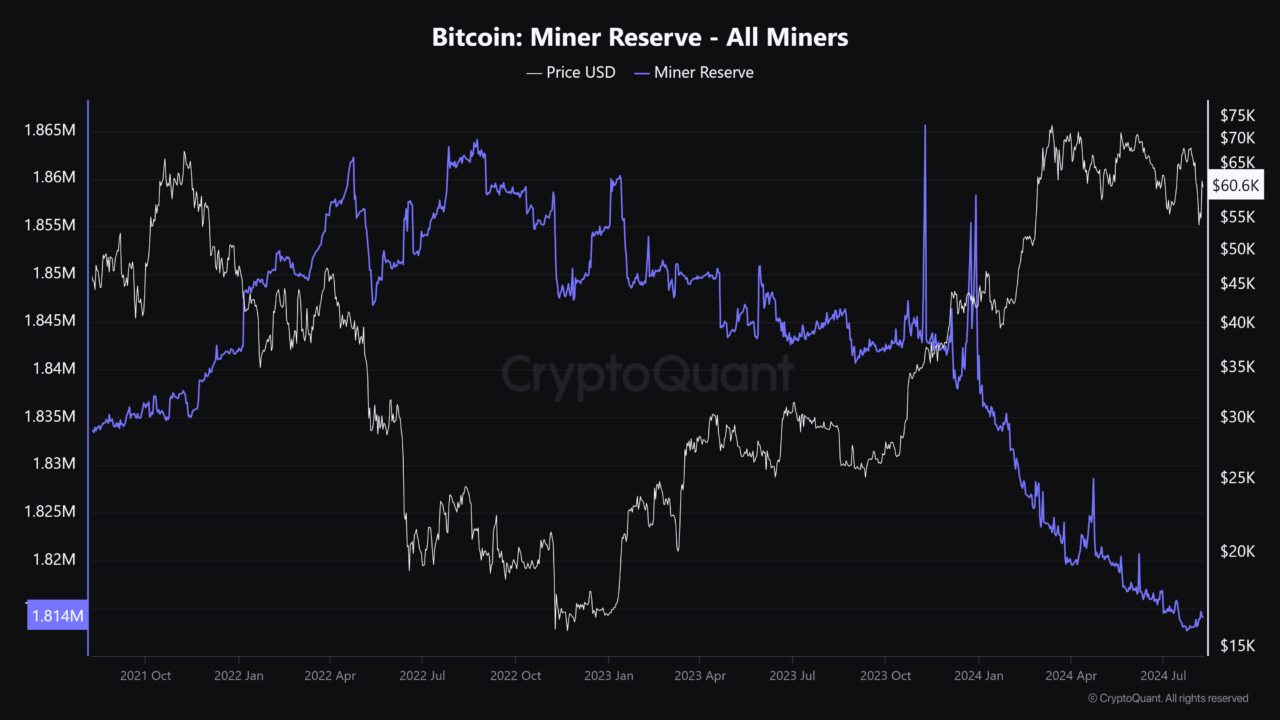

Bitcoin miners has significantly reduced their BTC reserves over the last few months, to the point they’re not at their lowest level since January 2021, when the cryptocurrency’s price exploded from around $25,000 to over $69,000 before entering a downturn.

The total amount of Bitcoin held by miners has plummeted to a three-year low as a direct consequence of the recent halving upgrade in April, which halved the coinbase reward miners receive per new block found.

According to a report from Bloomberg citing Kaiko data, the amount of Bitcoin held by miners has dropped to around 1.5 million BTC, worth around $86 billion. Miners have notably seen selling tokens since the cryptocurrency market rallied in late 2023, with the proceeds from these sales often being used to fund their operations.

Data from cryptocurrency analytics firm CryptoQuant confirms there has been a severe downtrend in miner reserves, with its data pointing to reserves of around 1.8 million BTC.

Despite the overall trend, publicly traded mining firms like CleanSpark and Riot Platforms have increased their Bitcoin holdings by 60% since the start of the year, according to SEC filings, while Marathon Digital Holdings recently invested $100 million in the cryptocurrency.

However, the broader industry is under pressure, with Core Scientific recently reporting a staggering $804 million loss in the second quarter, primarily driven by mandatory, $796 million “non-cash mark-to-market adjustments” to warrants and contingent value rights issued during the bankruptcy processs. The company reported an increase in revenue to $141.1 million.

Notably, miners reserves are dropping at a time in which Bitcoin’s price chart is on the verge of forming a bearish technical pattern known as the “death cross.”

A death cross, it’s worth noting, occurs when a short-term moving average drops below a longer-term moving average, in this case the cryptocurrency’s 50 moving average is dropping below its 200 moving average.

According to Investopedia, market history of death crosses suggests the signal “tends to precede a near-term rebound with above-average returns.”

Market observers pointed out that in October 2023, Bitcoin also faced a death cross where the short-term moving average crossed below the long-term moving average, but it was quickly inverted as the price of the cryptocurrency started surging.

That death cross was formed with Bitcoin trading at around $27,000 and was followed by a bull run to a new all-time high around $73,000 after the U.S. Securities and Exchange Commission (SEC) approved spot Bitcoin exchange-traded funds (ETFs) in the country in January 2024.

The death cross is forming after a mysterious buying spree gripped the Bitcoin market, with permanent holders accumulating nearly $23 billion worth of the cryptocurrency over the past month amid a surge in demand that has sparked speculation.

Featured image via Unsplash.

UPDATED 13/08/2024 to contextualize Core Scientific’s losses and revenue.