On September 12, Grayscale Investments, the world’s largest cryptoasset manager and a whole-owned subsidiary of Digital Currency Group (DCG), announced the launch of its latest crypto investment product, the Grayscale XRP Trust, designed to provide investors with exposure to XRP, the digital token that powers the XRP Ledger. The Trust, which is now open for daily subscription, is available to accredited individual and institutional investors, according to a press release issued by the firm.

The XRP Ledger is a decentralized, peer-to-peer network created to streamline cross-border financial transactions, making them faster and more cost-efficient. Rayhaneh Sharif-Askary, Grayscale’s Head of Product & Research, highlighted the significance of XRP’s use case, emphasizing its potential to reshape traditional financial infrastructure. According to the press release, by enabling cross-border payments that can be completed in seconds, XRP may offer a solution to the limitations of legacy systems.

Grayscale’s new XRP Trust operates similarly to the company’s other single-asset investment trusts, focusing exclusively on XRP as its underlying asset. With the introduction of this trust, Grayscale continues to expand its lineup of cryptocurrency investment products, which currently includes over 20 different crypto assets.

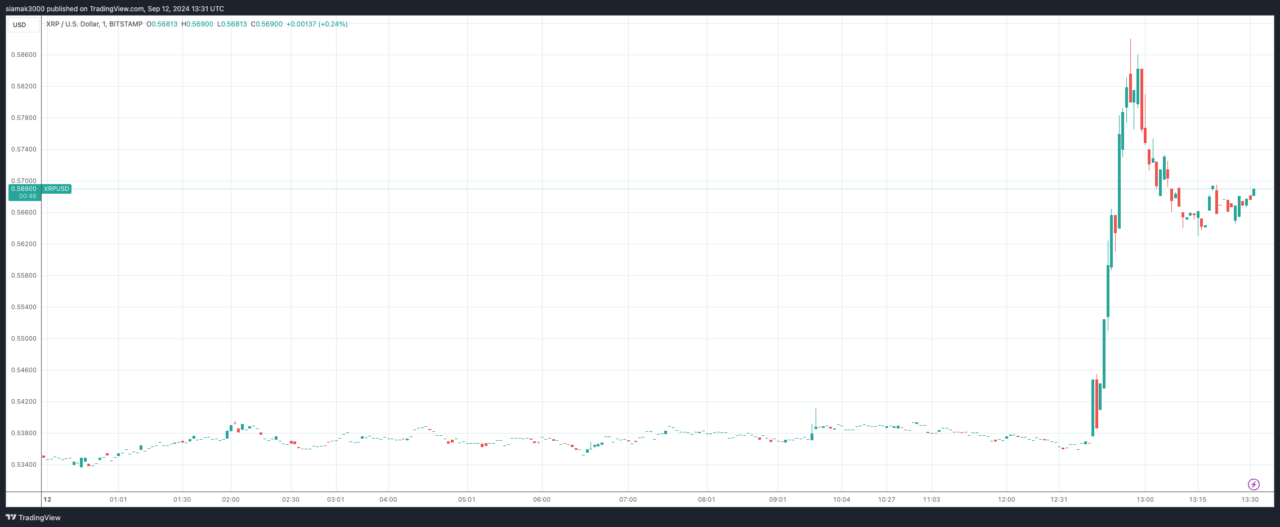

At the time of writing, XRP is trading at $0.5674, up 6.6% in the past 24-hour period.

On August 13, Grayscale unveiled the Grayscale MakerDAO Trust, which is designed to provide investors with direct exposure to MKR, the utility and governance token associated with MakerDAO, a decentralized autonomous organization (DAO) that governs the Maker Protocol, a decentralized finance (DeFi) platform built on the Ethereum blockchain. The MakerDAO ecosystem plays a crucial role in decentralized finance (DeFi), offering an on-chain credit protocol, stablecoins, and real-world asset integration.

The MKR token plays a crucial role in the Maker Protocol, acting as both a governance tool and a mechanism for maintaining the system’s stability. As the governance token, MKR gives its holders the power to influence key decisions about how the Maker Protocol operates. These decisions can include setting the risk parameters, determining which types of collateral should be accepted, and adjusting the fees associated with generating DAI, the stablecoin managed by the protocol.

On August 7, Grayscale introduced the Grayscale Bittensor Trust and Grayscale Sui Trust. The Grayscale Bittensor Trust is dedicated to investing in Bittensor’s native token, TAO, while the Grayscale Sui Trust exclusively focuses on the SUI token of the Sui protocol.

Featured Image via Unsplash