Ripple, the developer and largest holder of XRP, has recently sold 150 million XRP from its July reserves for approximately $64.5 million, represents a decrease of $13.5 million compared to the company’s XRP sales in June.

The sale follows Ripple’s release of 1 billion XRP from an initial distribution, with the tokens then locked in monthly escrows until 2027. This month, Ripple allocated 200 million XRP to its treasury account, while the remaining 800 million were placed in new escrows, as Finbold reports.

Notably, an additional 100 million XRP were transferred from a wallet identified on the XRP Leger as “Ripple (35)” to the sell-off reserves, bringing the total allocated for sale this month to 300 million XRP.

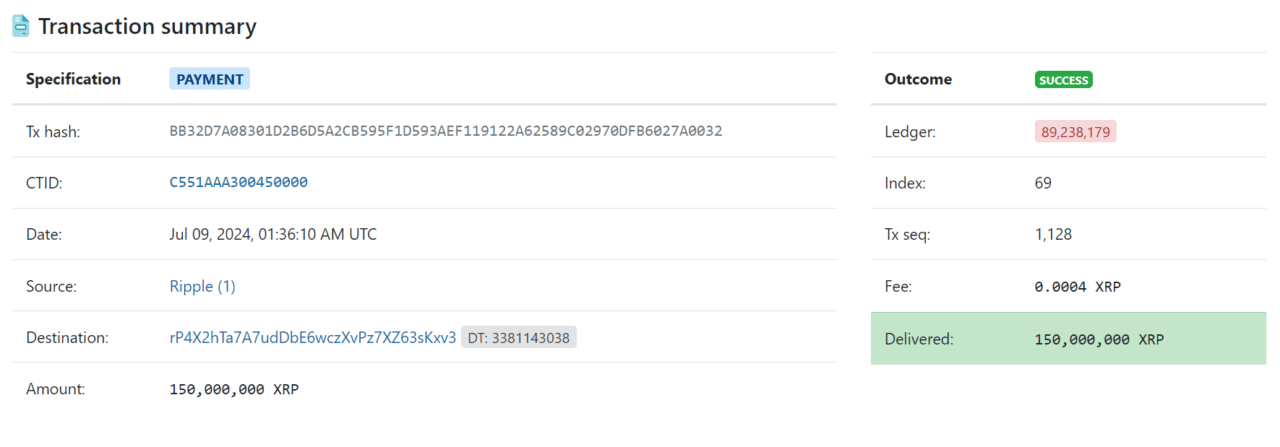

The sale itself took place through the company’s treasury account, labeled “Ripple (1),” which sent the tokens to an unlabeled account, “rP4X2hTa.” This injects previously uncirculated XRP into the market, potentially contributing to inflation of the XRP supply.

While 100 million XRP currently remain in the “rP4X2hTa” account, Ripple has historically transferred a portion of the XRP it’s set to sell to another intermediary address, “rhWt2bhR,” before ultimately listing them on cryptocurrency exchanges.

The sales come at a time in which the price of XRP has been underperforming. Despite the recent lull, a popular cryptocurrency analyst has recently suggested the cryptocurrency could soon see an explosive upward move after identifying similar price patterns throughout XRP’s history, pointing to symmetrical triangle breakouts.

In a post shared on the microblogging platform X (formerly known as Twitter) with his over 40,000 followers, analyst Javon Marks suggested that “something massive can be truly nearing” after pointing to the “way prices are coiling/shaping up combined with where the’ve come from (historical data) and high volume plus an already confirmed Hidden Bullish Divergence.”

Marks’ analysis points to XRP’s past performance as a potential benchmark. In mid-2017, XRP’s price skyrocketed over 70,000% before reaching its all-time high in early 2018. Marks suggests that a similar, aggressive bull run could be forthcoming.

His short-term prediction involves a potential rally to $1.44, fueled by technical indicators. Reaching this price point, Marks argues, could trigger a breakout from a six-year price consolidation pattern that in the long run could see XRP exceed the $200 mark per token, representing a 45,000% jump from its current level. This projection assumes a “full logarithmic follow-through” based on historical data.

In a more conservative scenario, Marks suggests XRP could still reach $15-$20 if the price pattern breaks, representing an increase of over 4,000% from current levels.

Featured image via Pixabay.