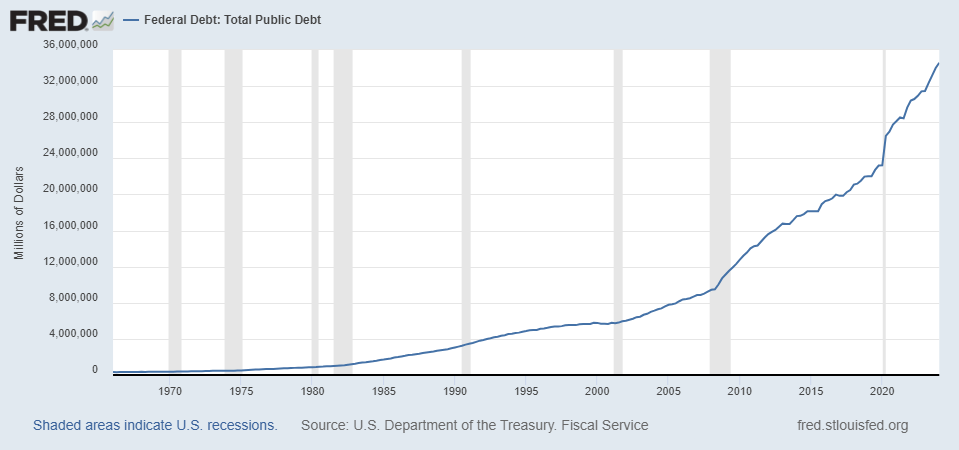

The US national debt has surpassed the $35 trillion milestone at a time in which financial markets keep on moving up, with Bitcoin itself now nearing the $70,000 mark after a historic speech from former U.S. President Donald Trump at the Bitcoin 2024 conference in Nashville.

According to data from a US debt tracker, the country’s debt is now above $35 trillion, meaning debt per citizen is now slightly above $100,000, while debt per taxpayer is at $267,000. Its debt to GPT ratio is now at 122.55%, up from 56.8% in 2000, and 34.6% in 1980.

Despite the recent rises, markets are on edge as the Federal Open Market Committee (FOMC) prepares to convene this week, with Federal Reserve Chair Jerome Powell, whose words carry immense weight in shaping both traditional and cryptocurrency markets being at the center of investor attention.

While no rate cuts are anticipated at this meeting, the tone of Powell’s post-meeting press conference will be closely scrutinized for clues about the central bank’s future trajectory. Market participants are primarily focused on the September meeting, where rate reductions are largely priced in.

According to the CME Group’s FedWatch tool, market participants are pricing in a 96% chance of an interest rate cut in September. The potential for interest rate cuts is a boon for risk assets, including cryptocurrencies, as it typically boosts liquidity.

However, this week’s economic calendar is packed with data points that could introduce volatility as various companies within the S&P 500 are reporting their earnings.

Bitcoin itself has recently surged over Trump’s speech at the Bitcoin 2024 conferece, where the former US President laid out his plan “to ensure that the United States will be the crypto capital of the planet and the Bitcoin superpower of the world and we’ll get it done.”

Donald Trump has also pledged to put an end to the “anti-crypto crusade” led by President Joe Biden and Vice President Kamala Harris if he is elected. He vowed to take immediate action, stating that on his first day in office, he would dismiss U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler.

However, it’s worth noting that the President of the United States does not have the authority to fire appointed commissioners, but can appoint a new commissioner to the SEC.

Trump also announced plans to establish a “Bitcoin and crypto presidential advisory council” and expressed his intention to have all remaining Bitcoins mined within the United States. Additionally, he emphasized the importance of protecting the right to self-custody of cryptocurrency assets.

Following Trump’s speech, Senator Cynthia Lummis (R-Wy) presented a legislative proposal to create a U.S. Federal Reserve holding of 1 million Bitcoins over the next five years. According to the proposal, the Bitcoins would be held for a minimum of 20 years and would be utilized to reduce the country’s debt.

Featured image via Unsplash.