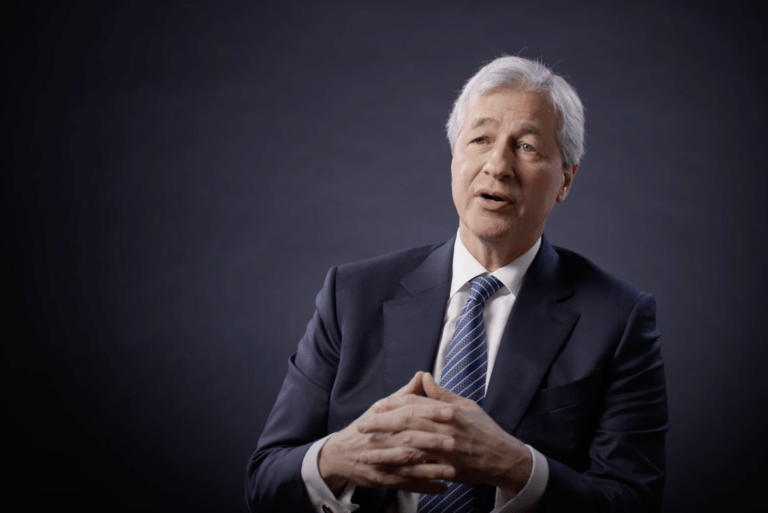

Earlier today, Jamie Dimon, CEO of JPMorgan Chase, shared his thoughts on artificial intelligence (AI), the state of Initial Public Offerings (IPOs), and Federal Reserve policies during an interview with Bloomberg’s Lisa Abramowicz at the JPMorgan Tech Stars Conference in London. Dimon, known for his candid views on global markets, provided a deep dive into his perspectives on the current technology landscape, macroeconomic policies, and how businesses need to adapt to an evolving world.

Dimon began by highlighting the historical significance of technological advancements. According to him, technology has been shaping human societies for centuries, citing examples like the printing press, steam engines, electricity, and the internet. Dimon described AI as “another wave” of innovation with the potential to change industries across the board. He emphasized that AI is “real” and will have a profound impact on many sectors, including banking.

Although there are concerns about job losses due to automation, Dimon insisted that tech-driven advancements have historically led to better living standards, longer lifespans, and improved productivity. Dimon noted that while AI could replace some jobs, it will also enhance others, particularly by reducing errors and increasing productivity. He was clear that “we need to find a better way to help those impacted by tech,” stressing that retraining and redeploying workers will be crucial in mitigating the negative consequences of AI.

When asked about the current state of IPOs, Dimon acknowledged the complexities. He pointed out that, despite elevated public markets, companies have been hesitant to go public. Dimon cited several reasons for this, including access to private capital and the ability of firms to reduce their cash burdens.

He underscored the importance of healthy public markets, noting that venture capitalists will need to liquefy their positions at some point. Dimon was candid in saying he doesn’t foresee a rapid uptick in IPO activity in the near future, adding that the regulatory landscape in the U.S. has made it harder for smaller companies to go public. He advocated for changes that would lower the costs and barriers to IPOs, making it easier for companies to access public markets.

Turning to the post-Brexit landscape, Dimon commented on London’s financial sector, suggesting that while London has lost some clout compared to New York and other financial hubs, he remains optimistic about its future. Dimon praised the current U.K. government’s focus on growth and capital markets, noting that the decline could become more permanent without such measures. He stressed the need for Europe to focus on initiatives like the Capital Markets Union to foster regional growth and productivity.

On the topic of U.S. monetary policy, Dimon supported the Federal Reserve’s recent decision to cut interest rates by 50 basis points. He acknowledged that inflation is coming down and noted that the Fed acted appropriately by taking its foot off the gas. While Dimon conceded that the rate cut’s magnitude—whether 50 or 25 basis points—might not matter much, he argued that it was the right move to help avoid a recession.

At the same time, Dimon warned about long-term inflationary pressures due to factors like fiscal deficits, the green economy, demographics, and potential energy price shocks. Dimon stressed that these inflationary forces will hit later and that the Fed should respond when those pressures materialize.

Dimon didn’t shy away from discussing the geopolitical tensions that are reshaping the global landscape. He warned that wars overseas and countries acting against Western interests present serious risks to global stability. Dimon underscored the importance of strong military defense and economic growth to counter these threats.

In his view, the geopolitical situation has created a more volatile environment for markets. He expressed concerns about the potential long-term effects of global conflicts on inflation, supply chains, and economic growth. Dimon noted that businesses must be prepared for a wide range of outcomes, from inflation spikes to no growth at all, depending on how the geopolitical landscape evolves.

Dimon also touched on the growing U.S. deficit, describing it as an inflationary force that policymakers will need to address sooner rather than later. He compared the current deficit situation to that of the 1980s, emphasizing that the U.S. debt-to-GDP ratio is now much higher. Dimon called for a bipartisan effort, similar to the Simpson-Bowles Commission, to tackle the deficit before it reaches unsustainable levels.

One of the more personal moments of the interview came when Dimon was asked why he hadn’t endorsed a candidate in the upcoming U.S. presidential election. Dimon explained that while he will vote, he has traditionally refrained from endorsing candidates. He shared his view that the next president should prioritize competence and effectiveness in government and suggested that half of the cabinet should be made up of private-sector leaders.

Featured Image via YouTube