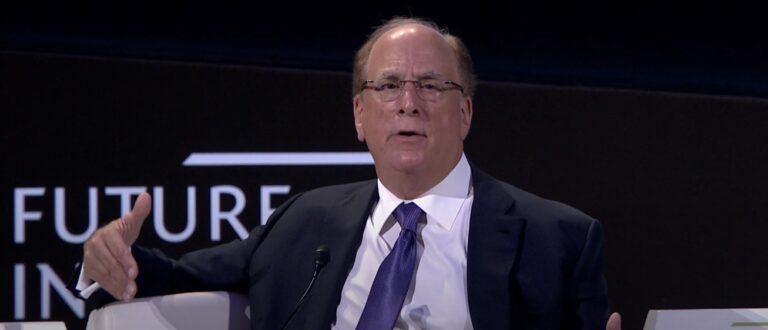

On July 15, 2024, BlackRock Chairman and CEO Larry Fink appeared on CNBC’s “Squawk on the Street” to discuss the company’s latest quarterly financial results, the economic outlook, the failed assassination attempt on former U.S. President Donald Trump, the current investing landscape, the state of capital markets, and the evolving role of cryptocurrency in financial portfolios.

Quarterly Earnings and Economic Outlook

Larry Fink began the interview by discussing BlackRock’s impressive quarterly earnings, which showcased record assets under management. Fink attributed this success to strong investor confidence and effective growth strategies. He stressed that growth is the most critical component for all countries, particularly in the current environment of rising deficits and geopolitical uncertainties. Fink argued that growth cannot be achieved through short-term measures like tax cuts or increases but through strategic investments in infrastructure, energy efficiency, and digitization.

He highlighted the need to streamline the permitting processes that hinder development, arguing that the U.S. must leverage its energy efficiency and technological capabilities to stimulate growth. Fink noted that these measures are vital not only for the U.S. but also for countries worldwide facing similar economic challenges. He pointed out the rapid growth of U.S. deficits, warning that without significant growth, these deficits could become a substantial burden on future generations.

Fink emphasized that the U.S. has the most dynamic capitalistic system in the world, with great companies, ingenuity, and technology. He argued that this system should be unleashed to create jobs and opportunities, thereby fostering a rising equity market that can fuel economic prosperity.

Thoughts on the Failed Assassination Attempt on Former President Trump

Addressing the recent failed assassination attempt on former President Donald Trump, Fink described the event as a tragedy and a reflection of the current state of America. He emphasized the need for unity and hope, urging political leaders, religious figures, and community leaders to work together to bring communities together and foster a sense of optimism. Fink stressed that political stability and unity are essential for economic growth.

He highlighted that despite the loud and messy nature of American politics, the U.S. has historically managed to get things done. The incident, he suggested, should serve as a wake-up call to address rising hatred and focus on creating opportunities for all citizens. Fink argued that all leaders have a responsibility to bring hope and provide a better future. He called for more conversations about opportunities and positives, rather than focusing on negatives.

Fink also touched on the resilience of the American system, despite its often chaotic nature, and expressed his belief that the recent events should galvanize efforts to bring about positive change. He underscored the importance of creating a fair and just system that offers real opportunities for growth and improvement.

The Investing Landscape and Capital Markets

Fink discussed the importance of unfettered businesses and private sector growth as key drivers of economic progress. He argued that the private sector is essential for driving economic growth and reducing the burden of public deficits. He noted that U.S. deficits have grown at an unsustainable rate, emphasizing the need to rely more on the dynamic capitalistic system and less on public spending.

He highlighted BlackRock’s successful quarter, with $150 billion in ETF flows, the highest in the company’s history. Fink attributed this success to BlackRock’s innovative investment strategies and technological advancements. He mentioned the launch of initiatives like LifePath Paycheck, aimed at providing more hope for retirement, and the closing of the Global Industrial Properties (GIP) transaction, which underscores BlackRock’s commitment to infrastructure investing.

Fink also emphasized the importance of technology in driving growth, noting that BlackRock managed to increase its assets by $2 trillion over the past year without increasing its employee count. This, he said, is a testament to the power of technology and innovation in enhancing operational efficiency and performance.

Fink’s vision for growth involves creating a business environment that is free from excessive regulation, allowing companies to innovate and expand. He believes that this approach will lead to job creation and a more robust economy. By reducing regulatory barriers and promoting private sector investment, Fink argues that the U.S. can achieve sustainable growth and address the challenges posed by rising deficits.

The Role of Cryptocurrency in Financial Portfolios

In the last part of the interview, Fink talked about his evolving perspective on cryptocurrencies, particularly Bitcoin. Historically a skeptic, Fink has undergone a considerable shift in his views over the past few years. He acknowledged his initial skepticism, explaining that he studied and learned about Bitcoin extensively, which led him to change his opinion from five years ago.

Fink now believes that Bitcoin is a legitimate financial instrument, despite acknowledging that, like all financial instruments, it has its misuses. He emphasized that Bitcoin offers unique benefits, such as providing uncorrelated returns, which can be particularly valuable in times of economic instability:

“I believe Bitcoin is a legitimate financial instrument. I’m not trying to say there’s not misuses like everything else, but it is a legitimate financial instrument that allows you to have maybe uncorrelated, non-correlated type of returns.”

He highlighted that Bitcoin serves as a hedge when there is a belief that countries are debasing their currencies through excess deficits Fink pointed out that in countries where people fear for their everyday existence, Bitcoin offers an opportunity to invest in something outside their country’s control, thereby providing more financial control.

“I believe it is an instrument that you invest in when you’re more frightened. It is an instrument when you believe that countries are debasing their currency by excess deficits, and some countries are … We have countries where you’re frightened of your everyday existence and have an opportunity to invest in something that is outside your country’s control. Then you can have more financial control.“

He also likened Bitcoin to digital gold, stressing the need for everyone to consider it as an alternative asset class.

He expressed confidence that Bitcoin would become one of the asset classes that investors look at, particularly for those seeking to express their financial acumen in uncertain times. Fink emphasized that Bitcoin is not just an instrument for hope, but rather a vehicle to express concerns about the world’s financial stability. He also mentioned the significant industrial use for Bitcoin, which he believes many people overlook.