On July 11, Scott Wren joined CNBC’s “Closing Bell Overtime” to discuss the day’s U.S. stock market action.

Scott Wren is a senior global market strategist at Wells Fargo Investment Institute (WFII), a registered investment adviser and wholly owned subsidiary of Wells Fargo Bank, N.A. WFII focuses on providing top-tier investment expertise and advice, helping investors manage risks and achieve financial success. Wren plays a key role as a member of the Global Investment Strategy Committee, where he contributes to the development and approval of asset allocation strategies and guidance recommendations for various markets, including global financial, real asset, and alternative markets.

Wren began by addressing the softer-than-expected U.S. Consumer Price Index (CPI) report for June 2024 and positive jobless claims data. Wren said these indicators suggested a favorable economic environment, leading to a surge in previously underperforming stocks, notably in the Russell 2000. He emphasized that while the Russell 2000 saw a significant one-day gain, it is too early to consider this a consistent trend. Wren expects the economy to remain in a slow growth phase for the next two to four quarters.

According to Wren, the US stock market has been led by the technology and communication services sectors for the past 18 months. In his opinion, these sectors have seen substantial gains, stretching their valuations. Wren noted that the positive inflation news sparked hopes for broader market participation beyond just a few leading sectors.

Wren explained that WFII has been reallocating investments from technology and communication services to sectors like industrials, materials, and energy. These sectors, which performed well on the day of the interview, are seen as having better value and are less inflated compared to the major tech stocks. Industrials and materials, he highlighted, are particularly attractive due to their sensitivity to economic cycles and the ongoing data center build-outs driven by artificial intelligence (AI) advancements. Healthcare was identified as another sector with good value. Energy was also mentioned as a key focus due to its economic sensitivity and potential for strong performance as the market dynamics evolve.

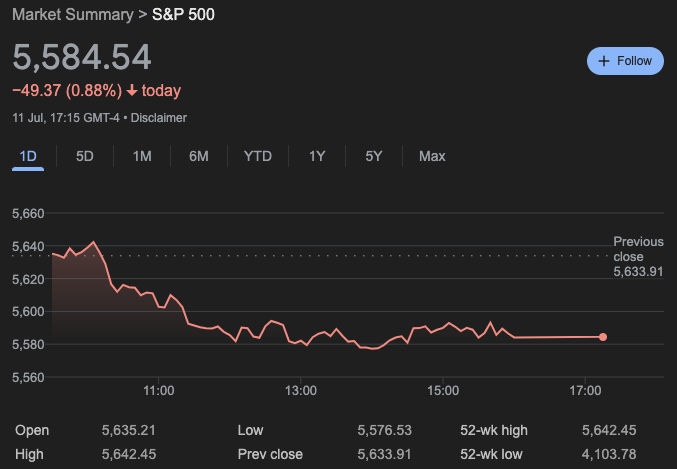

Wren highlighted the stretched valuations in the “Mag 7” stocks, specifically Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta, Broadcom, and Tesla. On the day of the interview, these major tech stocks saw significant declines, with each dropping more than 2%. This decline had a notable impact on the S&P 500, demonstrating how heavily the index is influenced by these few large-cap stocks.

Despite the decline in major tech stocks, other sectors experienced gains, illustrating a potential shift towards broader market participation. The market’s concentration in a few large-cap stocks has been a double-edged sword, driving significant gains during uptrends but also causing sharp declines when these stocks underperform.

The June CPI report showed a slight decline in consumer prices. The CPI for All Urban Consumers (CPI-U) fell by 0.1 percent on a seasonally adjusted basis, following an unchanged reading in May. Over the past year, the all items index increased by 3.0 percent before seasonal adjustment.

The report highlighted a notable decrease in gasoline prices, which dropped by 3.8 percent in June after a 3.6 percent decline in May. This significant reduction in gasoline prices contributed to a 2.0 percent decline in the overall energy index for the month, mirroring the decrease observed in the previous month. The sustained reduction in energy costs played a crucial role in offsetting rising prices in other sectors, such as shelter.

Food prices experienced a modest increase of 0.2 percent in June. Within this category, the index for food away from home rose by 0.4 percent, while the index for food at home saw a smaller increase of 0.1 percent. These incremental rises indicate a steady, albeit moderate, upward trend in food prices for consumers.

The index for all items excluding food and energy, often referred to as core inflation, rose by 0.1 percent in June. This increase followed a 0.2 percent rise in May. Specific categories that saw price increases in June included shelter, motor vehicle insurance, household furnishings and operations, medical care, and personal care. Conversely, indexes for airline fares, used cars and trucks, and communication experienced declines during the month.

On an annual basis, the all items index rose by 3.0 percent for the 12 months ending in June. This represents a slightly smaller increase compared to the 3.3 percent rise recorded for the 12 months ending in May. Notably, the core inflation index (excluding food and energy) saw a 3.3 percent increase over the past year, marking the smallest 12-month increase since April 2021. The energy index showed a 1.0 percent rise for the 12 months ending in June, while the food index increased by 2.2 percent over the same period.

The decline in the CPI for June 2024 suggests a slight easing of inflationary pressures, primarily driven by the continued drop in gasoline and energy prices. This trend may provide some relief to consumers who have faced rising costs in various sectors over the past year. However, the persistent increases in shelter and other essential services highlight ongoing inflation challenges in specific areas.

Featured Image via Unsplash