Monochrome Asset Management has made history by launching Australia’s first exchange-traded fund (ETF) that directly holds Ether (ETH), according to a report by Martin Young for Cointelegraph. This new fund, called the Monochrome Ethereum ETF (IETH), debuted on 15 October 2024 on the Cboe Australia equities exchange. As of 2:00 p.m. local time on launch day, the fund had reached assets under management (AUM) totaling $176,600, equivalent to 262,500 Australian dollars.

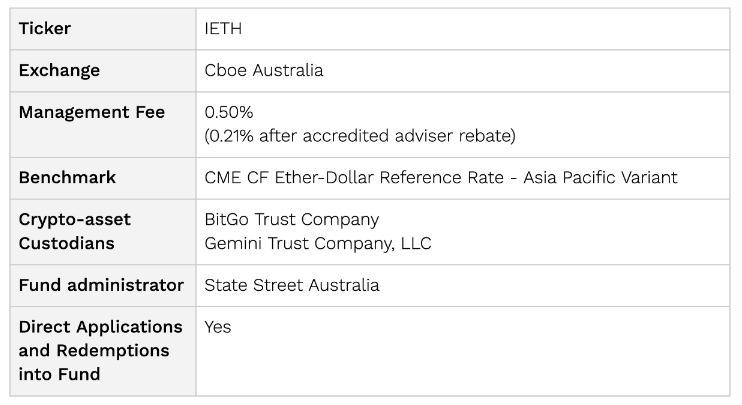

The IETH offers a management fee of 0.50% and unique dual-access functionality, allowing transactions to be made in cash or Ether. This sets it apart as Australia’s only ETF offering in-kind applications and redemptions in both currency options. BitGo and Gemini handle the ETF’s crypto custody, while State Street Australia serves as the fund administrator, ensuring safe management of the assets.

This Ethereum ETF follows Monochrome’s earlier success with its Bitcoin ETF (IBTC), launched in June 2024. The Bitcoin ETF has amassed an impressive $10.7 million (16 million Australian dollars) in AUM, showcasing a strong appetite for spot crypto ETFs in the Australian market. According to Monochrome CEO Jeff Yew, many investors have been shifting their crypto assets from exchanges into more secure structures like ETFs, further fueling the growth of these products. Yew has expressed confidence in the long-term success of spot crypto ETFs in Australia, pointing out that the market is on a different trajectory compared to other regions.

Monochrome’s efforts come amid a growing global interest in cryptocurrency ETFs. Australia’s first spot Bitcoin ETF, launched by VanEck in June, has garnered $35 million (52 million Australian dollars) in assets so far. Meanwhile, in the United States, crypto ETFs have surged in popularity, with spot Bitcoin funds amassing a total of over $19.3 billion in AUM in 2024.

Featured Image via Pixabay