Bitcoin mining stocks have reportedly faced significant setbacks in the first two weeks of August, reversing gains linked to artificial intelligence (AI) hype as the network hash rate surged. According to an article by Will Canny for CoinDesk, citing a research report released by JPMorgan last Friday, the rising hash rate has pushed mining profitability to unprecedented lows, leading to a substantial decline in the market value of Bitcoin mining companies.

Bitcoin’s hash rate represents the total computational power used by miners in the Bitcoin network to solve complex mathematical puzzles that validate and secure transactions. It’s measured in hashes per second (H/s). A higher hash rate means more miners are actively working, making the network more secure against attacks like double-spending. It also reflects the difficulty of mining new blocks; as more miners join the network, the difficulty adjusts to maintain a steady block production rate. The hash rate is a critical indicator of the network’s health, security, and the competitive landscape of Bitcoin mining.

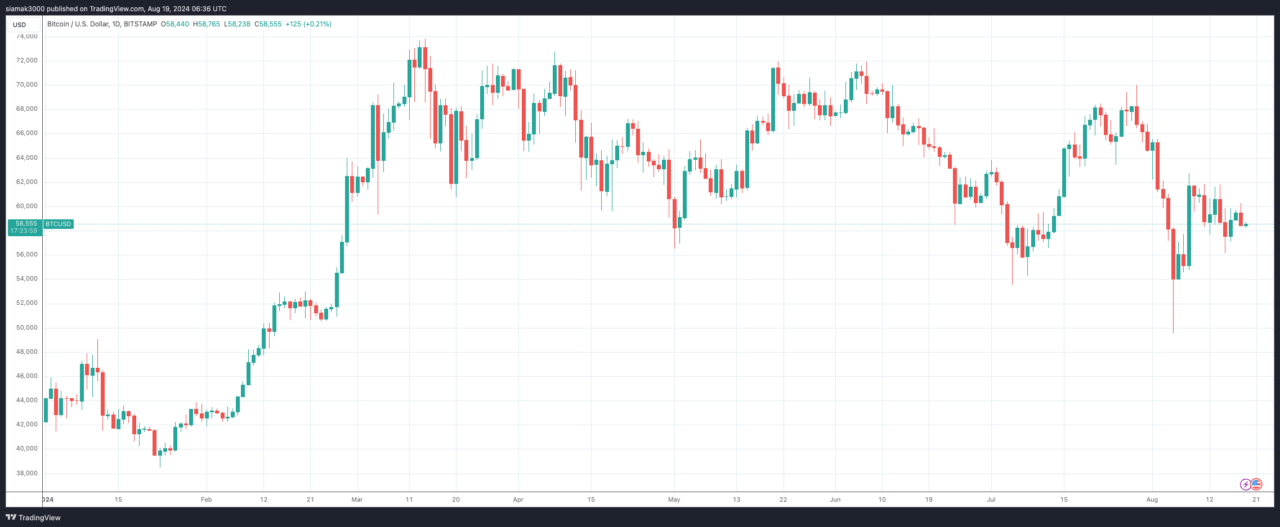

The hashrate increased by approximately five exahashes per second (EH/s) to an average of 621 EH/s during the first half of August. This 1% rise in hashrate represents a notable challenge for miners, particularly as it remains 30 EH/s below levels seen prior to the Bitcoin halving event.

JPMorgan analysts Reginald Smith and Charles Pearce highlighted that the total market capitalization of 14 U.S.-listed Bitcoin mining companies tracked by the bank dropped by 18% since the end of July. These stocks are now trading at twice their proportional share of the four-year block reward, signaling a significant overvaluation in the market.

Despite these headwinds, U.S.-listed miners have managed to increase their share of the global Bitcoin network hashrate for the fourth consecutive month, reaching a record 26%. However, this achievement is overshadowed by the continued decline in mining profitability. The hashprice, a key metric for assessing mining profitability, remains 30% below December 2022 levels and 40% below pre-halving levels. This sustained pressure on profitability could potentially slow the growth of the network hashrate in the near future.

Bitcoin’s price has declined by 8.3% since the last Bitcoin halving (April 19th) but is still up 39.4% year-to-date and 124.5% year-on-year.

Amid these industry-wide challenges, Marathon Digital Holdings, Inc. (NASDAQ: MARA), one of the largest Bitcoin mining firms globally, made a significant move on 14 August. The company secured $300 million through an oversubscribed offering of convertible senior notes. With these funds, Marathon purchased 4,144 BTC, valued at approximately $249 million, thereby increasing its strategic Bitcoin reserve to over 25,000 BTC.

Marathon Digital Holdings has issued unsecured senior notes bearing interest at 2.125% per annum, payable semi-annually on March 1 and September 1, starting March 1, 2025. The notes will mature on September 1, 2031, unless repurchased, redeemed, or converted earlier. Beginning September 6, 2028, MARA may redeem all or part of the notes at 100% of the principal amount, plus accrued interest, provided MARA’s common stock price exceeds 130% of the conversion price for a specified period before the redemption notice. If fewer than all notes are redeemed, at least $75 million in aggregate principal must remain outstanding.

Noteholders may require MARA to repurchase their notes on March 1, 2029, or upon certain fundamental changes at 100% of the principal amount plus accrued interest. MARA may also be required to increase the conversion rate if notes are converted in connection with specific corporate events or a redemption notice.

The notes are convertible into cash, shares of MARA’s common stock, or a combination of both, at MARA’s discretion. Conversion is limited to specific events and periods before March 1, 2031, and is unrestricted thereafter until two trading days before maturity.

The initial conversion rate is 52.9451 shares per $1,000 principal amount, equivalent to an initial conversion price of approximately $18.89 per share, subject to adjustment based on certain events.

Featured Image via Pixabay