On June 27, Matthew Sigel, Head of Digital Assets Research at VanEck, announced via the social media platform X (formerly known as Twitter) that VanEck has filed for the first spot Solana (SOL) exchange-traded fund (ETF) in the United States. In his announcement, Sigel shared detailed insights into why VanEck believes Solana is a compelling choice for an ETF and why they view SOL as a digital commodity similar to Bitcoin and Ether.

Why VanEck Filed for a Spot Solana ETF

Sigel explained that VanEck’s decision to file for a Solana ETF stems from Solana’s unique capabilities as a blockchain platform. According to Sigel, as an open-source blockchain, Solana is designed to support a wide range of applications, including payments, trading, gaming, and social interactions. Sigel says that unlike many other blockchains, Solana operates as a single global state machine without relying on sharding or layer 2 solutions, which simplifies its architecture.

VanEck believes that Solana’s primary strengths lie in its scalability, speed, and cost-effectiveness. Sigel highlighted that the blockchain can handle thousands of transactions per second while maintaining minimal transaction fees, making it an attractive platform for various use cases. This performance, he says, is achieved through a novel security mechanism that integrates proof-of-history (PoH) with proof-of-stake (PoS), ensuring robust security and high throughput.

Sigel noted that these attributes—high transaction throughput, low fees, and strong security—combined with a vibrant community, make Solana an appealing option for an ETF. VanEck thinks that offering a spot ETF based on Solana will provide investors with exposure to a versatile and innovative ecosystem that is well-suited for the growing demands of decentralized applications.

Why VanEck Considers SOL a Commodity

VanEck views Solana’s native token, SOL, as a commodity akin to Bitcoin and Ether. Sigel pointed out that SOL is used to pay for transaction fees and computational services on the Solana blockchain, much like how Ether is used on the Ethereum network. According to Sigel, SOL can be traded on digital asset platforms and utilized in peer-to-peer transactions, demonstrating its liquidity and utility.

Sigel also mentioned that the Solana ecosystem supports a broad spectrum of applications and services, including decentralized finance (DeFi) and non-fungible tokens (NFTs), which underscore SOL’s utility and value. Importantly, he added, the Solana network operates without a central intermediary, adhering to the principle of decentralization. Sigel emphasized that the network’s transaction validation and recordkeeping are managed by a diverse group of independent validators globally, ensuring no single entity can control the system.

Sigel further emphasized that SOL’s decentralized nature, high utility, and economic feasibility align it with other established digital commodities. These characteristics, he claimed, make SOL a valuable asset for investors, builders, and entrepreneurs seeking alternatives to dominant app stores and centralized platforms.

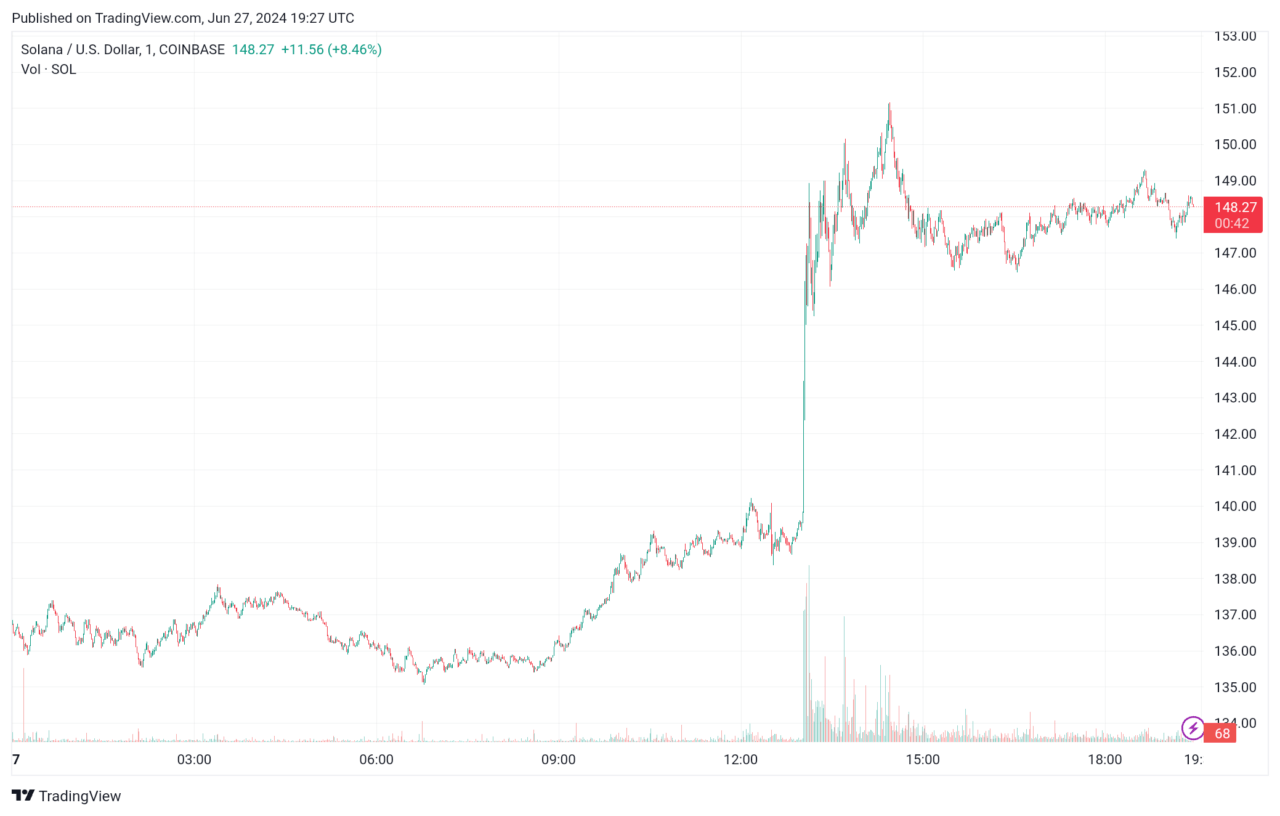

VanEck’s announcement seems to have helped the SOL price to surge nearly 9% today, as you can see from the price chart below: