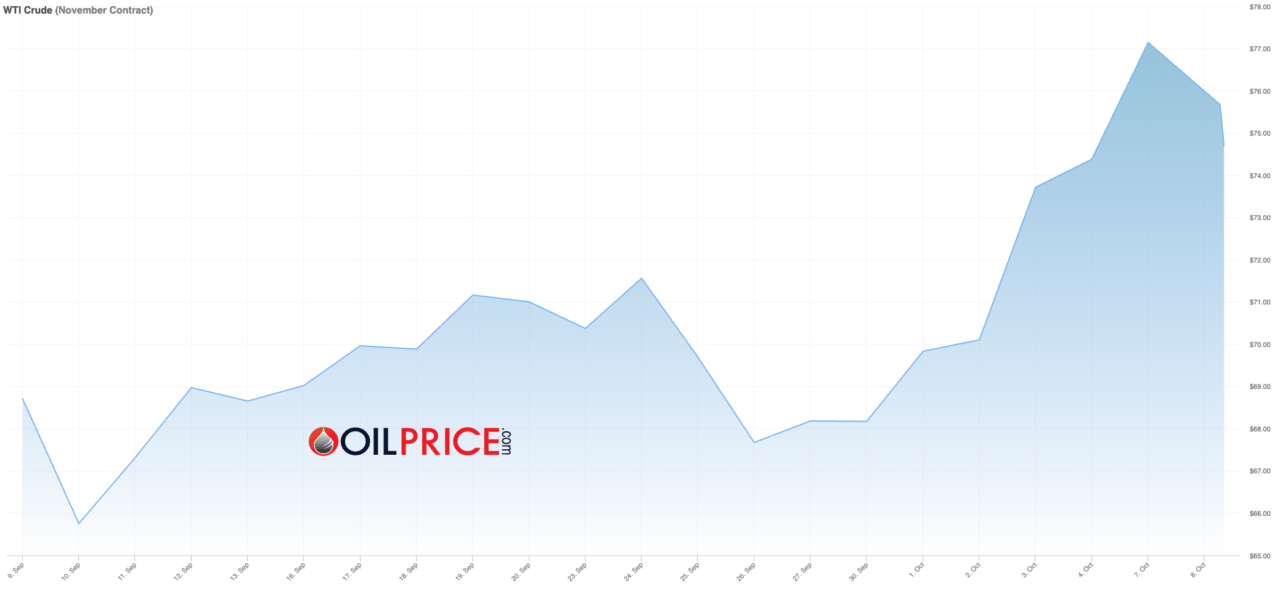

As tensions rise in the Middle East, growing concerns are emerging about the potential economic consequences, particularly the risk of a major disruption to the global oil supply, reports Peter S. Goodman in an article for The New York Times (NYT). Israel is preparing its response to last week’s missile strikes from Iran, and the prospect of a wider conflict has sparked fears of an oil price surge. Such a development could dramatically increase the costs of gasoline, fuel, and other petroleum-based products, with significant repercussions for global economies, especially those dependent on imported oil, notes the NYT report.

An Israeli attack on Iran’s oil facilities could trigger retaliatory strikes on critical refineries in Saudi Arabia and the United Arab Emirates, according to the NYT. Another potential risk is Iran’s threat to block oil tankers from passing through the Strait of Hormuz, a vital waterway that transports nearly one-third of the world’s oil supply. While such actions are considered unlikely, the recent escalation of tensions has expanded the realm of possible outcomes.

The NYT piece points out that the potential economic impact extends beyond oil prices. In recent months, central banks in the U.S. and Europe have been reducing interest rates to curb inflation, a move aimed at boosting investment, hiring, and economic growth. However, an oil supply shock could reverse that progress, driving inflation back up, discouraging investment, and slowing growth. This would hit energy-dependent nations particularly hard, with poorer countries in Africa — already grappling with debt crises — likely facing the most severe consequences.

China and Europe are also highly vulnerable to any oil price spikes, the NYT article adds. China purchases more than 90% of Iran’s oil exports and relies heavily on imported energy. Meanwhile, Europe is still dealing with the fallout from reduced Russian oil supplies following the war in Ukraine. A sharp increase in oil prices could lead to stagflation in Europe — a combination of rising inflation and stagnating economic growth.

Per the NYT report, the geopolitical ramifications of an oil price surge would likely extend to Russia. Higher oil prices could provide a financial boost to Russia, enabling it to further its war efforts in Ukraine. Additionally, Russia could channel some of this newfound wealth into supporting its ally Iran, potentially raising the stakes for Israel as it considers military action. If Israel’s actions lead to higher oil prices, it could inadvertently strengthen both Iran and Russia, further complicating the global situation.

According to CNBC, crude oil futures also saw a decline of approximately 2% on Tuesday, with the geopolitical-driven rally pausing as markets awaited Israel’s response against Iran.

The CNBC report goes on to add that investor sentiment was dampened when Chinese officials failed to announce new stimulus measures at a Tuesday press briefing, which the market had anticipated. Before the Middle East conflict intensified, markets had already been impacted by bearish views, largely due to weak demand in China, the world’s largest importer of crude oil. Concerns about oil supplies potentially exceeding demand in 2025 had pushed oil prices to their lowest point since December 2021, earlier in September.

Phil Flynn, a senior analyst at Price Futures Group, noted that oil prices had slightly retreated after the previous day’s surge, partly due to China’s lack of new economic stimulus announcements.

Featured Image via Pixabay