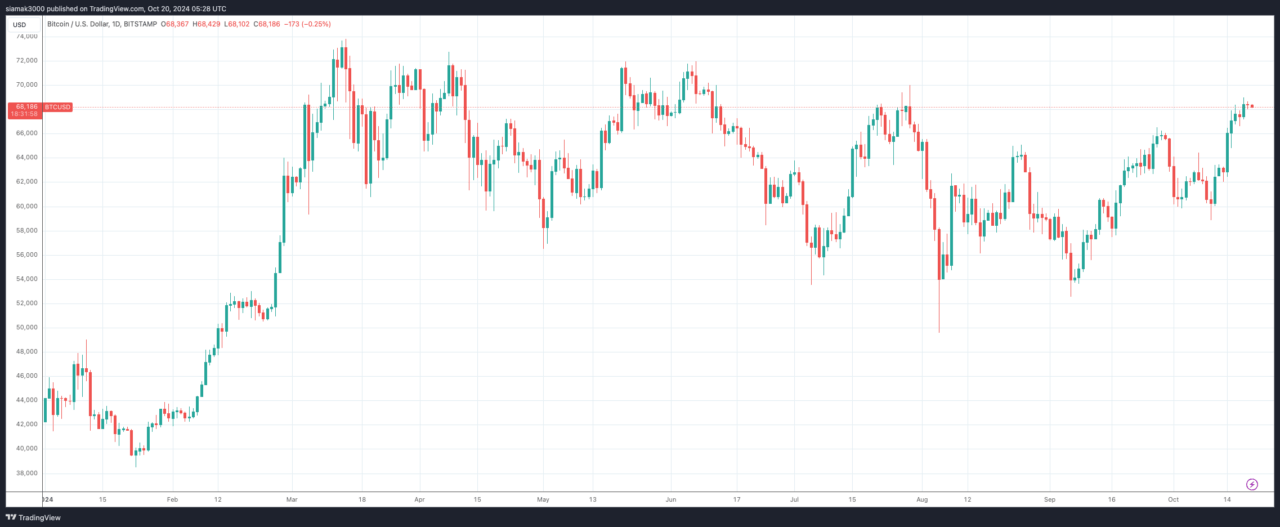

Six months after Bitcoin’s April 2024 halving, cryptocurrency mining firms are facing critical decisions as their revenue has been significantly reduced, according to a report by David Pan for Bloomberg News.

The halving, which occurs every four years and halves the reward miners receive for verifying transactions, limits Bitcoin’s supply to help control inflation. This adjustment has created considerable pressure on miners, who now generate fewer profits for each block mined.

Publicly traded mining companies like MARA Holdings (NASDAQ: MARA), Riot Platforms (NASDAQ: RIOT), and CleanSpark (NASDAQ: CLSK) are adopting different strategies to adapt. Some are opting to hold onto their mined Bitcoin, anticipating that the asset’s value will appreciate over time. This “HODL” approach reflects a belief that long-term gains will offset short-term revenue losses. Meanwhile, other miners are diverting resources toward building data centers that support artificial intelligence (AI) applications, a move aimed at diversifying their revenue streams.

Wolfie Zhao, an analyst at TheMinerMag, argues that holding Bitcoin allows miners to sidestep selling at unfavorable prices while funding their operations through other financial means like debt or equity. This strategy helps companies delay losses and potentially capitalize on future price increases.

Despite Bitcoin’s more than 60% price increase this year, firms holding onto their mined Bitcoin have seen their stock prices drop. MARA and RIOT, two very popular Bitcoin mining stocks, have experienced declines of roughly 18% and 36%, respectively, in the year-to-date (YTD) period.

In contrast, companies like Core Scientific (NASDAQ: CORZ) and TeraWulf (NASDAQ: WULF), which have embraced AI, are seeing major gains. Core Scientific’s share price has increased by 272% this year after securing multi-billion-dollar contracts with AI company CoreWeave, while TeraWulf’s stock has more than doubled (up 128% so far this year) as it pivots to AI data centers.

Miners sticking to Bitcoin have learned to time their operations more effectively after previous market downturns. Large-scale operators like MARA and CleanSpark continue to maintain positive gross margins, driven by improvements in mining hardware and the potential for further Bitcoin price appreciation. As Bitcoin’s price recovers from the 2022 crash, miners have resumed taking on debt and issuing shares. Firms like MARA are even following MicroStrategy’s playbook by using raised funds to purchase additional Bitcoin, signaling long-term confidence in the asset.

However, Ethan Vera, COO at Luxor Technology, warns that this strategy carries risk. Should Bitcoin’s price decline, miners could face severe losses and shareholder dilution as they deal with rising operational costs.

Featured Image via Pixabay