In the wake of the Federal Reserve’s recent decision to cut interest rates by half a percentage point, speculation has arisen among some Republicans over whether the move was politically motivated to favor Vice President Kamala Harris’s presidential campaign. Some have questioned whether the rate cut was timed to make the economy appear stronger and thus benefit the current administration.

However, according to the opinion piece by Paul Krugman published in The New York Times (NYT) on Thursday, this line of thinking is misguided.

Paul Krugman is a highly influential American economist known for his academic contributions and role as a public intellectual. Born in 1953, he has had a long and distinguished career, including receiving the Nobel Memorial Prize in Economic Sciences in 2008 for his groundbreaking work on international trade theory and economic geography. His research helped explain the complexities of trade patterns, demonstrating how economies of scale and consumer preferences shape the global marketplace.

Krugman earned his undergraduate degree in economics from Yale University and completed his Ph.D. at the Massachusetts Institute of Technology (MIT). His academic career has included teaching positions at Yale, MIT, and Princeton University, where he was a professor for over 15 years. He is now a professor emeritus at Princeton and continues to teach at the City University of New York.

Krugman acknowledges that while the interest rate cut might seem minor in practical terms, with the federal funds rate dropping from 5.5% to 5%, it holds symbolic importance. The Fed’s decision signals that inflation, which had been a significant concern, is now under control. Krugman emphasizes that this message from the Fed is crucial, as it reassures the public and investors that the U.S. economy is stabilizing. However, he firmly rejects the idea that the move was politically timed.

Krugman argues that the Federal Reserve, led by Jerome Powell, doesn’t have access to any secret economic information that others don’t have. He stresses that Powell and his colleagues at the Fed base their decisions on the same data—like unemployment and inflation—that are available to economists across the board. According to Krugman, financial experts like Mark Zandi at Moody’s and Jan Hatzius at Goldman Sachs have been saying for months that inflation is under control, so Powell’s decision to cut rates simply reflects the reality of the economic data, not any hidden political agenda.

Krugman further points out that the Fed’s decision to cut rates wasn’t driven by any political pressures. In fact, he argues that not cutting rates would have been more of a political move. He says the rate cut is consistent with the Fed’s broader goals of managing inflation and ensuring economic stability, and the timing aligns with economic needs rather than electoral considerations.

As Krugman explains, the Federal Reserve’s gradual approach to adjusting interest rates is based on caution and long-term stability. While the half-point rate cut was larger than the typical quarter-point adjustments, he argues that it was justified by the economic conditions, including cooling inflation and a slightly weaker labor market. Krugman highlights that inflation is nearing the Fed’s 2% target, and with the labor market not as tight as it was pre-pandemic, the economic rationale for a rate cut was overwhelming.

However, Krugman also addresses the political implications of the rate cut. He acknowledges that the move could indirectly benefit Kamala Harris by improving consumer sentiment and showcasing an economy that Powell has described as being in “good shape.” But Krugman is adamant that this wasn’t the Fed’s intent and that the Federal Reserve’s actions were driven by sound economic data, not by any desire to sway the upcoming election.

Krugman also takes aim at critics, such as Donald Trump, who suggested that the Fed’s move was politically motivated. Trump’s claim, according to Krugman, doesn’t hold water when examined through the lens of economic necessity. In Krugman’s view, the notion that the Fed is “playing politics” with rate cuts is simply a distraction from the real economic forces at work.

In the end, while the rate cut might provide some political benefits to the Biden-Harris administration, Krugman firmly believes that these effects are incidental.

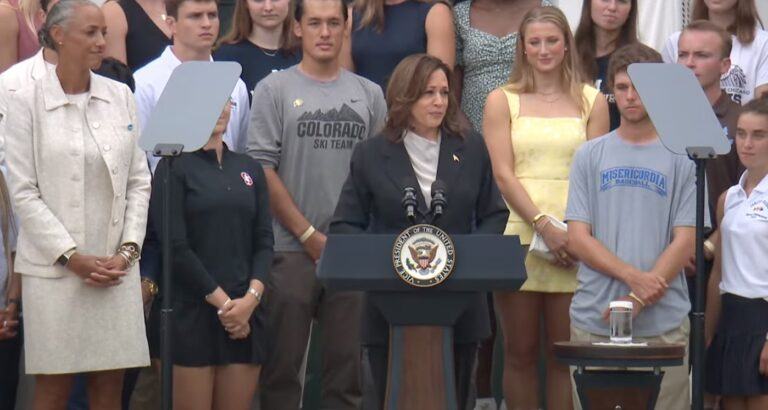

Featured Image via YouTube