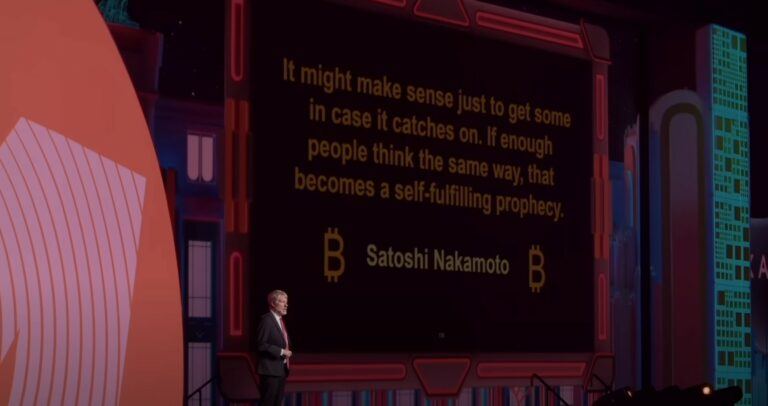

On July 26, in a keynote speech at the Bitcoin 2024 conference in Nashville, Michael Saylor, Co-Founder and Executive Chairman of MicroStrategy Inc., presented a transformative view of Bitcoin as the key to solving our economic challenges. His talk emphasized the revolutionary potential of Bitcoin as a long-term asset, contrasting it with the limitations of traditional financial and physical assets.

Reimagining the Global Economy with Digital Capital

Saylor began by highlighting the outdated nature of our current financial systems, which are built on 20th-century ideas and technologies. He pointed out that the world’s wealth, approximately $900 trillion, is largely tied up in physical and financial assets that are inefficient and prone to decay over time. Bitcoin, representing a small fraction of global wealth, is positioned as a revolutionary asset that can transform the way we preserve and grow capital.

The Physics of Money

Using a quote from Nikola Tesla, Saylor introduced the concept of the physics of money. He equated energy to money, frequency to the lifespan of money, and vibration to the transactions and transformations of money. He presented an equation to determine the useful life of an asset: the value of the asset divided by the cost to maintain it. He believes this concept, similar to the stock-to-flow model in the Bitcoin community, highlights the inefficiencies of maintaining traditional financial assets.

The Shortcomings of Traditional Assets

Saylor detailed the various ways in which financial and physical assets fail to preserve wealth over the long term. He said that financial assets, such as currencies and bonds, are eroded by inflation, taxes, and other economic factors. As for physical assets, like real estate and commodities, he believes they suffer from depreciation, maintenance costs, and external risks such as political instability and natural disasters.

Bitcoin as Digital Capital

Bitcoin, according to Saylor, is digital capital that is immortal, immutable, and immaterial. It is not subject to the same forces of decay and depreciation that plague traditional assets. Saylor said that Bitcoin’s infinite lifespan and resistance to external economic threats make it an ideal store of value. He argued that as digital assets like Bitcoin become more integrated into the global economy, they will revolutionize capital preservation and economic stability.

Strategic Adoption of Bitcoin

Saylor outlined specific strategies for individuals, corporations, institutions, and nations to adopt Bitcoin effectively:

- Individuals: Convert excess earnings to Bitcoin, utilize subsidized credit to buy Bitcoin, and avoid risky trading practices.

- Corporations: Convert capital and cash flows to Bitcoin, issue equity and debt to buy Bitcoin when advantageous, and avoid dilutive financial practices.

- Institutions: Modify investment charters to include Bitcoin, reallocate from short-term to long-duration assets, and use Bitcoin as a benchmark for cost of capital.

- Nations: Reallocate treasury holdings from gold and bonds to Bitcoin, issue currency and debt to buy Bitcoin, and create favorable regulatory environments for Bitcoin adoption.

The Future of Global Wealth: Detailed Price Targets for Bitcoin

Saylor’s forecast for Bitcoin extends to 2045, predicting significant appreciation in its value based on various growth scenarios. He presented both a base case and extreme cases (bull and bear) to provide a comprehensive outlook.

Base Case Scenario

In Saylor’s base case scenario, Bitcoin’s annual growth rate (CAGR) is projected to start at 55% and gradually decrease to 20% by 2045. This scenario is grounded in the assumption that Bitcoin’s growth will decelerate as it matures but will still outperform traditional assets like the S&P 500. Based on these projections, Bitcoin’s value could reach approximately $13 million per coin by 2045. This growth reflects Bitcoin capturing about 7% of the world’s wealth, marking a significant increase from its current market share.

Bear Case Scenario

Even in a conservative bear case scenario, where Bitcoin’s growth rate drops more significantly, Saylor believes that Bitcoin could still achieve a value of around $3 million per coin by 2045. This scenario assumes a more modest adoption and integration of Bitcoin into the global financial system but still recognizes its superior properties as a store of value compared to traditional assets.

Bull Case Scenario

In the most optimistic bull case scenario, where Bitcoin’s adoption and integration into global finance accelerate faster than expected, Saylor projects that Bitcoin could reach up to $49 million per coin by 2045. This scenario hinges on a sustained high growth rate and Bitcoin capturing a more substantial portion of global wealth, potentially up to 20% or more.

Implications for Global Wealth Distribution

Saylor emphasized that Bitcoin’s potential to transform global wealth distribution is unprecedented. He mentioned that as Bitcoin grows, it will likely demonetize other assets like gold and real estate, which have traditionally been used as stores of value. In Saylor’s mind, the digital nature of Bitcoin, combined with its scarcity and security, makes it an attractive alternative for both individuals and institutions looking to preserve and grow their capital.

Featured Image via YouTube (Bitcoin Magazine’s Channel)