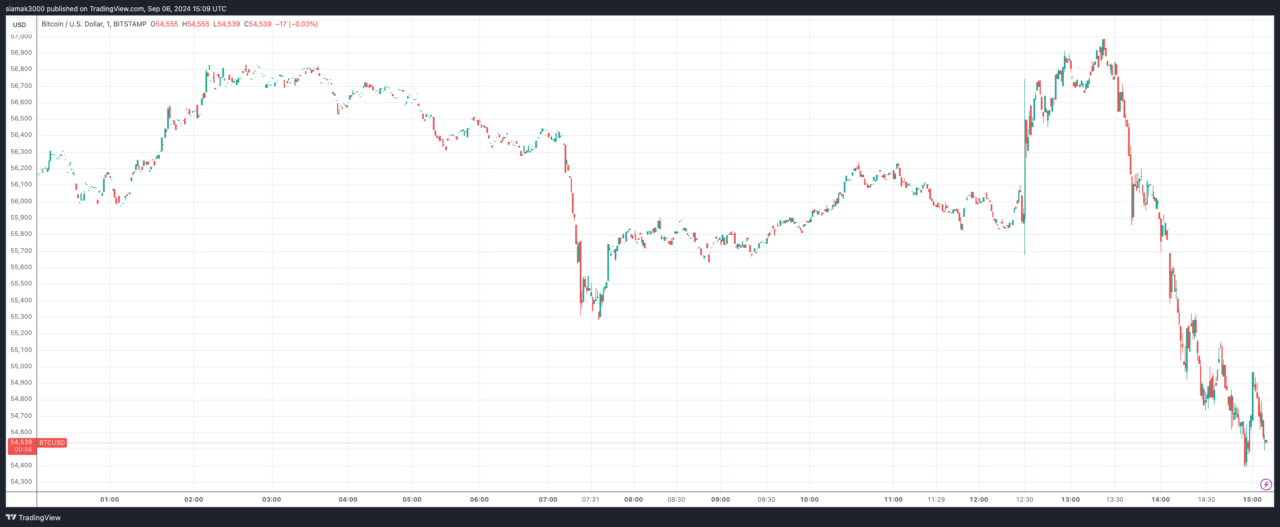

As of 2:50 p.m. UTC on 6 September 2024, Bitcoin is trading at $54,746, marking a 3.4% drop over the past 24 hours. This significant decline in Bitcoin’s value seems closely tied to the disappointing U.S. jobs data for August 2024, which was released earlier in the day. The broader cryptocurrency market, which typically follows Bitcoin’s lead, has also been negatively impacted by the same economic factors.

According to the press release from the U.S. Department of Labor Statistics, nonfarm payroll employment increased by 142,000 in August, a figure that fell short of expectations. In contrast to earlier predictions of stronger growth, this result reflects a slowing labor market, which has heightened concerns about the overall health of the U.S. economy. Additionally, the unemployment rate remained at 4.2%, with 7.1 million people unemployed, reflecting a higher number compared to the same period last year, when the unemployment rate stood at 3.8% and there were 6.3 million unemployed individuals.

The report highlighted notable job gains in sectors like construction and health care. Construction employment rose by 34,000 jobs, while healthcare saw an increase of 31,000 jobs in August. However, other sectors showed little to no improvement. Employment in manufacturing edged down by 24,000, mainly due to a decline in durable goods industries, and industries such as retail trade, transportation, financial activities, and government remained relatively stagnant over the month.

Although a softer labor market often signals to investors that there may be a potential interest rate cut in the near future—something that could typically provide a boost to risk assets such as Bitcoin—this report has instead stoked fears of a possible recession in the U.S. economy. Concerns that a slowing labor market might be an indicator of broader economic weakness have overshadowed the hope of Federal Reserve intervention at the upcoming FOMC meeting.

The reaction of the stock market to this news further exacerbated the negative sentiment. CNBC reported that the S&P 500 fell 1.4%, while the Nasdaq dropped 2.1%. The Dow Jones Industrial Average also shed 290 points, or about 0.7%. Mega-cap technology stocks were hit particularly hard, with Amazon and Alphabet both down more than 2%, while Microsoft and Meta saw losses of around 1%. The semiconductor sector also took a major hit, with companies like Nvidia, AMD, and Broadcom all seeing sharp declines. Broadcom, in particular, dropped 10% after issuing in-line guidance for its fiscal fourth-quarter revenue.

The weak August jobs data only added to these concerns, triggering a sell-off across various risk assets. As Bitcoin continues to be viewed as a risk asset akin to high-growth tech stocks, its price was dragged down in the broader wave of selling. Investor appetite for risk has been significantly reduced amid mounting worries about the potential for economic contraction, which has extended the downward pressure on Bitcoin and the cryptocurrency market.

Featured Image via Pixabay