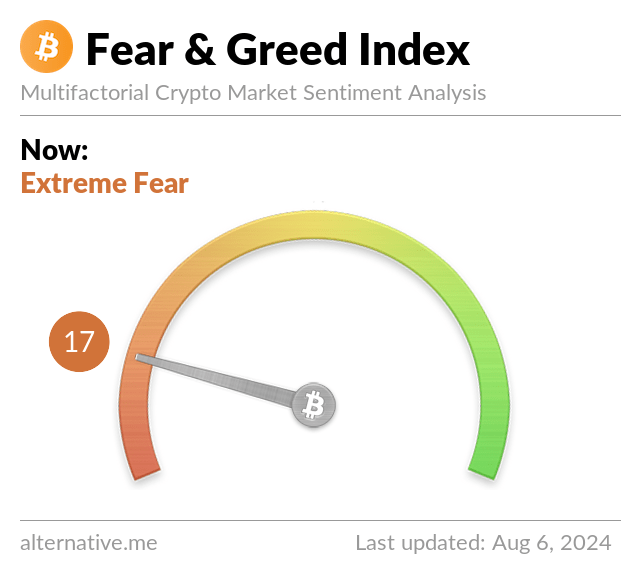

A massive cryptocurrency market sell-off earlier this week saw the market’s Crypto Fear & Greed Index plunge into its lowest level in two years signaling “extreme fear” among investors for the first time since July 2022.

The index, which utilizes multiple sources, including social media, to produce a relative number that reflects investor sentiment, has risen from 6 when BTC dropped below $18,000 last year. Per the index, behavior in the cryptocurrency market is “very emotional” and people “get greedy when the market is rising which results in FOMO (Fear of missing out).”

The index also adds that people “often sell their coins in irrational reaction of seeing red numbers.” The index entered “extreme fear” levels after a massive cryptocurrency market sell-off briefly saw the price of Bitcoin dip below the $50,000 mark before recovering.

That sell-off came amid a wider financial markets rout over a confluence of various factors, including investors concerns surrounding economic growth and the potential overvaluation of artificial intelligence.

Economic data in the United States has started pointing to a potential recession after worst-than-unexpected unemployment data triggered what’s known as the Sahm rule, an indicator that measures the three-month moving average of the U.S. unemployment rate against its previous 12-month low.

Meanwhile, rising tensions in the Middle East exacerbated investor anxiety as Iran is expected to soon attack Israel in response to the killing of Hamas’s leader Ismail Haniyeh in Tehran.

The sell-off saw equities markets plunge, with Japan’s Nikkei 225 index seeing its worst two-day performance ever to lose nearly 20% of its value in that period before recovering. It was so intense several brokerages briefly went down.

Featured image via Unsplash.