In a recent interview with David Lin, renowned economist Professor Steve Hanke offered his insights on various economic and political topics, including the Federal Reserve’s monetary policy, inflation, and the potential implications of Kamala Harris’s housing plan.

Steve H. Hanke is a prominent professor of applied economics at Johns Hopkins University, where he also co-directs the Institute for Applied Economics, Global Health, and the Study of Business Enterprise. He is widely recognized for his expertise in currency reform, particularly in emerging-market countries, and has made significant contributions to global economic policy.

Hanke holds several influential positions, including serving as a senior fellow and director of the Troubled Currencies Project at the Cato Institute. He has also advised multiple heads of state across Asia, South America, Europe, and the Middle East on economic issues, particularly in establishing currency boards and implementing dollarization strategies.

Hanke’s academic career has been complemented by his practical experience in economics, having served as a senior economist on President Ronald Reagan’s Council of Economic Advisers from 1981 to 1982. Over the years, he has also held advisory roles for various governments and institutions, playing key roles in economic stabilization programs in countries like Argentina, Bulgaria, and Ecuador.

Additionally, Hanke is involved in several other academic and financial institutions, including serving as a senior fellow at the Independent Institute and a senior adviser at Renmin University of China’s International Monetary Research Institute. He is also an experienced currency and commodity trader and currently chairs the supervisory board of Advanced Metallurgical Group N.V. in Amsterdam.

Hanke began by addressing the recent remarks by Federal Reserve Chairman Jerome Powell at the Jackson Hole meeting. According to Hanke, Powell reaffirmed that a Fed rate cut in September is likely, and while this has already been somewhat priced into the market, it could still put downward pressure on the U.S. dollar. Hanke noted that the dollar has already weakened slightly against the Euro in recent weeks, but he emphasized that this isn’t a significant development, as the market had already anticipated these moves.

Continuing on the topic of the Federal Reserve, Hanke pointed out that the U.S. money supply, as measured by M2, has been contracting since July 2022. He explained that this contraction is unusual and has only occurred four times since the establishment of the Federal Reserve in 1913. Each of those instances, Hanke said, was followed by either a recession or, in the case of 1929-1933, a Great Depression. Hanke and his colleague John Greenwood have consistently predicted that this monetary contraction will lead to a recession in late 2024 or early 2025. Hanke expressed no surprise at the recent downward revision in U.S. job numbers, noting that it was consistent with his expectations of an economic slowdown driven by the shrinking money supply.

Shifting the conversation to inflation, Hanke criticized Powell’s explanation for the recent inflationary pressures, which Powell attributed to supply chain disruptions caused by the pandemic. Hanke dismissed this as “absolute baloney,” arguing that the real cause of inflation was the rapid expansion of the money supply in early 2021, when M2 was growing at an unprecedented annual rate of 27%. According to Hanke, such a sharp increase in the money supply inevitably leads to inflation, which is precisely what occurred, with inflation peaking at 9.1%. Hanke and Greenwood had accurately predicted this inflation spike, and Hanke stated that their forecast for inflation to decline to 2.5-3% by the end of 2024 remains on track, with current inflation already down to 2.9%.

Hanke then turned his attention to Kamala Harris’s proposed plan to combat inflation by building 3 million homes and providing $25,000 in assistance to first-time homebuyers. Hanke was critical of the plan, describing the $25,000 assistance as a form of “theft” from taxpayers, who would ultimately bear the cost of this gift. He questioned the logic behind giving such large sums to homebuyers, suggesting that it would only drive up demand for real estate and, consequently, increase housing prices. Hanke pointed out that this would contradict the intended goal of making housing more affordable.

Hanke also took issue with the idea of rent controls, which he recalled writing against in an op-ed for the Baltimore Sun in the early 1980s. He argued that rent controls distort the housing market and often lead to housing shortages, as landlords and developers reduce their investments in housing. Hanke warned that Harris’s plan to impose rent controls could backfire, creating more problems in the housing market rather than solving them.

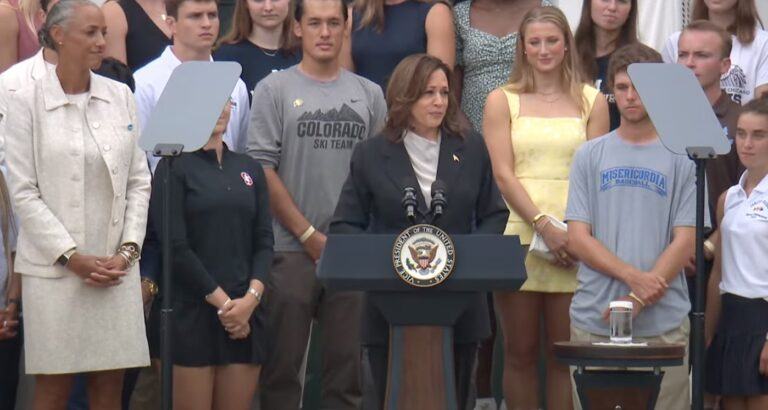

Featured Image via YouTube