For the first time in U.S. history, the government has spent over $1 trillion on interest payments, according to a report by Jeff Cox for CNBC that was published on 12 September 2024.

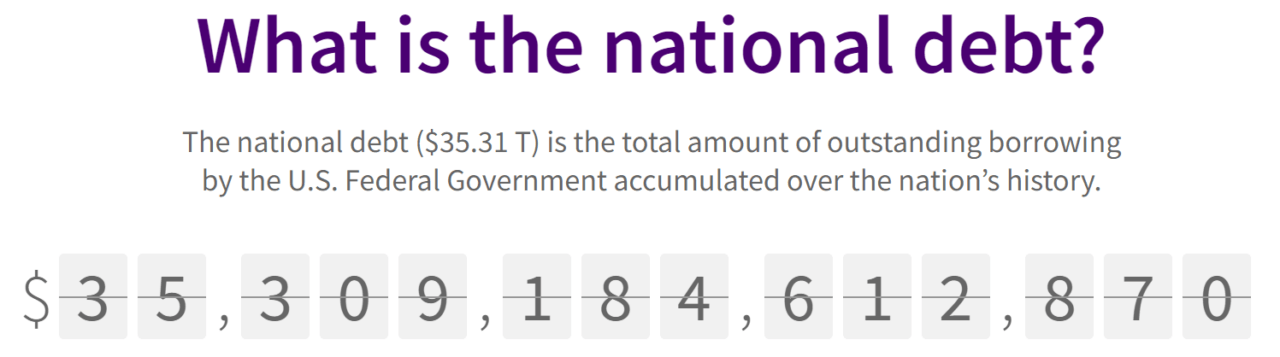

This historic figure comes from the Treasury Department’s latest data, which shows that the government has spent $1.049 trillion servicing its $35.3 trillion national debt. CNBC highlighted that this represents a 30% increase from the same period in 2023, driven largely by the Federal Reserve’s decision to keep interest rates at their highest level in 23 years.

According to Fiscal Data, the national debt refers to the total amount of money the federal government has borrowed to cover its expenses when revenues fall short. Just like an individual might use a credit card for purchases and not pay off the entire balance each month, the government borrows money by issuing marketable securities, such as Treasury bonds, bills, notes, and Treasury inflation-protected securities (TIPS). These securities are sold to investors, and the government is obligated to pay interest on them.

When annual spending exceeds revenue—like using more funds for infrastructure than what is collected in taxes—it leads to a budget deficit. As these deficits occur repeatedly over time, they accumulate, causing the national debt to grow, along with the interest owed to investors.

In the same report, CNBC shared that the Treasury Department projects total debt servicing costs to reach $1.158 trillion by the end of the year. When accounting for the interest the government earns from its investments, net interest payments totalled $843 billion. As CNBC pointed out, this figure is now higher than nearly every other spending category, except for Social Security and Medicare.

As noted by CNBC, the U.S. budget deficit also saw a significant jump in August 2024. Data from the Treasury Department reveals that the deficit surged by $380 billion in that month alone, a stark contrast to the $89 billion surplus recorded in August 2023. That surplus was largely due to accounting maneuvers related to student loan forgiveness. The total deficit for the year is now approaching $1.9 trillion, which is a 24% increase compared to last year.

Looking ahead, CNBC reports that the Federal Reserve is widely expected to lower interest rates by a quarter percentage point in the coming week. As further rate cuts are anticipated over the next few months, Treasury yields have already started to decline.

The yield on the 10-year Treasury note is currently around 3.7%, down more than 0.75 percentage points since early July.

Featured Image via Pixabay