In a video published yesterday on his YouTube channel “Meet Kevin,” finance expert Kevin Paffrath discussed a stark warning from UBS about a potentially significant decline in the S&P 500. The UBS report, featuring insights from Rebecca Cheong, a top strategist for U.S. equity derivatives at UBS, forecasts a possible 15% drop in the S&P 500 over the next two months. With market internals at their weakest in six years, Paffrath analyzed the factors behind this bearish outlook and discussed strategies investors might consider to navigate the looming volatility.

According to a report by Seeking Alpha, UBS strategist Rebecca Cheong said in an investor note emailed on Tuesday that market conditions have deteriorated markedly, rendering the S&P 500 more vulnerable than it has been in years.

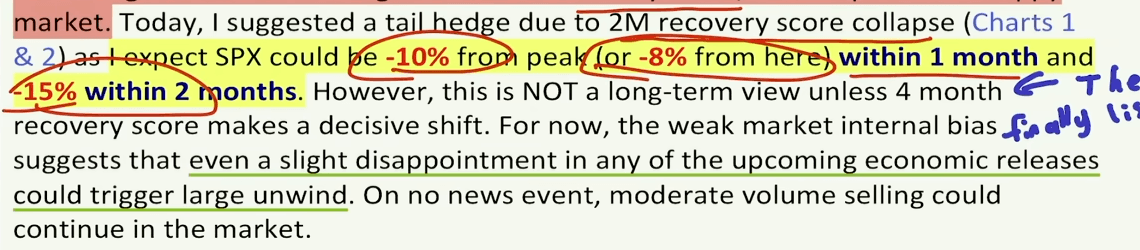

Cheong stated:

“I am turning tactically bearish [for the] next 2 months… As I expect [the] S&P 500 could be -10% from peak within 1 month and -15% within 2 months.“

She also highlighted that market internals have worsened to their lowest point year-to-date, increasing the risk of a substantial downturn.

Cheong warned that even a slight disappointment in upcoming economic data could trigger a large-scale unwind. She noted, “On [a] no news event, moderate volume selling could continue in the market.”

The report emphasizes that the market’s internal bias is so fragile that both external shocks and the absence of positive news could lead to significant declines in the S&P 500.

In light of the anticipated downturn, Cheong identified specific instruments for hedging against a declining market:

- iShares Russell 2000 ETF (IWM): Chosen due to its clean short/hedge positioning after a recent short squeeze.

- Financial Select Sector SPDR ETF (XLF): Option premiums are screened as cheap, sitting in the bottom 25th percentile versus the past five years.

- iShares iBoxx $ High Yield Corporate Bond ETF (HYG): Also identified for its inexpensive option premiums, making it a suitable hedge.

Kevin echoed the concerns raised by UBS, emphasizing the precarious state of the S&P 500. He broke down the UBS report, underscoring the following points:

- Intraday Recovery Scores at Six-Year Low: The market’s ability to rebound after sell-offs has significantly diminished, increasing vulnerability to downward movements.

- Investor Sentiment Shifting: There’s a noticeable change in investor behavior, with many opting to sell the dip instead of buying it. This shift could exacerbate market declines.

- Upcoming Economic Indicators: Paffrath highlighted the importance of upcoming economic data releases, such as the Consumer Price Index (CPI) and Producer Price Index (PPI), which could influence the market’s direction significantly.

- Political Events as Catalysts: He noted that political events, including debates and elections, could introduce additional volatility to the market.

Featured Image via Pixabay