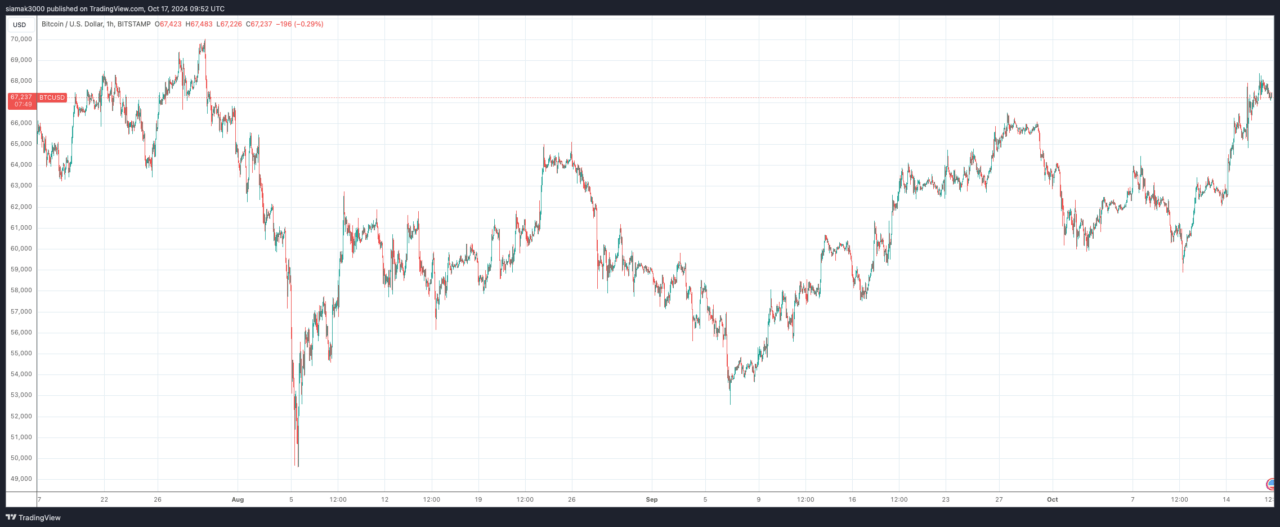

Bitcoin surged above the $68,000 level on Wednesday, reaching a peak not seen since July 29 and triggering a broader rally across the cryptocurrency sector.

Over the past week, Bitcoin has gained 10.6%, while Ethereum (ETH) has climbed by around 9.9%. Other prominent tokens have also followed suit, with Solana (SOL) gaining 10.2%, and Dogecoin (DOGE) jumping 15.e%.

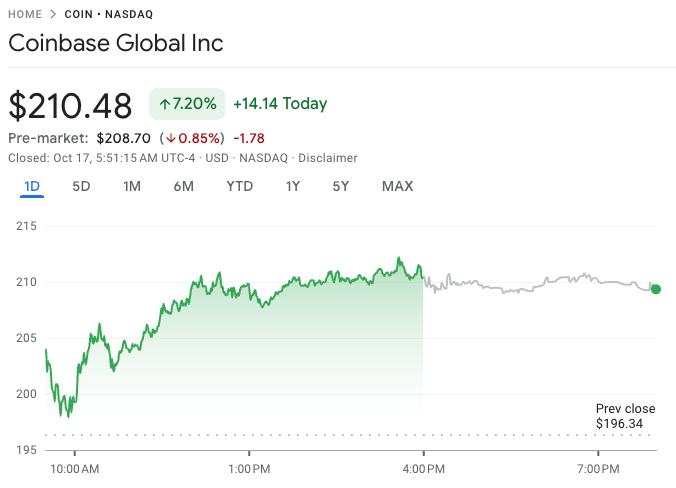

The rally extended to stocks tied to digital assets. Coinbase, a leading cryptocurrency exchange, saw its stock rise by 7.2% on Wednesday, culminating in a three-day gain of 19%, the highest the stock has been since August. Bitcoin miners like Marathon Digital and Riot Platforms also posted notable gains.

One key driver behind Bitcoin’s 60% rise this year has been the introduction of new spot Bitcoin exchange-traded funds (ETFs), launched in January, which attracted a fresh wave of investors. Ethereum-based ETFs, introduced in July, also contributed to the market momentum. In the last three days alone, investors have poured $1.2 billion into these ETFs, bringing total holdings to more than $63 billion. BlackRock’s iShares Bitcoin Trust (IBIT) has led the way, accounting for over 30% of recent ETF purchases.

BlackRock’s Chief Investment Officer for ETF and Index Investments, Samara Cohen, recently told CNBC that a significant portion of IBIT’s investors—80%—are direct investors, with 75% of them new to BlackRock ETFs. Cohen remarked that while they anticipated educating traditional ETF investors about Bitcoin, they found themselves also teaching crypto investors about the advantages of the ETF structure.

MicroStrategy’s stock has outperformed every company in the S&P 500 index since August 2020, according to a post shared by on-chain intelligence firm Arkham on X (formerly Twitter) on 14 October 2024. The post highlights the company’s remarkable growth over the past four years, driven by its heavy investment in Bitcoin.

In the year-to-date period, MicroStrategy Inc. shares (NASDAQ: MSTR) are up 183.26%.

Featured Image via Pixabay