The price of the flagship cryptocurrency plunged last week to little over $53,000 after a massive $400 billion sell-off hit the cryptocurrency market that came after BTC dropped below its 200-day moving average for the first time in 10 months, but Bitfinex has suggested that “a potential local bottom has been reached.”

Bitcoin’s aggressive sell-off last week led to over $800 million of long positions being liquidated in just three days, and was a confluence of various factors. As Bloomberg reported Bitcoin miners, who rely on powerful machines to secure the Bitcoin network and get rewarded with BTC for doing so, are still grappling with the financial impact of the halving event in April, which reduced the coinbase reward they received per block found in half. In response, some miners have been forced to sell off portions of their bitcoin holdings.

These miners are selling alongside the German government , which has been slowly moving funds from a wallet in which it has over 46,000 BTC onto cryptocurrency exchanges. The German government’s Bitcoin stash was originally of nearly 50,000 BTC, seized from the operators of a film piracy platform, Movie2k.to, which was last active over a decade ago.

On top of all this, defunct cryptocurrency exchange Mt. Gox has recently started repaying creditors in a move that puts an end to a 10-year long waiting period for users to get their digital assets back.

The exchange dominated Bitcoin trading volumes before it suffered a security breach in 2014 that resulted in the loss of an estimated 740,000 BTC and their bankruptcy. Some of the BTC was recovered and is now being returned to creditors, who analysts believe will sell the coins on the market after their 10-year waiting period.

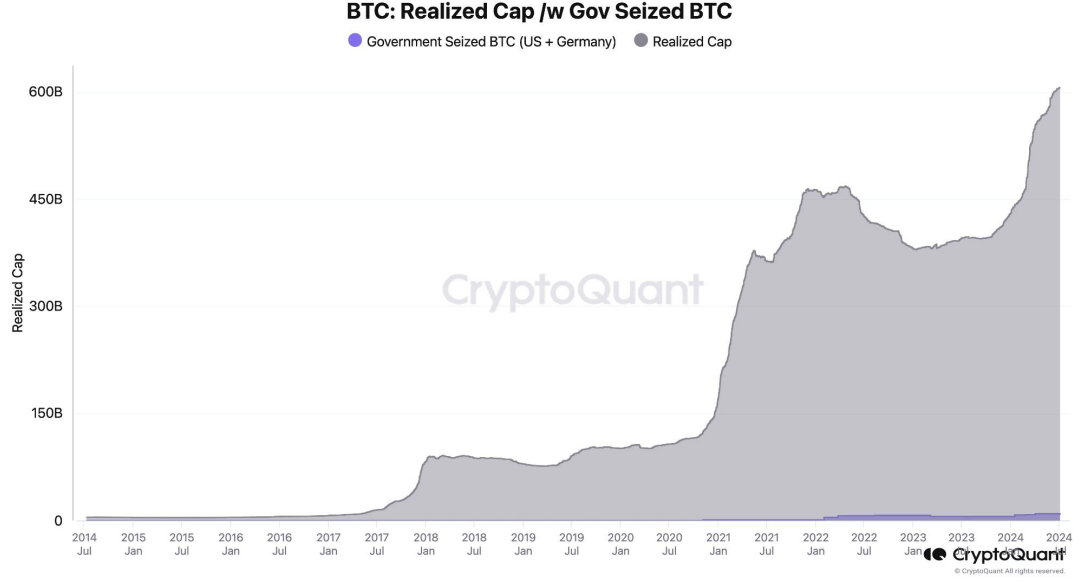

In a recent report, Bitfinex noted that the market is now realizing that while the German government is selling large amounts of BTC, these funds are a “relatively small number” as a proportion of all the BTC bought and sold since last year.

The firm also noted that volatility metrics are showing signs of stabilization. The narrowing spread between implied volatility and historical volatility suggests that the market anticipates a period of greater stability going forward. This implies that Bitcoin’s price may range around its current levels or experience less dramatic declines, the firm said.

On top of that, market positioning shows “complacency with shorts,” evidenced by the high number of short liquidations, even during the recent rebound, which to Bitfinex suggests an influx of “late shorters” on shorter timeframes, potentially lacking conviction in their bearish stance.

While long-term holders continue to take profits on their Bitcoin investments, selling by short-term holders may be nearing exhaustion, as the firm noted the Spent Output Profit Ratio (SOPR) for short-term holders is sitting at 0.97, indicating they are now selling at a loss.

Bitfinex added that when this happened in the past, prices rebound as “selling pressure eased.” Further bolstering the case for a potential bottom is the recent shift in Bitcoin perpetual swap funding rates, which have turned negative for the first time since May, when prices bottomed as well.

While this could be interpreted as increased bearish sentiment, it also strengthens the view that Bitcoin may be stabilizing or nearing a bottom, as the balance of buying and selling pressures adjusts.

Beyond the cryptocurrency space, Bitfinex noted that the recently released minutes from the Federal Reserve’s policy meeting show continued caution regarding interest rate cuts, despite supportive labor market data and easing inflation.

The unemployment rate in the US currently stands at 4.1%, the highest since November 2021, reflecting an economy transitioning to a new growth pattern with adjusted hiring trends.

Featured image via Pixabay.