Hedge fund billionaire John Paulson, renowned for his successful bet against the housing market during the financial crisis, recently warned that Vice President Kamala Harris’ proposed tax plans could lead to a financial market collapse and a recession, according to a report by Yun LI for CNBC. Paulson, a vocal supporter of former President Donald Trump, shared his concerns during an interview on CNBC’s Money Movers.

As reported by CNBC, Paulson criticized Harris’ plan to increase corporate taxes from 21% to 28% and long-term capital gains taxes from 20% to 39%, as well as the introduction of a 25% tax on unrealized capital gains. He predicted that implementing these policies would cause a market crash, with “no question about it.” Harris has proposed a 28% tax on capital gains for households earning over $1 million annually, which is lower than the 39.6% rate proposed by President Joe Biden for the 2025 fiscal year.

Harris has previously endorsed Biden’s idea of a 25% tax on unrealized gains for households worth $100 million or more, also known as the billionaire minimum tax, CNBC noted. However, investor Mark Cuban and others close to Harris’ campaign have suggested she has no real interest in taxing unrealized gains, and there are doubts about whether such a plan could pass through Congress.

CNBC mentioned that Paulson, who made a fortune during the financial crisis by betting against mortgage bonds, has also been an adviser to Trump, reportedly discussing the idea of creating a U.S. sovereign wealth fund. Paulson has been a significant donor to Trump’s 2024 campaign.

The investor also expressed concerns that the economy could fall into a recession if the proposed tax on unrealized gains were to be implemented. According to CNBC, Paulson warned that such a tax could trigger massive sell-offs in assets like homes, stocks, companies, and art, potentially leading to an economic downturn.

Some Wall Street economists, cited by CNBC, agree that raising corporate tax rates from the 21% level set during Trump’s presidency could negatively impact S&P 500 earnings and share prices. However, they don’t foresee a downturn of the magnitude Paulson described.

Paulson also downplayed concerns over Trump’s proposed tariffs potentially reigniting inflation, stating that tariffs could be targeted effectively. He argued that lower taxes would boost economic growth, ultimately increasing revenues and helping close the budget deficit, CNBC added.

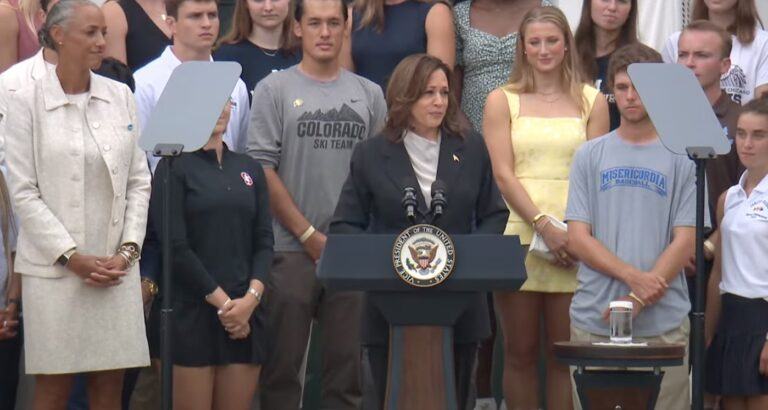

Featured Image via YouTube