The total holdings of the spot Bitcoin exchange-traded funds (ETFs) approved in the United States earlier this year have surpassed the 1 million BTC market, meaning total market capitalization of the BTC held by these funds is now above a staggering $72.5 billion.

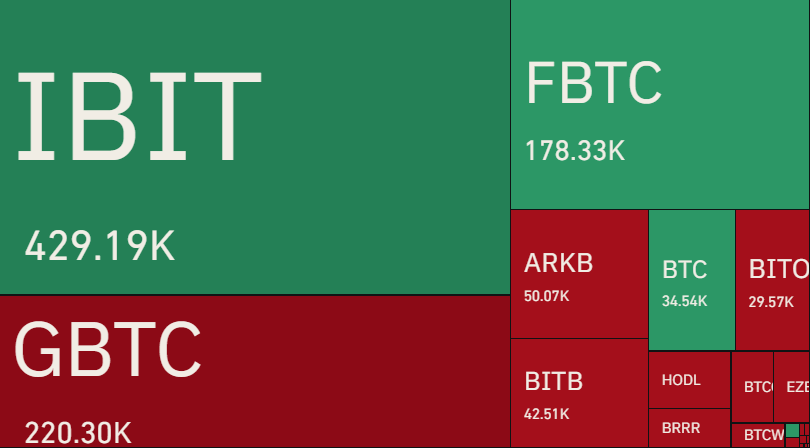

According to data from CoinGlass, the milestone was achieved after these funds saw inflows of $896 million over the past day, up from $827 million the previous day. BlackRock’s iShares Bitcoin Trust (IBIT) saw the lion’s share of inflows, to now hold 429,190 BTC.

In terms of total BTC holdings, IBIT is followed by Grayscale’s GBTC, which saw significant Bitcoin outflows since it was converted into a spot Bitcoin ETF. In third place is Fidelity’s Wise Origin Bitcoin Fund (FBTC), with 178,330 BTC.

The spot Bitcoin ETFs have, as CryptoGlobe reported, seen over $23 billion in total inflows so far this year as the price of the flagship cryptocurrency Bitcoin saw its price move up more than 70% year-to-date to now trade above the $72,000 mark.

Its performance has seen IBIT, the leading spot Bitcoin ETF, trade $3.3 billion in a single day, with the volume striking Bloomberg senior ETF analyst Eric Balchunas as “odd” as it came during a BTC price rise, while typically volumes for ETFs surge during downturns, although “volume can spike if there’s a FOMO-ing frenzy,” referring to investors being affected by fear of missing out (FOMO).

The 1 million BTC holdings milestone comes at a time in which the cryptocurrency community is celebrating the anniversary of the Bitcoin white paper, which was sent by Bitcoin creator Satoshi Nakamoto to the Cryptography Mailing List back on October 31, 2008.

Some analysts attribute Bitcoin’s recent price rises with U.S. Presidential candidate Donald Trump leading in election markets when it comes to election odds. Trump has taken a pro-crypto stance during this election cycle, going as far as saying there’s never been anything like Bitcoin.

Featured image via Unsplash.