Matt Hougan, Chief Investment Officer at Bitwise Asset Management, is forecasting a bright future for Ethereum, predicting the cryptocurrency will surpass its all-time high by year-end thanks in part to the launch of spot Ethereum Exchange-Traded Products (ETPs) to trade above $5,000.

In a new blog post, Bitwise noted that he believes that the launch of these Ethereum ETPs “could be choppy,” as “money may flow out of the $11 billion Grayscale Ethereum Trust (ETHE) after it converts to an ETP.”

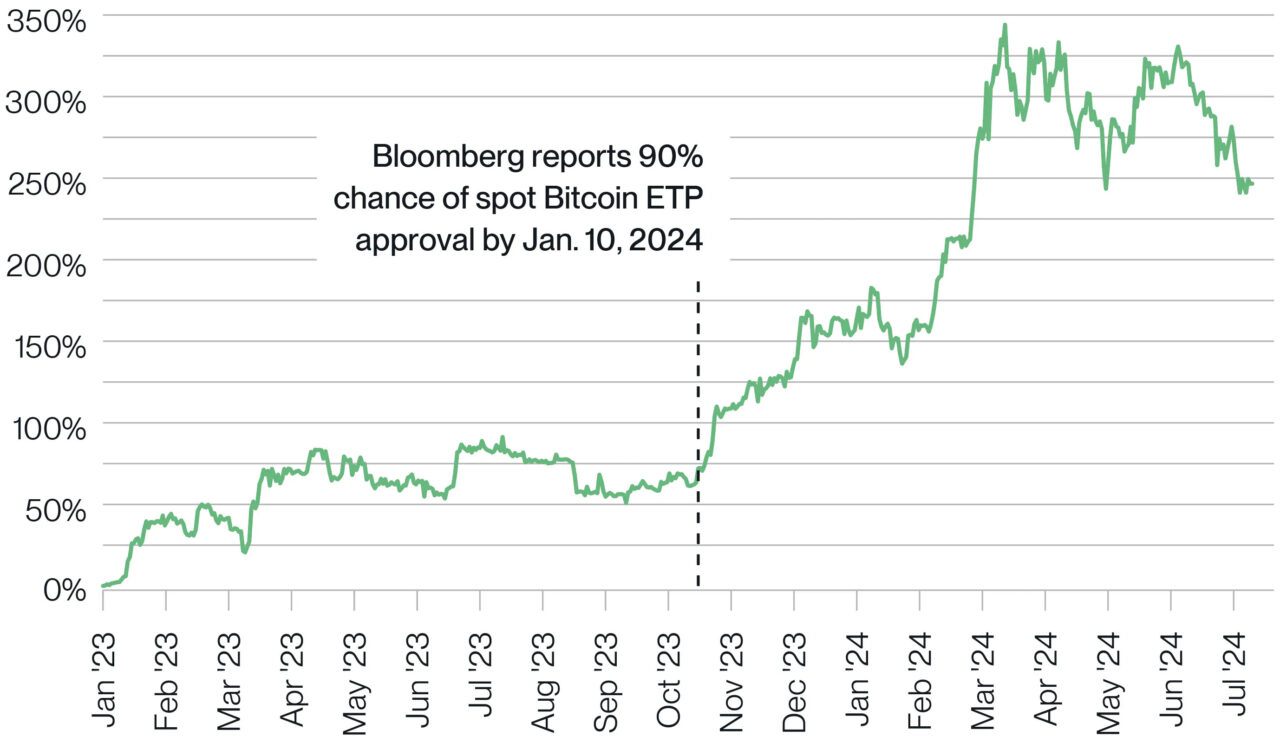

Per Hougan, since the launch of spot Bitcoin ETPs these funds have “brought more than twice as much Bitcoin as miners have been able to produce,” with these ETPs buying up 263,965 coins while miners produced 129,181 BTC since their launch.The result was Bitcoin’s price rose.

Hougan’s bullish outlook hinges on three key factors that differentiate Ethereum from Bitcoin.First, Ethereum boasts a significantly lower short-term inflation rate compared to Bitcoin when its ETPs debuted.

While Bitcoin saw an inflation rate of 1.7%, Ethereum currently sits at nearly zero as consumed ETH is burned on the network. This balance between new coin creation and network activity creates a more favorable supply-demand dynamic for Ethereum, potentially pushing prices upwards.

Secondly, Ethereum’s Proof-of-Stake system reduces selling pressure on the market. Unlike Bitcoin miners who must often sell newly minted coins to cover operational costs, validators on the Ethereum network face no such pressure, translating to less forced selling of ETH, further bolstering its price.

Lastly, a significant portion of the Ethereum supply is currently unavailable for sale as roughly 28% of all ETH is staked, while an additional 13% is locked up in decentralized finance smart contracts. With nearly 40% of the total supply effectively removed from circulation, scarcity could drive prices higher, he argued.

Hougan anticipates these factors, coupled with an estimated $15 billion flowing into new Ethereum ETPs over the next 18 months, to create a perfect storm for Ethereum’s price surge.

With the cryptocurrency currently trading at around $3,400 after moving up 11%, it’s well below its previous peak. To Hougan, it is likely that Ethereum will not only challenge its all-time high but potentially surpass it.

Featured image via Unsplash.