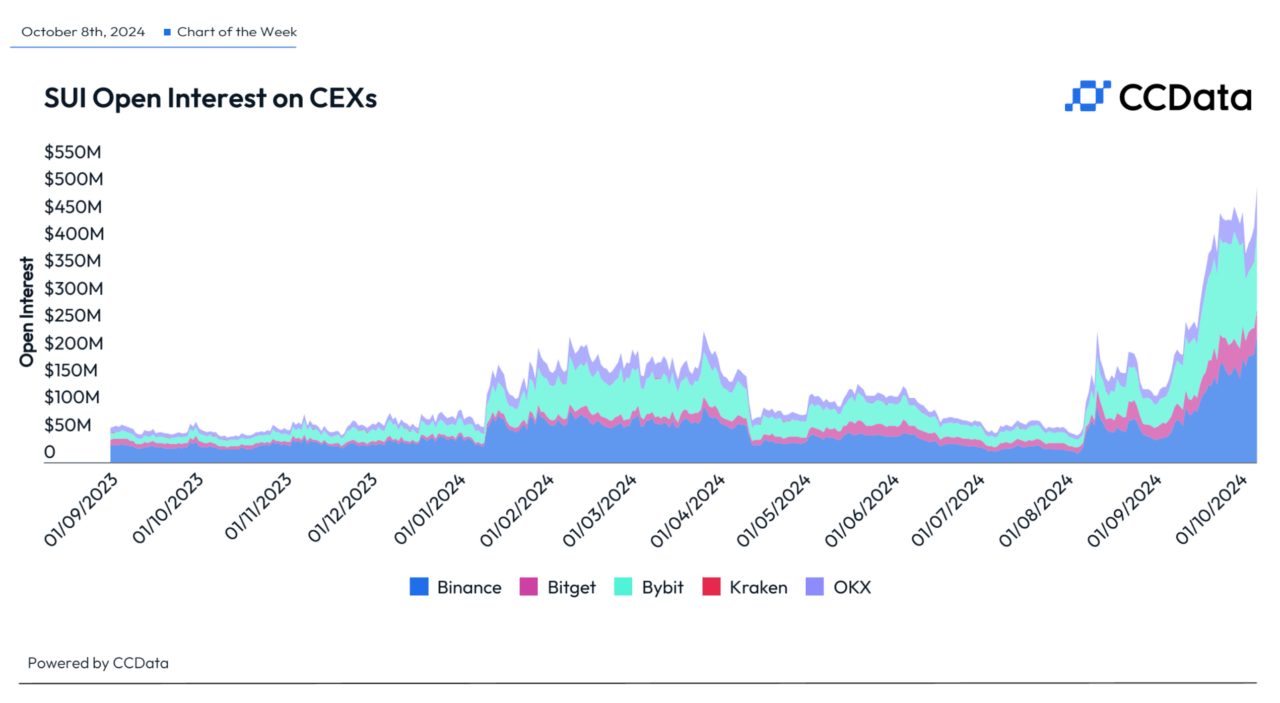

Beyond the core SUI token and FDUSD, the ecosystem boasts a diverse range of projects, including decentralized exchanges (DEXs), meme coins, and lending protocols. Notablu, SUI has seen a notable rise in open interest across major centralized cryptocurrency exchanges, indicating increased investor activity. As of October 7, data shows exchanges including Binance, Bybit, Kraken, and OKX reported over $508 million in open interest for SUI.

The surge in open interest comes as Circle’s USDC stablecoin is set to be launched on the Sui network, boosting market confidence and participation. Since the beginning of the year, SUI’s open interest surged 495%, outpacing that of major assets like BNB and DOGE, according to CCData.

Featured image via Pixabay.