While the price of Bitcoin has recently plunged to a low slightly above the $53,000 mark before it started to recover, institutional investors have entered their “second-largest” accumulation process of the year, acquiring more than $5.8 billion worth of BTC in a week.

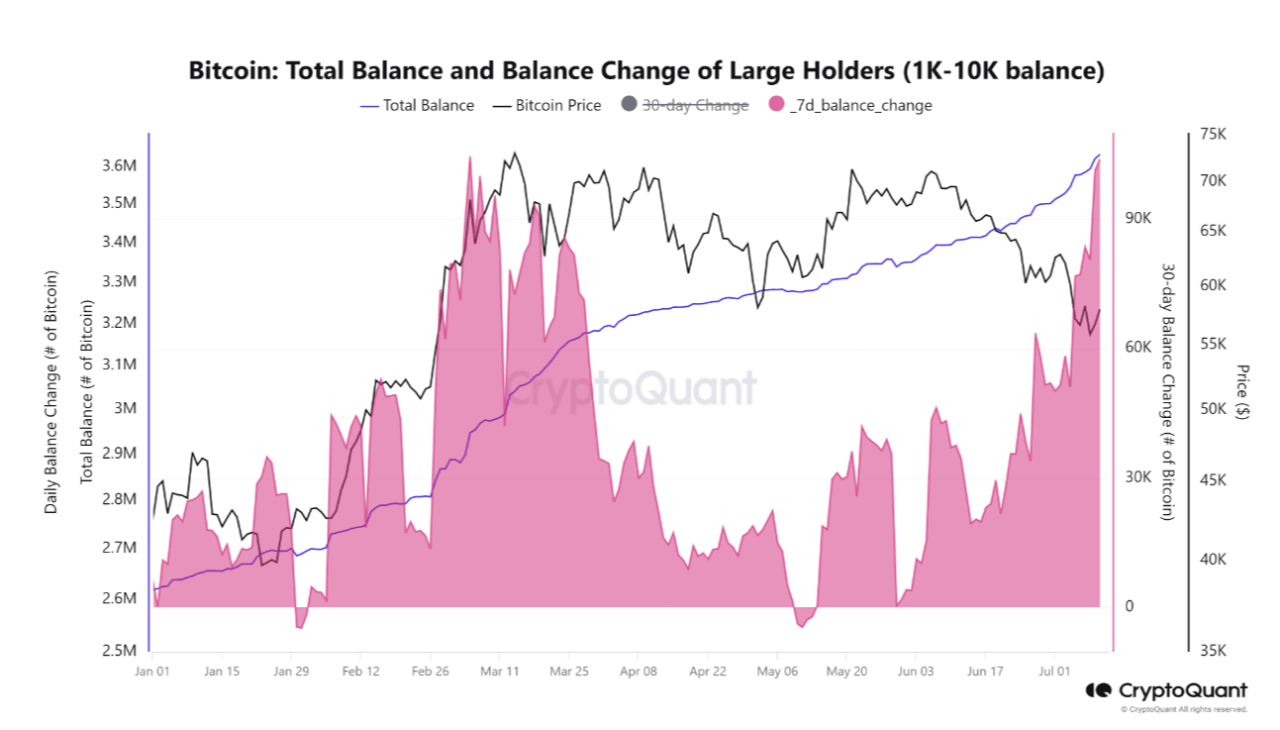

According to a recent blog post from on-chain analytics platform CryptoQuant, institutional investors accumulated a staggering 100,000 BTC in a single week while “many novice investors capitulated.”

This buying spree indicates a strong conviction among these institutional players, even as the price of Bitcoin has dropped over 13% over the last 30-day period.

The analysis, conducted by CryptoQuant contributor Cauê Oliveira, focused on the change in wallet balances of entities holding between 1,000 and 10,000 BTC – a segment considered representative of institutional investors. Notably, this accumulation continued even as Bitcoin prices hit their lowest point since late February, highlighting a potential long-term view among these big-money players.

Oliveira noted that last week there was an “accumulation process of approximately 101.6 thousand BTC” amid low volume of fundraising in exchange-traded funds and as price fell, which means that the institutional accumulation seen this month was a “true process of “buying the dip” in large players,” rather than a short-term investment strategy.

Notably, sentiment in the cryptocurrency space has plunged to its lowest level in more than a year to enter the “extreme fear” territory for the first time since January 2023 and is now at 25, down from over 72 last month.

The price of Bitcoin plunged amid an aggressive sell-off earlier this month over a confluence of factors that included Bitcoin miners having to reduce some of their BTC holdings after the halving event in April, the German government heavily selling, and defunct cryptocurrency exchange Mt. Gox starting creditor repayments.

It’s worth noting, however, that Germany’s Bitcoin fire sale is nearing its end, as its stash was originally of nearly 50,000 BTC seized from the operators of a film piracy platform, but of those 40,000 have already been sold.

Some experts predict Germany could exhaust its entire Bitcoin stash in the near future if the current selling pace continues. The government’s decision to sell has drawn criticism from Bitcoin proponents within the German parliament, who argue that the government should hold onto the scarce digital asset instead of converting it to euros.

Notably a Bitfinex report has suggested that “a potential local bottom has been reached.” The report noted the market is now realizing that while the German government is selling large amounts of BTC, these funds are a “relatively small number” as a proportion of all the BTC bought and sold since last year.

The firm also noted that volatility metrics are showing signs of stabilization. The narrowing spread between implied volatility and historical volatility suggests that the market anticipates a period of greater stability going forward. This implies that Bitcoin’s price may range around its current levels or experience less dramatic declines, the firm said.

Featured image via Unsplash.