The price of the flagship cryptocurrency Bitcoin ($BTC) has been steadily falling over the last few days after hitting a $64,000 high late last month. It’s now trading at $56,00 but, according to one popular analyst, it could soon surge to surpass the $130,000 mark.

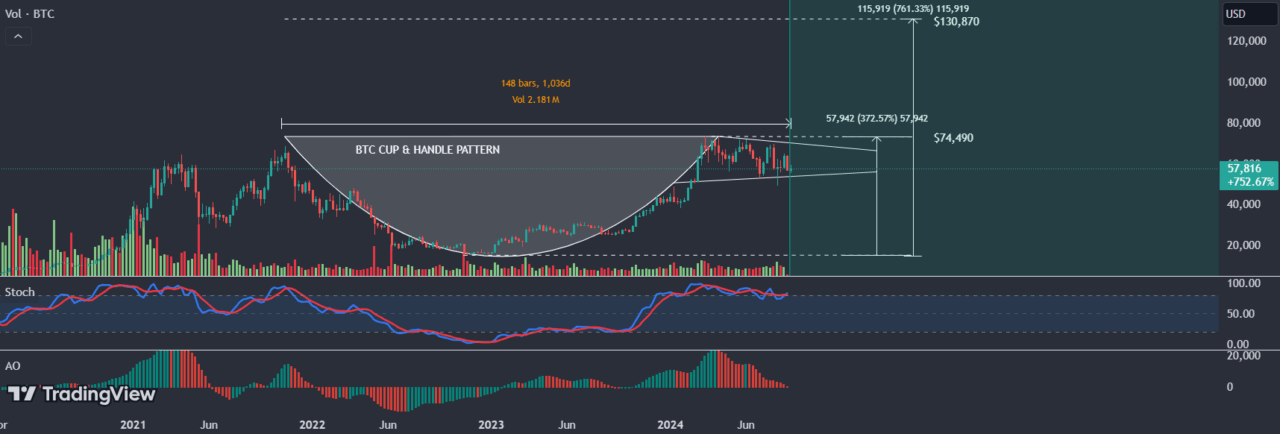

According to a post published by cryptocurrency analyst MetaShackle on TradingView, the flagship cryptocurrency’s chart is forming an “absolutely massive” cup and handle pattern that could lead to a massive price rise.

Per the analyst’s post, there has “never been a formation like this in the history of crypto, and it’s sure to be an incredible run to levels that will shock the world.”

A cup and handle pattern occurs when the price of a security trends downward and recovers to form a “u” shape, before seeing another slight downward drift that forms the handle. It’s widely considered a bullish signal.

As CryptoGlobe reported since the middle of August a specific cohort of Bitcoin investors, those holdings onto the cryptocurrency for shorter periods of tie, have offloaded 642,366 BTC, worth more than $36.65 billion, onto the market.

According to data from cryptocurrency analytics firm Glassnode shared by popular analyst Ali Martinez, the amount of Bitcoin held by short-term holders has been decreasing steadily over time, and recently saw a significant downturn.

Per the analyst, when this holder cohort buys Bitcoin the price of the cryptocurrency tends to rise, but it also tends to drop when these holders sell.

In response to Martinez another cryptocurrency analyst, known on the microblogging platform by Checkmate, suggested that short-term Bitcoin holders aren’t selling their holdings, but that instead more are “maturing into long-term status.”

In a separate post on the microblogging platform X (formerly known as Twitter), Martinez noted that there was a “spike in the Taker Buy/Sell Ratio” on cryptocurrency exchange HTX which “indicates a surge in aggressive buying” and is interpreted as a sign of “upward momentum ahead.”

Featured image via Unsplash.