A recent analysis from K33 Research, as reported by Bloomberg, highlights a growing risk of a short squeeze in the Bitcoin market, which could lead to sudden price surges in the world’s largest cryptocurrency. This warning comes as the Bitcoin derivatives market, particularly the perpetual futures segment, shows signs of increasing bearish sentiment among speculators.

The key indicator behind this potential short squeeze is the funding rate for Bitcoin perpetual futures. This rate is a critical gauge of market sentiment, revealing whether traders are predominantly bullish or bearish. As of August 20, K33 noted, that the seven-day average annualized funding rate had dropped to its lowest level since March 2023, a time when the failure of several US banks shook investor confidence. This low funding rate suggests that many traders are betting on Bitcoin’s price to fall.

K33 analysts Vetle Lunde and David Zimmerman pointed out that the negative funding rates, combined with a sharp increase in open interest, signal aggressive short selling. This creates a market environment where a short squeeze—a scenario where unexpected price increases force traders to quickly cover their short positions—could easily occur. The resulting buying pressure could amplify any upward price movement, leading to a sharp rally.

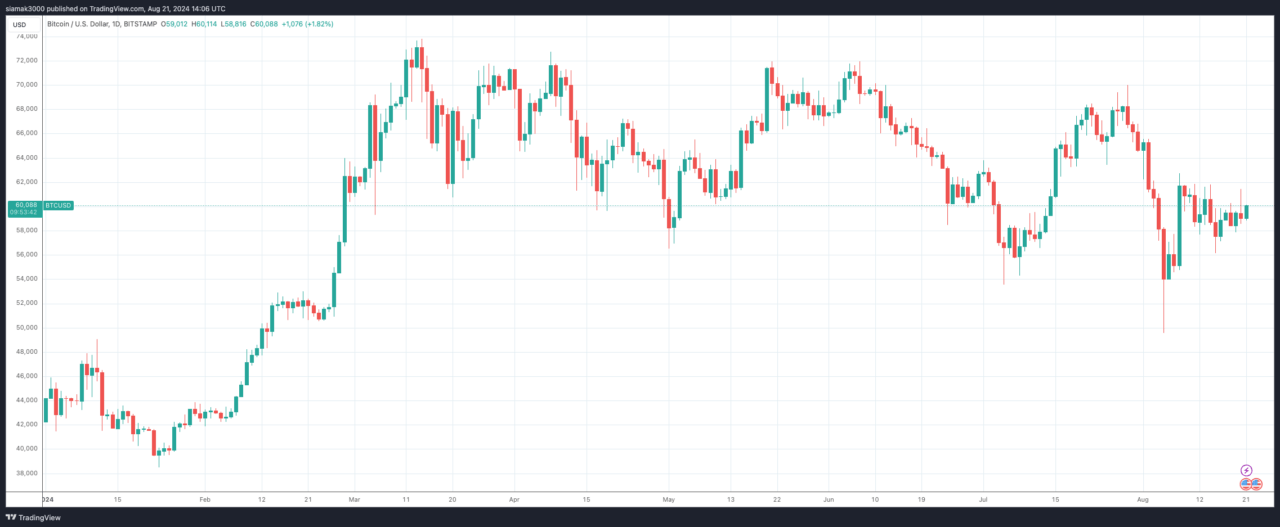

Recent market conditions have been challenging for Bitcoin. The cryptocurrency has been struggling throughout August, failing to sustain levels above $60,000. This is in stark contrast to other asset classes, such as global stocks and gold, which have been performing strongly, Bloomberg noted.

Furthermore, the notional open interest in Bitcoin’s perpetual futures market has surged by the equivalent of nearly 29,000 Bitcoin over the past week, underlining the scale of bearish bets being placed.

Perpetual futures are particularly favored by cryptocurrency traders because they lack an expiry date, allowing for continuous speculation. Bloomberg noted that K33’s analysis suggests that the current combination of rising open interest and negative funding rates is unusual and could be setting the stage for a significant market move.

Beyond the derivatives market, other factors have also been weighing on Bitcoin’s price. There is ongoing speculation, according to Bloomberg, that the US government might be selling seized Bitcoin, which has added to the downward pressure. Furthermore, traders are closely watching upcoming remarks from Federal Reserve Chair Jerome Powell, as his comments on future interest rate policies could introduce additional volatility into the market.

Featured Image via Pixabay