The U.S. Treasury Department has formally withdrawn a 2020 proposal to impose know-your-customer (KYC) requirements on non-custodial crypto wallets, as reported by Nikhilesh De for CoinDesk. This decision, finalized on August 19, concludes a years-long debate that originated in the last days of the Trump administration.

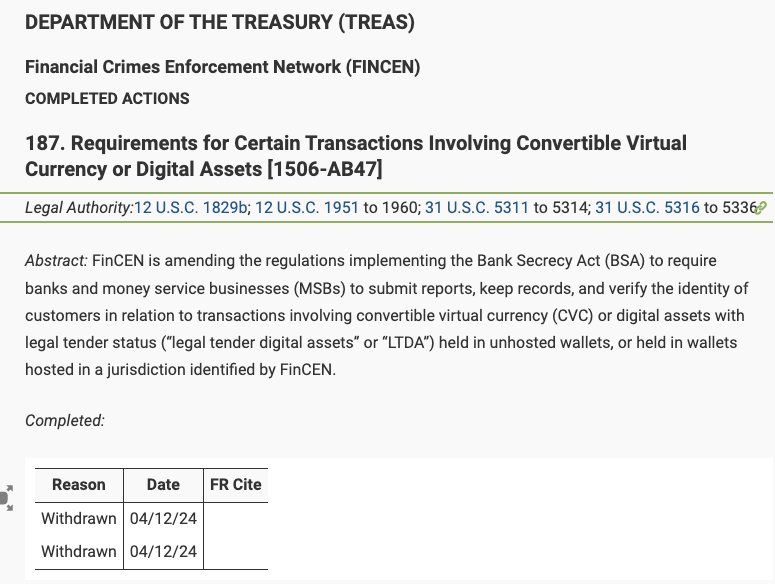

In December 2020, the Financial Crimes Enforcement Network (FinCEN), under then-Treasury Secretary Steven Mnuchin, introduced a rule that sought to extend KYC regulations to non-custodial wallets—wallets managed directly by individuals, without third-party intermediaries. According to CoinDesk, the proposal faced immediate and broad opposition from the U.S. crypto industry, with critics arguing that the rule was both technically unfeasible and excessively vague.

CoinDesk highlights that thousands of comments were submitted in response to the proposal, with input from industry leaders, lawmakers, and legal experts. They emphasized that non-custodial wallets do not collect personal information, making compliance with KYC regulations difficult, if not impossible. The proposal was criticized for being out of step with the decentralized nature of blockchain technology.

As mentioned by by CoinDesk, the transition to the Biden administration in January 2021 significantly reduced the proposal’s momentum. The extended comment period allowed for further review and the rule was gradually sidelined, culminating in its official withdrawal this month.

Michael Mosier, a former acting director of FinCEN, told CoinDesk that the decision to withdraw the rule reflects a growing recognition within the government of the need to adapt regulatory approaches to modern technologies rather than relying on outdated frameworks.

CoinDesk also notes that another proposal from 2020, known as the Travel Rule, remains under consideration. This rule would require financial institutions to report personal information for transactions exceeding $250, significantly lower than the current $3,000 threshold. The future of this proposal remains uncertain.