In a video released on August 2, David Lin of “The David Lin Report” hosts Clem Chambers to discuss the current market downturn and its potential implications.

Clem Chambers is a prominent figure in the financial and technological sectors, known for his expertise as a financial analyst and author. He serves as the CEO of ADVFN, a global stocks and shares information website, and has a significant presence as a columnist for Forbes, where he writes on various financial and investment topics. Chambers has authored numerous books on finance and trading, contributing to his reputation as an influential voice in these fields.

Market Reaction to Jobs Report

The unemployment rate has ticked up to 4.3%, leading to significant market reactions:

- NASDAQ: Down by 2.43%

- VIX (Volatility Index): Spiked by over 94% in the past one month period

- Gold: Went down slightly on Friday, but is still close to its all-time high

- Bitcoin: Down 9% in the past seven-day period

Chambers attributes these market movements to the interplay of money flows and central bank policies, particularly focusing on the actions of the Bank of Japan.

Yen/USD vs. Stocks

Chambers explains the concept of carry trades, where investors borrow money at low interest rates (historically from Japan) and invest in higher-yielding assets like U.S. stocks. However, with Japan increasing its interest rates, investors are forced to pull their money back, causing a ripple effect across global markets. He claims that this retraction of funds is a significant factor in the current downturn.

Will the Market Crash Continue?

Chambers discusses the possibility of a prolonged market downturn but leans towards a correction rather than a full-blown crash. He emphasizes the role of the Federal Reserve in managing the money supply and notes that recent actions suggest the Fed is trying to stabilize the economy.

VIX and Market Sentiment

The VIX, often termed the “fear index,” has surged, indicating high levels of uncertainty. Chambers argues that this is more about market uncertainty than outright fear, reflecting the unpredictable nature of current economic conditions.

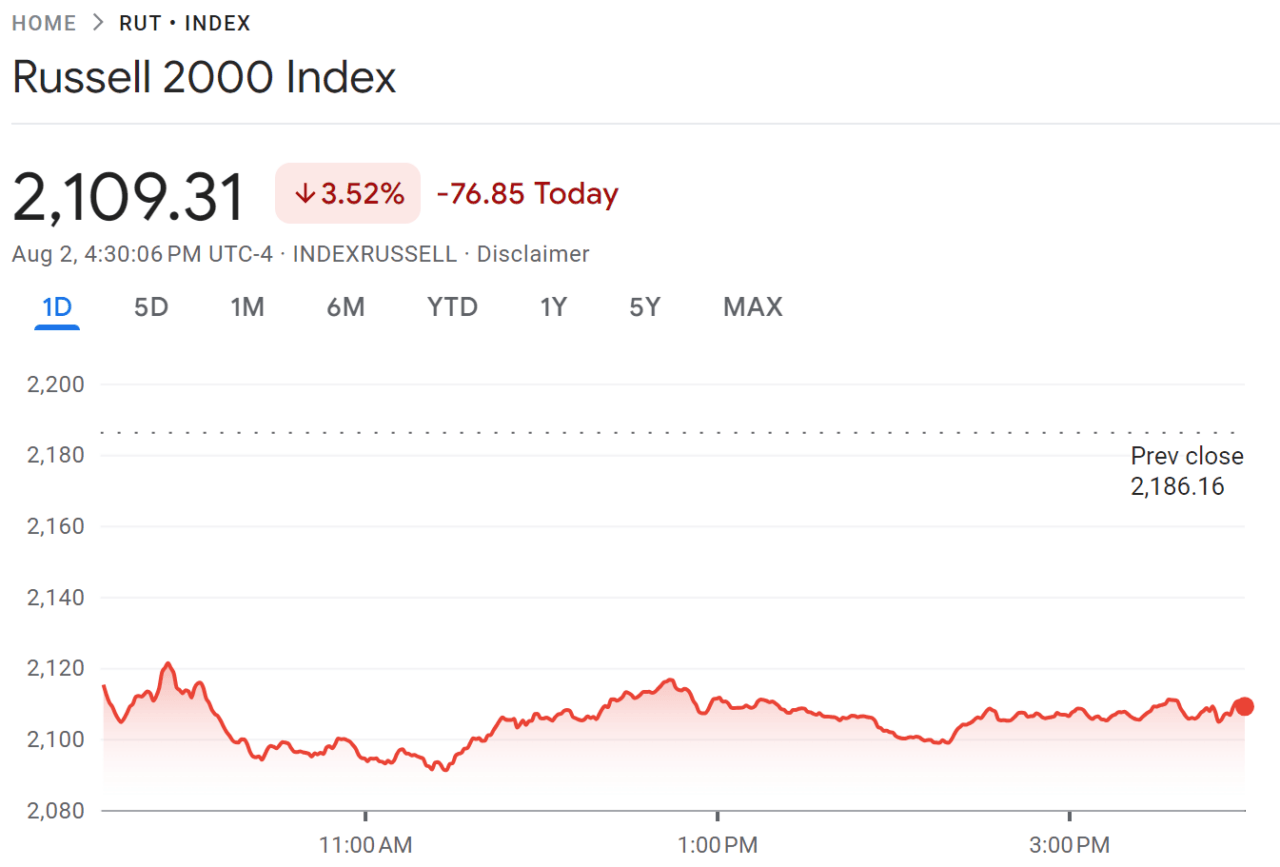

Russell 2000 and Market Rotation

Chambers notes that the Russell 2000 index, which represents small-cap stocks, initially saw gains when money rotated out of large-cap tech stocks but has since given back those gains. He attributes this rotation to investors’ attempts to find safer or more profitable positions amid the current volatility.

How to Play ‘Uncertainty’

Chambers advises investors to understand their positions and strategies thoroughly. He believes that those with a clear rationale for their investments are better positioned to weather the current storm. He cautions against panic selling and suggests that those with solid, long-term strategies will likely fare better.

Rate Cut vs. Stocks

The Bank of England recently cut rates, but the FTSE 100 continued to decline. Chambers explains that markets often price in future expectations, and a rate cut might signal deeper economic troubles ahead, leading to negative market reactions.

Bitcoin

Bitcoin has also been affected by these broader economic trends. Despite some positive news, such as potential strategic reserves in the U.S., Bitcoin’s price remains volatile. Chambers views Bitcoin as a long-term asset with potential, albeit one that requires patience and a strong stomach for volatility.

Featured Image via Pixabay