On July 8, pseudonymous crypto analyst Aylo shared a comprehensive analysis on the social media platform X, examining the performance of tokens launched through airdrops.

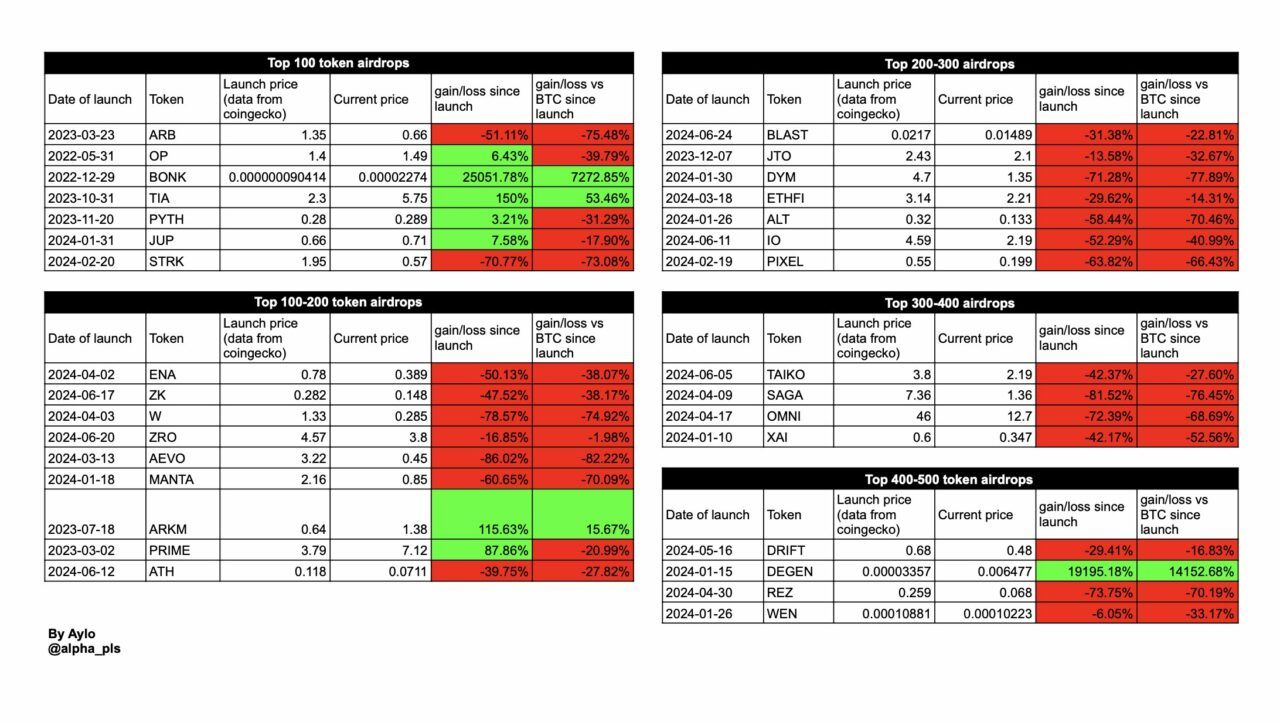

Aylo began by expressing curiosity about the performance of tokens launched through airdrops, questioning whether it is ever advantageous to hold onto such tokens. He analyzed data from the top 500 tokens by market capitalization, comparing their current prices to their prices on the day of their launch.

Aylo revealed that 23 out of 31 tokens have declined in value since their launch, with some experiencing significant drops. According to Aylo, only four out of these 31 tokens have outperformed Bitcoin (BTC) since their launch, and only one of these outperforming tokens was launched in 2024. He highlighted that two meme-related airdrops, BONK and DEGEN, have been notably successful. Despite the current negative sentiment, Aylo mentioned that TIA is also performing well above its launch price and has outperformed BTC.

Aylo concluded that selling airdrops on launch day and converting them into USD or BTC is generally the best strategy. He acknowledged that while it is possible to time an initial price increase post-launch, holding onto airdropped tokens tends to result in poorer performance over time. He emphasized that there are always exceptions, but the odds are heavily against holding the right airdrop, especially relative to BTC.

For those bullish on a project’s long-term prospects, Aylo suggested that there are usually better opportunities to buy at lower prices than on launch day. He noted that the next bear market might present better investment opportunities for some of these tokens, which include several promising projects.

Aylo pointed out that airdrops are not the sole reason for the decline in these tokens’ values. Often, these projects set their valuations too high with the help of market makers. The subsequent dumping of the airdropped tokens by users quickly reveals the inflated nature of these valuations. He stressed that many participants are learning the hard way that Fully Diluted Valuation (FDV) matters. Holding airdrops implies a belief that tokens will have enough demand to appreciate in price despite large unlocks and investors hedging with shorts.

Yield farmers, according to Aylo, typically sell regardless of price as they aim to extract yield and move on. While tokens should theoretically recover once these “mercenaries” exit, Aylo’s data suggests that most do not. He acknowledged that there is still time for some tokens to recover, as his analysis is a snapshot and market conditions can change rapidly.

Aylo observed that many airdrops are poorly designed, resulting in detrimental short- and medium-term impacts on the token. He noted that executing an airdrop without harming the token’s price is challenging. Interestingly, he found that two surprise meme coin airdrops with low starting valuations—BONK and DEGEN—have performed the best for holders. These airdrops were designed to grow ecosystems (Solana and Farcaster) and started with very low valuations, which may have contributed to their success.

Aylo cautioned against assuming that meme airdrops will always perform well, noting that many have gone to zero instantly. He suggested that the success of BONK and DEGEN might be due to their surprise nature and low initial valuations. He believes points programs, a common feature in Web2, are likely to persist and can enhance user experience, but he does not expect airdrops to continue in their current form.

Aylo concluded by advising crypto projects to carefully consider the form their airdrop takes if they decide to conduct one at all.

Featured Image via Pixabay