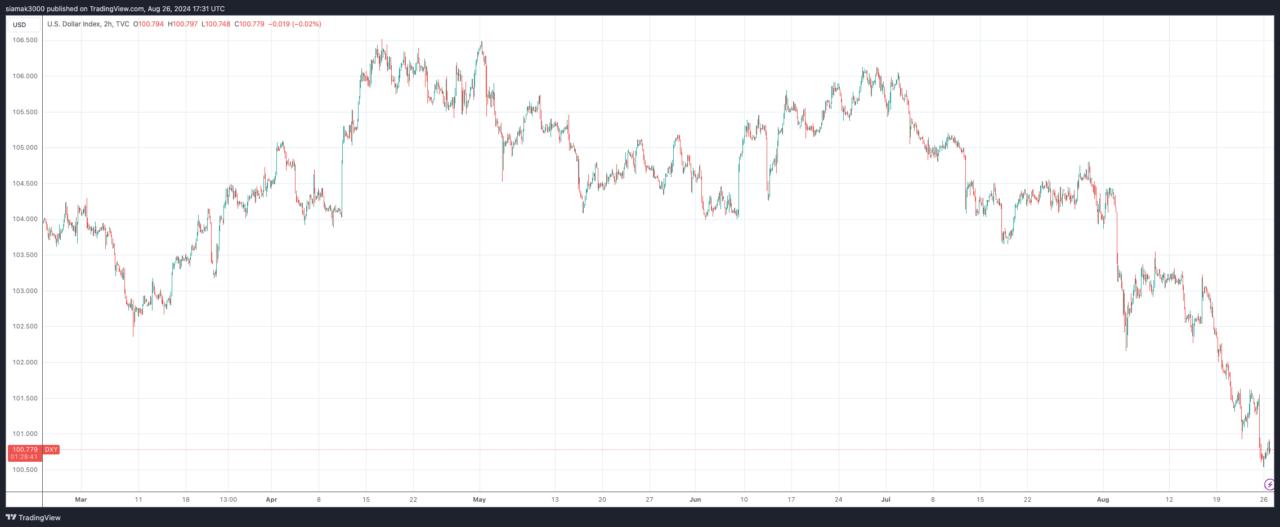

The U.S. dollar has been on a downward trend over the past few months, and while this might initially seem concerning, Yahoo Finance anchor Madison Mills has provided a comprehensive analysis of both the pros and cons of a weaker dollar.

In her detailed breakdown, Mills highlights how this currency depreciation can impact inflation, consumer prices, international travel, and investment opportunities.

Inflation and Domestic Prices

Mills begins her analysis by addressing one of the most immediate concerns for consumers: inflation. She explains that a weaker dollar can lead to higher prices on imported goods, which could exacerbate inflation in the United States. Since many everyday products are imported, a declining dollar means that it costs more to purchase these goods. Mills emphasizes that this is a critical issue to watch, especially as economic policymakers consider the broader implications of currency fluctuations. The potential for increased inflation due to a weaker dollar is a significant downside, as it can directly affect the purchasing power of American consumers.

Impact on International Travel

For those who love to travel, a weaker dollar can be a double-edged sword, according to Mills. On the one hand, she notes that if the dollar continues to weaken, it could make international travel more expensive for Americans. This is because the value of the dollar would not stretch as far when exchanged for foreign currencies. Mills advises that if you have plans to travel abroad, particularly to countries where the dollar has been historically strong, such as Japan, now might be the best time to go before the dollar potentially weakens further. This advice underscores the importance of timing in travel planning when currency values are in flux.

Investment Opportunities

Despite the potential downsides for consumers and travelers, Mills points out that a weaker dollar can present unique opportunities for investors. She explains that currency depreciation can be beneficial for those looking to invest in foreign assets. For example, investors might consider buying foreign stocks, bonds, or even currencies, taking advantage of the weaker dollar to gain assets that could appreciate when converted back to U.S. dollars. Mills references the recent “carry trade” involving the dollar and the yen, where institutional investors capitalized on the weaker yen to realize significant gains. She stresses the importance of monitoring central bank actions globally, as these can significantly influence the success of such investment strategies.

Featured Image via Pixabay