In a recent article, The New Yorker’s John Cassidy unveils a startling development in the 2024 U.S. presidential race: Donald Trump’s unexpected pivot to become a champion of cryptocurrency, particularly Bitcoin.

Trump’s Crypto Conversion

The New Yorker reports that Trump, who in 2019 dismissed Bitcoin’s value as “based on thin air,” has now positioned himself as its biggest advocate. According to the article, Trump’s appearance at a Bitcoin conference in Nashville saw him promising to create a “strategic Bitcoin stockpile” and transform the United States into “the Bitcoin superpower of the world.”

Regulatory Rollback Concerns

A key concern highlighted by The New Yorker is Trump’s pledge to fire Gary Gensler, the current chair of the Securities and Exchange Commission (SEC). The article notes that Gensler has been a vocal critic of the crypto industry, describing it as having a “record of failures, frauds, and bankruptcies.” His removal, The New Yorker suggests, could signal a significant loosening of regulatory oversight.

Parallels to Past Financial Crises

Drawing parallels to the 2008 financial crisis, The New Yorker article warns of the potential consequences of deregulating crypto assets. It cites the Commodity Futures Modernization Act of 2000, which exempted certain financial derivatives from regulation, leading to the explosive growth of mortgage derivatives that played a crucial role in the financial meltdown.

Integration with Mainstream Finance

The New Yorker expresses serious concern about the potential integration of largely unregulated crypto assets into the mainstream financial system. The article quotes Dennis Kelleher, president of Better Markets, who warns of the dangers if a crypto crash were to occur in an environment where crypto is “fully integrated and interconnected with the banking system.”

Political Influence of Crypto Money

The article in The New Yorker also illuminates the crypto industry’s significant political donations. It cites Bloomberg data showing that three crypto super PACs have raised $170 million from donors, including Coinbase, Ripple, and venture capital firm Andreessen Horowitz. The New Yorker suggests that this influx of money could be used to influence policy decisions favorable to the industry.

Trump’s Personal Interests

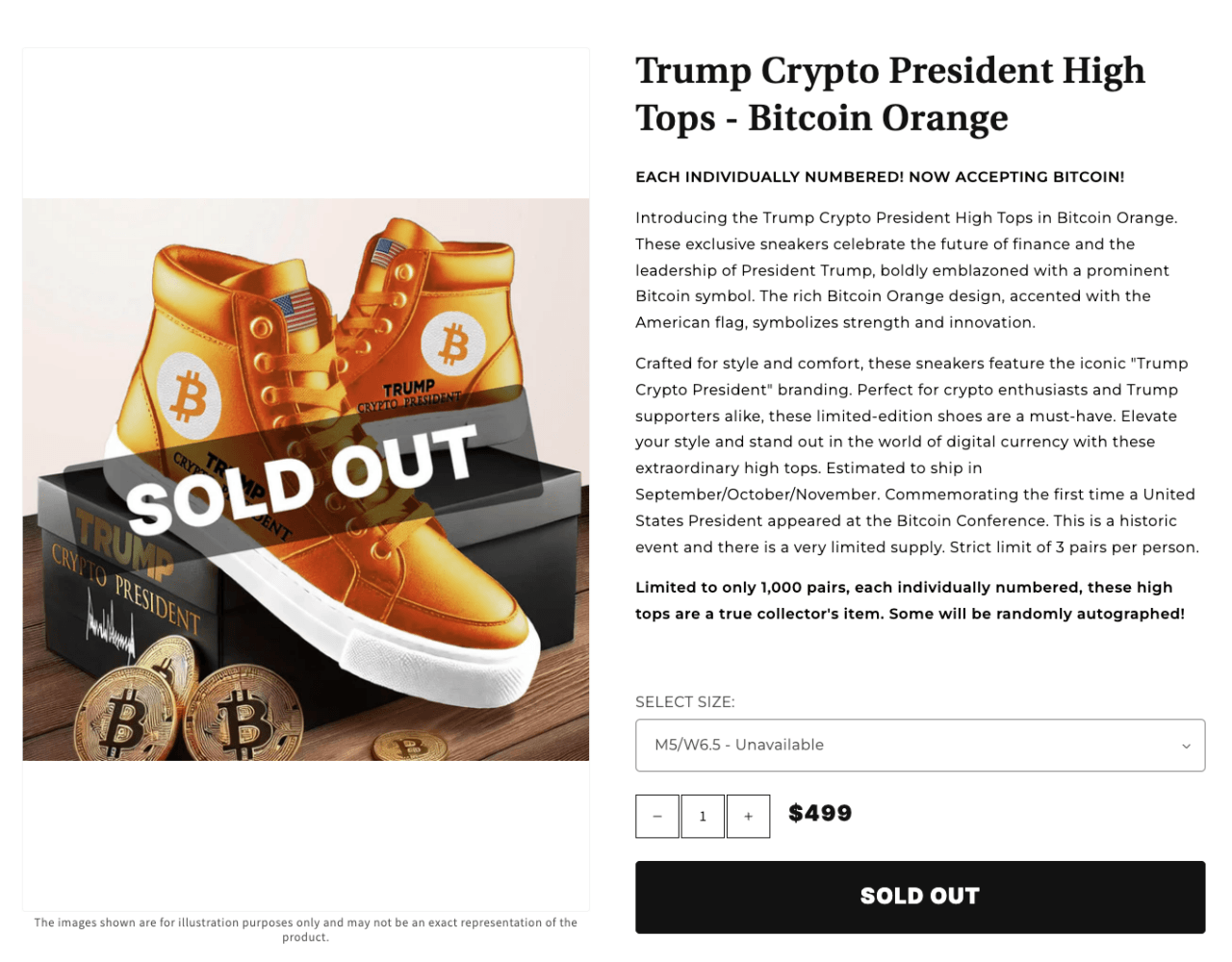

The New Yorker points out that Trump’s embrace of crypto appears to extend beyond policy proposals. The article reports that Trump’s company has launched a line of Bitcoin-themed sneakers, suggesting a personal financial interest in the cryptocurrency’s success. This raises questions about potential conflicts of interest, should Trump return to the White House.

Lack of Clear Social Purpose

A final concern raised by The New Yorker is the apparent lack of a clear social purpose for cryptocurrencies. The article contrasts this with past financial innovations, such as mortgage securities, which at least purported to serve a larger social goal of expanding homeownership. The absence of such a purpose for crypto, The New Yorker suggests, makes the risks associated with light regulation harder to justify.

Featured Image via Pixabay