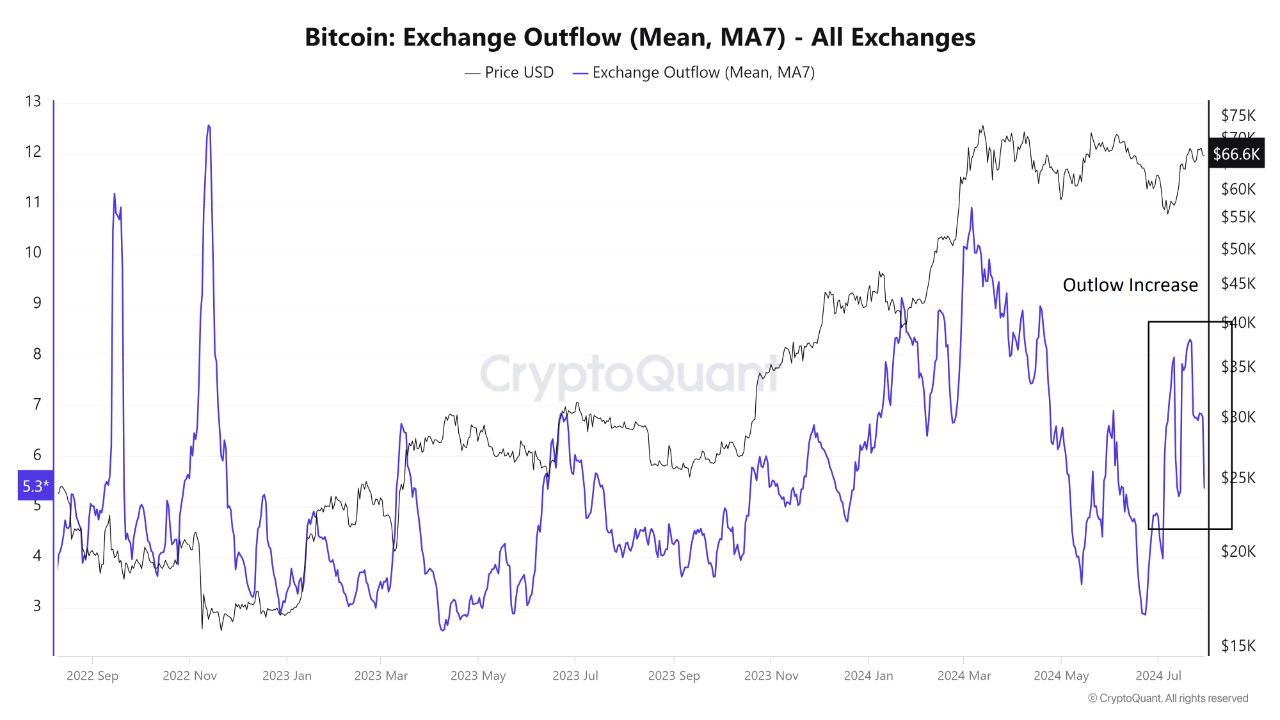

The amount of the world’s largest cryptocurrency Bitcoin ($BTC) on exchanges has been seeing an increase in outflows “despite the fact that Bitcoin has entered into a fluctuation area since February.”

According to analysis published by on-chain analytics firm CryptoQuant, there has been a steady rise in Bitcoin outflows from exchanges in recent weeks, in a trend that is typically seen as bullish. A smaller supply of BTC exchanges means that the cryptocurrency’s price could rise if demand is maintained or grows.

Moreover, the number of new Bitcoin addresses has also been climbing, as CryptoPotato reported, as after hitting multi-year lows in June, this metric has reversed course, a pattern often associated with growing interest in the cryptocurrency.

The exchange outflows come at a time in which the US national debt has surpassed the $35 trillion milestone. The milestone came before Bitcoin faced a rejection as it attempted to breach the $70,000 mark, and ended up correcting to now trade at $63,000.

Notably, leading stablecoin issuer Tether, the company behind the USDT token, has announced record-breaking profits of $5.2 billion for the first half of 2024 while also revealing a significantly expanded portfolio of U.S. government bonds, now valued at an estimated $97.6 billion.

The firm has also revealed it now holds around 80,000 Bitcoin worth around $5.1 billion. As CryptoGlobe reported, last year Tether committed to use 15% of its realized net operating profits to invest in the flagship cryptocurrency BTC.

Unlike traditional banks, which operate on a fractional reserve basis, Tether maintains its cryptocurrencies backed by mostly cash and short-term U.S. Treasury bills. At the time of writing, 3-month U.S. Treasurys are yielding around 5.28%. The firm also holds gold.

Featured image via Unsplash.