The September 2024 edition of CCData’s Exchange Review report reveals several significant trends in the digital asset market.

CCData, an FCA-authorized benchmark administrator, is a global leader in digital asset data. It offers high-quality real-time and historical data for institutional and retail investors. Known for its expertise and objective insights into the digital asset industry, CCData publishes the Exchange Review monthly.

This report captures key developments in the cryptocurrency exchange market, including analyses of exchange volumes, crypto derivatives trading, market segmentation by fee models, and crypto-to-crypto versus fiat-to-crypto volumes. It also examines Bitcoin trading against various fiat currencies and stablecoins, ranks top crypto exchanges by spot trading volume, and tracks historical volume trends for top trans-fee mining and decentralized exchanges. The review caters to crypto enthusiasts, investors, analysts, and regulators seeking comprehensive and specific market analyses.

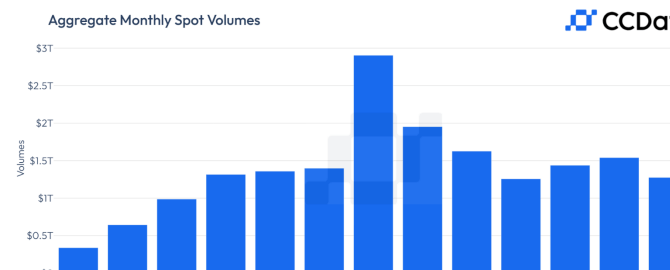

In September, combined spot and derivatives trading volume on centralized exchanges dropped 17.0% to $4.34 trillion, marking the lowest monthly activity since June. Spot trading volumes alone fell by 17.2% to $1.27 trillion, while derivatives trading volumes declined 16.9% to $3.07 trillion. T

he slowdown in trading activity was expected, coinciding with the final month of the typical seasonality period, which often experiences reduced activity. However, the report suggests optimism for increased trading volumes in Q4 due to catalysts such as heightened market liquidity from the Federal Reserve’s interest rate cut and the upcoming U.S. election.

Binance, the market leader, saw its spot trading volume plunge by 22.9% to $344 billion, its lowest since November 2023. Binance’s share of the spot market fell to 27%, and its overall market share, which includes both spot and derivatives trading, declined to 36.6%—the lowest since September 2020. Meanwhile, Crypto.com witnessed a sharp rise in activity, with its combined spot and derivatives volume surging over 40%, pushing its market share to 11%, positioning it as the fourth-largest centralized exchange by volume.

The derivatives market also experienced a decline, but the report highlights a notable surge in open interest, rising 32.1% to $52.4 billion, the highest since June 10th. This spike reflects increased optimism among traders, fueled by the Federal Reserve’s recent rate cut, which bolstered the bullish sentiment in the market. Binance retained its lead in the derivatives market, trading $1.25 trillion in September, followed by OKX and Bybit, which saw volumes of $565 billion and $469 billion, respectively.

While Binance continued to lead in both spot and derivatives trading, its market dominance has been eroding. On the flip side, Crypto.com and Upbit made significant gains in market share. Crypto.com, in particular, saw its spot market share rise to 10.5% in September, with a year-to-date growth of 8.08%, making it one of the fastest-growing exchanges in 2024. In contrast, Binance and OKX have lost market share throughout the year, with Binance experiencing a decline of 5.34% to 27.0% in 2024.

The report also highlights developments in the derivatives market, where traders increasingly sought to capitalize on market shifts. The CME exchange, a major player in institutional derivatives trading, saw its volumes drop by 11.8% to $114 billion, with Bitcoin futures volume down 9.04% to $95 billion. However, options trading volume on CME experienced a more significant decline, with a 43% drop, reaching $1.70 billion, the lowest since November 2023.

Featured Image via Unsplash