According to a recent research note by Greg Cipolaro, Global Head of Research at NYDIG, Bitcoin posted a modest 2.5% gain in the third quarter of 2024, bouncing back after a decline in Q2. Despite this, Cipolaro notes that the cryptocurrency’s trading has remained largely rangebound, fluctuating between $70,000 and $54,000 for most of the past six months. NYDIG’s report highlights that while Bitcoin struggled to make significant moves, it demonstrated resilience in a challenging environment.

NYDIG (New York Digital Investment Group) is a prominent player in Bitcoin financial services, offering a range of solutions tailored to institutions, corporations, and high-net-worth individuals. They focus on Bitcoin custody, financing, asset management, and infrastructure, enabling clients to securely integrate Bitcoin into their businesses. Their services are highly compliant with regulatory standards, helping banks and financial institutions offer Bitcoin-related products without directly holding Bitcoin on their balance sheets. The firm operates as a subsidiary of Stone Ridge Holdings Group.

A significant factor weighing on Bitcoin’s performance in Q3 was the near resolution of several major bankruptcies, including the Mt. Gox bankruptcy, which resulted in the return of billions of dollars worth of Bitcoin to creditors, according to NYDIG. Cipolaro explains that these developments, combined with notable Bitcoin sales by the U.S. and German governments, contributed to downward pressure on the asset’s price. However, NYDIG’s analysis suggests that the mere fear of these coins coming to market may have had a greater impact on Bitcoin’s price than the actual selling activity.

NYDIG’s research also points out that Bitcoin investors found the third quarter frustrating, as traditional asset classes outperformed the cryptocurrency. Cipolaro explains that lower interest rates provided a tailwind for assets such as utilities, real estate, and small-cap stocks, which fared better than Bitcoin during this period. NYDIG also notes that gold set new all-time highs, further challenging Bitcoin’s performance relative to other assets.

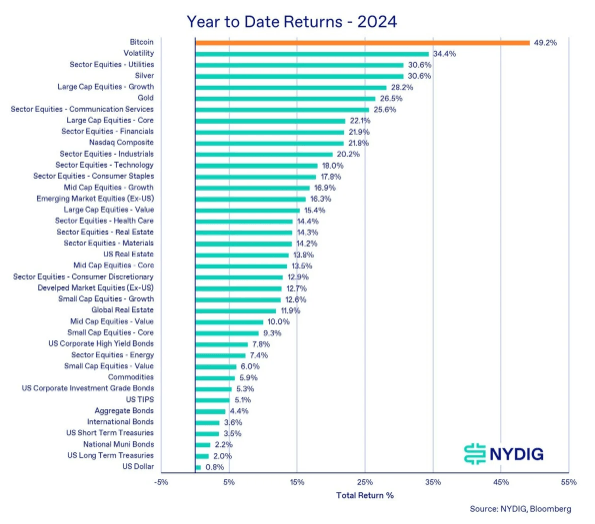

Despite these headwinds, Bitcoin remains the best-performing asset in 2024, according to NYDIG. Cipolaro emphasizes that Bitcoin’s lead over other asset classes has narrowed, especially as volatility spiked in August. While other assets, including precious metals and equities, gained ground, NYDIG’s analysis shows that Bitcoin continues to outperform on a year-to-date basis. Cipolaro notes that most asset classes are enjoying a strong year, echoing the trends seen in 2023.

Cipolaro also highlights that Bitcoin defied typical trends in September, posting a gain in what is historically a weak month for the asset, according to NYDIG. Bitcoin’s correlation with U.S. equities also increased during Q3, ending the quarter with a rolling 90-day correlation of 0.46. However, NYDIG’s report notes that while Bitcoin’s correlation with stocks has risen, it remains low enough to offer significant diversification benefits for multi-asset portfolios.

One of the dominant themes in Q3, as outlined by NYDIG, was the emergence of large Bitcoin holders who distributed or sold their holdings. Cipolaro explains that the Mt. Gox and Genesis bankruptcies, as well as government sell-offs, led to the transfer of approximately 204,000 Bitcoins during the quarter, valued at over $12.6 billion. However, NYDIG’s analysis shows that despite the magnitude of these events, there was little evidence of panic selling by creditors.

NYDIG’s report also points to continued demand from U.S. spot exchange-traded funds (ETFs) as a key factor supporting Bitcoin’s price during the quarter. According to Cipolaro, U.S. spot ETFs gathered $4.3 billion in total flows, with BlackRock’s iShares Bitcoin Trust leading the pack. NYDIG notes that while Grayscale’s new Bitcoin Mini Trust made a competitive entry into the market, BlackRock continues to dominate ETF inflows.

Cipolaro concludes by looking ahead to Q4, traditionally one of Bitcoin’s strongest periods, as noted by NYDIG. He identifies several catalysts that could boost Bitcoin’s performance, including the upcoming U.S. presidential election. According to Cipolaro, a Trump victory would likely deliver substantial gains for Bitcoin, given the former president’s endorsement of the crypto industry. However, NYDIG also suggests that Bitcoin’s strength as an asset detached from traditional financial and political systems could benefit from post-election instability, regardless of the outcome.

Featured Image via Pixabay