On October 30, MicroStrategy Inc. (Nasdaq: MSTR) released its Q3 2024 financial results, highlighting both its latest Bitcoin acquisition strategy and challenges within its software business.

The company, known for its substantial Bitcoin holdings, announced a three-year “21/21 Plan” to raise $42 billion—$21 billion in equity and $21 billion in fixed-income securities. This capital would be used to further grow its Bitcoin treasury, aiming to increase yield from these assets, according to CEO Phong Le.

During Q3, MicroStrategy raised $2.1 billion through equity and debt issuances, which it attributed to supporting this treasury strategy. The company’s Bitcoin holdings increased by 11% over the quarter, reaching approximately 252,220 bitcoins with a market value of $16.007 billion as of September 30.

MicroStrategy’s BTC yield—a metric the company uses to assess the performance of its Bitcoin strategy—reached 17.8% for the year-to-date, though it revised its longer-term yield target to between 6% and 10% annually from 2025 to 2027.

However, MicroStrategy’s software segment reported a 10.3% year-over-year revenue decline to $116.1 million, with decreases in product license and support revenues partially offset by a 32.5% growth in subscription services.

The company’s gross profit margin also narrowed to 70.4%, down from 79.4% in Q3 2023. Operating expenses surged by over 300%, largely driven by a $412.1 million impairment on its digital assets, leading to an operating loss of $432.6 million for the quarter. This compares to a significantly smaller loss of $25.2 million in the same period last year.

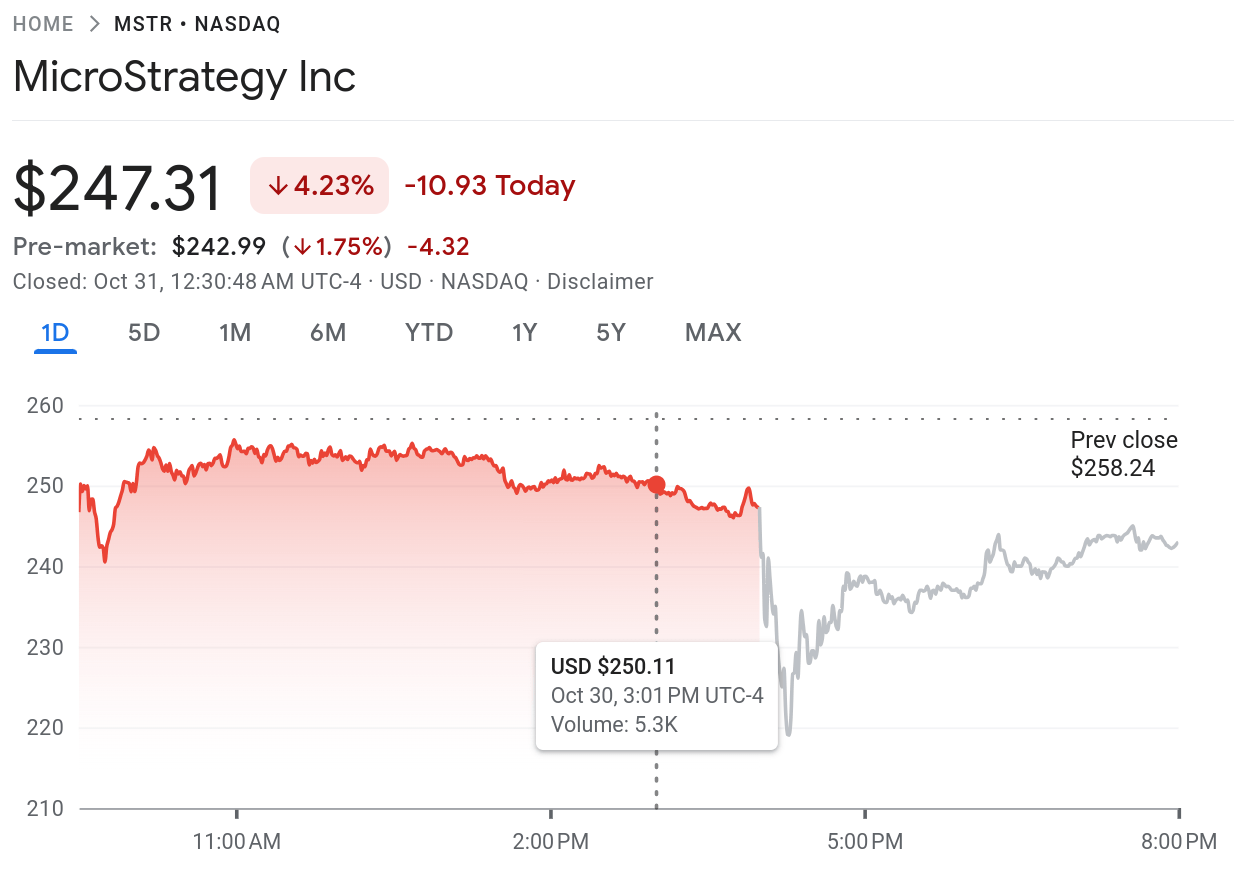

MicroStrategy’s stock fell 4.23% during the regular session, closing at $247.31. In after-hours trading, the stock dropped an additional 1.75% to $242.99.