Japan’s stock markets entered a bear market on Monday, mirroring a broader sell-off across Asia-Pacific markets that began last week. Both the Nikkei 225 and TOPIX indexes plummeted over 12%, marking a significant downturn.

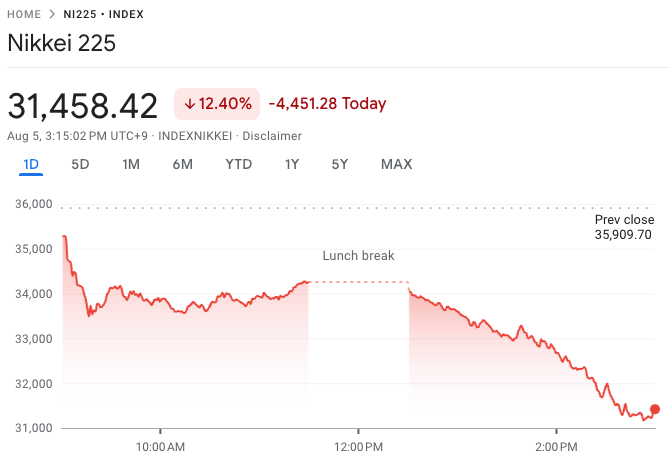

According to a report by CNBC, by Monday’s close, the benchmark indexes had declined more than 20% from their record highs on 11 July. The Nikkei 225 experienced a staggering 12.4% drop, closing at 31,458.42. This represents the worst day for the index since the notorious “Black Monday” crash of 1987. In absolute terms, the Nikkei lost 4,451.28 points, the largest point drop in its history, erasing all its gains for the year and pushing it into negative territory year to date.

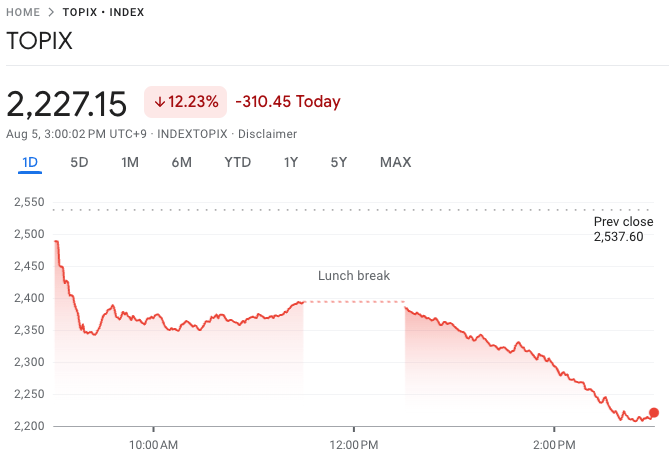

The broad-based TOPIX index also faced severe losses, dropping 12.23% to finish at 2,227.15. Major Japanese trading houses such as Mitsubishi, Mitsui & Co, Sumitomo, and Marubeni all saw their shares plummet over 14%, with Mitsui suffering nearly a 20% loss in market capitalization.

This sharp decline followed significant losses on Friday, where the Nikkei 225 and TOPIX fell by more than 5% and 6%, respectively. For the broader TOPIX, it was the worst single day in eight years, while the Nikkei marked its most severe drop since March 2020.

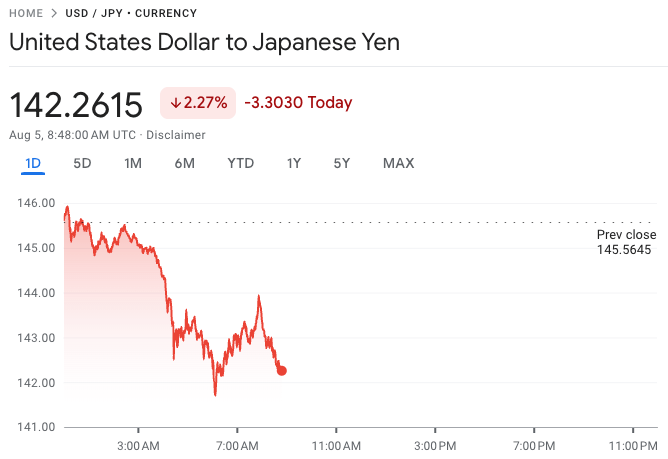

In currency markets, the Japanese yen strengthened to its highest level against the U.S. dollar since January, trading at 142.09 yen per dollar by 8:48 a.m. UTC.

The CNBC report also mentioned that other markets in the region also faced turmoil. South Korea’s Kospi index fell 8.77%, closing at 2,441.55, while the smaller-cap Kosdaq experienced an 11.3% decline, ending at 691.28. The severe sell-off triggered circuit breakers, halting trade for 20 minutes on both indexes.

Taiwan’s Taiwan Weighted Index dropped over 8%, primarily due to losses in technology and real estate stocks. Meanwhile, Australia’s S&P/ASX 200 fell 3.7% to 7,649.6. The Reserve Bank of Australia commenced its two-day monetary policy meeting on Monday, with expectations for rates to remain steady at 4.35%. However, investors are keenly awaiting the bank’s policy statement for any indications of a potential rate hike.

In Hong Kong, the Hang Seng index was down 1.62% towards the end of trading, and mainland China’s CSI 300 index fell 1.21% to 3,343.32, the smallest decline in the region.

The U.S. markets also faced significant declines on Friday, spurred by a disappointing jobs report for July, raising fears of an impending recession. The Nasdaq was the first of the major U.S. indexes to enter correction territory, having dropped over 10% from its peak. The S&P 500 and Dow were down 5.7% and 3.9% from their all-time highs, respectively. The S&P 500 fell by 1.84%, the Nasdaq Composite by 2.43%, and the Dow Jones Industrial Average lost 610.71 points, or 1.51%.

Earlier today, professional trader Adam Khoo offered insights into the panic sweeping Japan’s markets. Khoo highlighted the sharp rise in the JPY/USD exchange rate, which has triggered a massive unwinding of Yen carry trade positions. This practice involves traders borrowing Japanese yen at low interest rates, converting it to U.S. dollars, and using it to buy U.S. stocks. With the Bank of Japan raising interest rates, the yen has strengthened significantly against the dollar, exacerbating the situation for these traders.

Khoo explained that traders are now facing higher interest payments on their borrowed yen, coupled with substantial forex losses. The appreciation of the yen means that the U.S. assets held by these traders may no longer cover their yen-denominated debts. Consequently, traders are unwinding their positions by selling U.S. stocks to raise dollars, converting them back to yen to repay their loans. This process adds further selling pressure on U.S. stocks, potentially leading to more declines in the near term.

Compounding these financial strains are geopolitical tensions, including the escalating conflict in the Middle East and uncertainties in U.S. politics, which have fueled the prevailing fear and panic. Khoo views this crisis as an opportunity for investors to acquire high-quality U.S. stocks at significant discounts, capitalizing on temporary mispricings caused by short-term market turmoil.

Featured Image via Pixabay