Sentiment in the cryptocurrency market has dipped into “extreme fear” after the price of the flagship cryptocurrency Bitcoin ($BTC) dropped to $53,500 in a massive downturn that has seen the space’s total market capitalization dip below the $2 trillion mark.

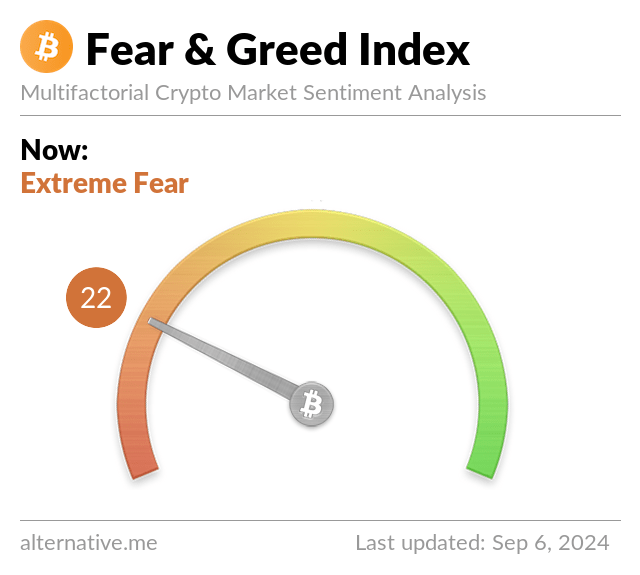

The Crypto Fear & Greed Index, which serves as an aggregate for investor confidence and attitude towards the market, dropped to 22, signaling extreme fear.

The index saw a low around 6 when BTC dropped below $18,000 in 2022 after the collapse of popular cryptocurrency exchange FTX.

These anxieties stem from concerns about a potential September correction that could push Bitcoin below the psychologically important $50,000 level. Arthur Hayes, the former CEO of cryptocurrency derivatives trading platform BitMEX, has recently revealed his belief that a price drop below $50,000 could occur this weekend.

Notably other analysts are bullish on the cryptocurrency, with cryptocurrency analyst MetaShackle on TradingView recently publishing analysis showing the cryptocurrency’s chart is forming an “absolutely massive” cup and handle pattern that could lead to a massive price rise.

Per the analyst’s post, there has “never been a formation like this in the history of crypto, and it’s sure to be an incredible run to levels that will shock the world.”

A cup and handle pattern occurs when the price of a security trends downward and recovers to form a “u” shape, before seeing another slight downward drift that forms the handle. It’s widely considered a bullish signal.

As CryptoGlobe reported since the middle of August a specific cohort of Bitcoin investors, those holdings onto the cryptocurrency for shorter periods of tie, have offloaded 642,366 BTC, worth more than $36.65 billion, onto the market.

Earlier, Morgan Stanley revealed in a filing it increased its Bitcoin exposure, revealing a 2.1% allocation to BlackRock’s spot Bitcoin ETF, IBIT, in its Institutional Fund.

Featured image via Unsplash.