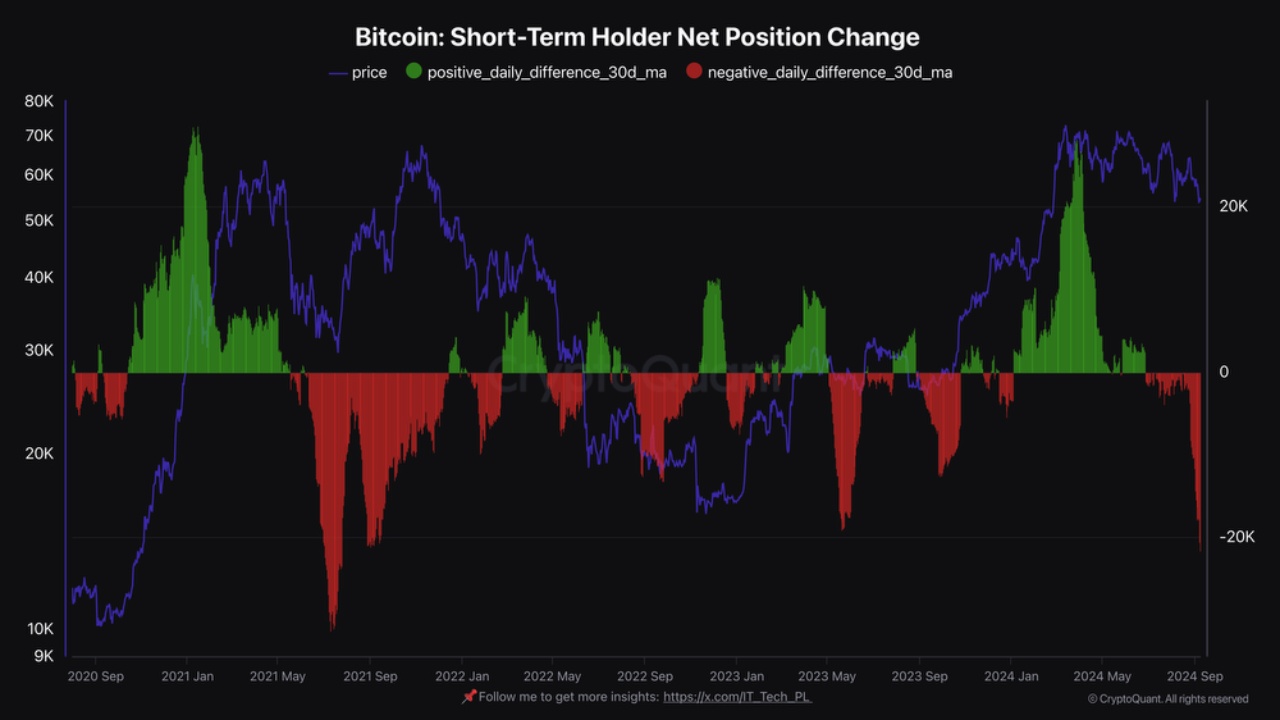

A recent analysis by crypto analytics firm CryptoQuant has revealed a significant shift in the dynamics of Bitcoin ownership, showing that short-term holders, those who have held their bitcoin for 155 days or less, have been steadily reducing their positions since late May, indicating weakening demand for the cryptocurrency.

In contrast, long-term BTC holders appear to be accumulating their positions as short-term holders sell off their holdings. CryptoQuant’s data shows a notable trend over the past few months, as short-term holders have significantly reduced their positions, particularly in July and August.

This sell-off by short-term holders could lead to medium-term price appreciation and market stabilization, according to CryptoQuant contributor IT Tech, who wrote that the “data shows a clear capital flow from weak hands (STH) to strong hands (LTH), signaling market stability.”

The charts show short-term investors exiting the market in the last two weeks, either realizing profits or losses. The trend comes short after sentiment in the cryptocurrency market has dipped into “extreme fear” after the price of the flagship cryptocurrency Bitcoin dropped to $53,500 in a massive downturn that has seen the space’s total market capitalization dip below the $2 trillion mark.

The Crypto Fear & Greed Index, which serves as an aggregate for investor confidence and attitude towards the market, dropped to 22, before it started recovering. The index saw a low around 6 when BTC dropped below $18,000 in 2022 after the collapse of popular cryptocurrency exchange FTX

Bitcoin has since recovered and is now trading at $56,700. Notably some analysts are bullish on the cryptocurrency, with cryptocurrency analyst MetaShackle on TradingView recently publishing analysis showing the cryptocurrency’s chart is forming an “absolutely massive” cup and handle pattern that could lead to a massive price rise.

Featured image via Unsplash.