On 13 June 2024, ARK Invest CEO and CIO Cathie Wood joined CNBC’s “Squawk Box” to discuss the future of Tesla Inc. (NASDAQ: TSLA) and her firm’s five-year price target for the stock.

Cathie Wood began by addressing the recent Tesla shareholder vote, which included a critical decision on Elon Musk’s pay package and moving Tesla’s legal home from Delaware to Texas. Wood expressed her surprise and pleasure at the large institutional shareholders supporting Musk. This vote, she noted, was initially driven by ESG considerations, prompting these institutional players to reconsider their voting strategies. Despite anticipating some legal battles ahead, Wood saw the vote as a healthy discussion for the company’s future.

Wood elaborated on ARK Invest’s new price target for Tesla, set at $2600 per share by 2029. This ambitious target hinges largely on Tesla’s autonomous taxi platform. Wood envisions this platform operating on a SaaS model, generating recurring revenue from every mile driven by these autonomous vehicles. She highlighted the potential for significantly higher margins compared to traditional car sales, with gross margins in the SaaS sector reaching around 80%, compared to the current 16% for automotive.

Wood discussed the potential scale and impact of autonomous mobility, describing it as the largest AI project on Earth. She emphasized the rapid advancements in Tesla’s full self-driving (FSD) technology, which has dramatically improved safety metrics. According to ARK’s research, Tesla vehicles equipped with FSD are significantly safer, with fewer accidents per mile compared to average cars.

The conversation also touched on regulatory challenges. While Elon Musk aims to have the autonomous taxi network operational within a couple of years, regulatory approval remains a crucial hurdle. However, Wood pointed out a shift in public officials’ attitudes. She referenced recent comments by Pete Buttigieg, the U.S. Secretary of Transportation, who seems open to the idea of autonomous vehicles, acknowledging that removing human drivers could drastically improve road safety.

Tesla CEO Elon Musk announced late Wednesday that Tesla shareholders are expected to approve his contentious $56 billion compensation plan and a proposal to relocate the electric vehicle company’s incorporation to Texas.

This news seems to have help Tesla stock, which is up nearly 4% today (as of 10:34 a.m. ET).

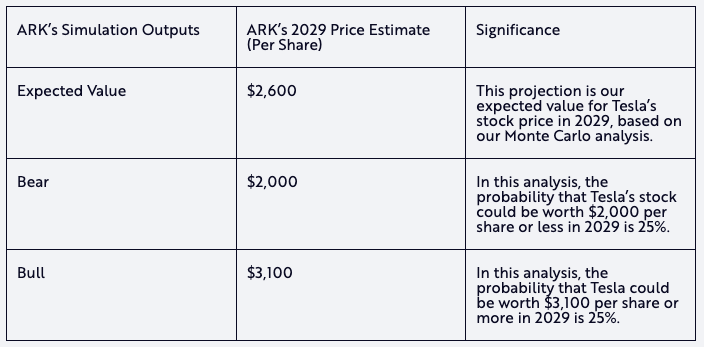

ARK Invest analysts released a report yesterday projecting an expected value of $2,600 per Tesla share by 2029, based on their updated open-source Tesla model. The analysis includes a range of potential outcomes, with a bullish scenario estimating a share price of $3,100 and a bearish scenario predicting $2,000 per share. The model uses distributions for 45 independent inputs to simulate various outcomes for the company’s future performance and stock valuation.

The report also suggests that by 2029, nearly 90% of Tesla’s enterprise value and earnings will come from the robotaxi business. In contrast, electric vehicles are anticipated to account for about a quarter of total sales and roughly 10% of earnings, as ARK believes the robotaxi sector will yield significantly higher margins.