The price of Solana’s native SOL token has plunged to a 45-day low amid a broader cryptocurrency market downturn that has seen the space lose over $100 billion in value. SOL is nevertheless underperforming the wider market.

According to popular cryptocurrency analyst TOBTC, Solana’s underperformance can be attributed to its reduced on-chain activity and a “lack of demand for leveraged positions,” as well s “competition from other smart contract-focused blockchains” such as Ethereum, Arbitrum, and BNB Chain.

The analyst predicted Solana could drop below the $130 support level with a rise in demand or institutional support.

Notably the co-founder of popular cryptocurrency derivatives trading platform BitMEX, Arthur Hayes, has set the cryptocurrency community abuzz with his prediction that Aptos (APT) will overtake Solana as the second-most prominent Layer 1 (L1) blockchain, behind only Ethereum, within the next two to three years.

Solana rose to prominence in 2020 as it addressed Ethereum’s limitations in scalability, transaction speed, and cost and the boom came after Circle expanded its USDC stablecoin onto the Solana network, in a move that came shortly after Tether’s USDT was added.

Also read: AI Prediction: Ethereum (ETH) vs Solana (SOL) – Which Is Likely the Better Buy for the Rest of 2024

The cryptocurrency’s price plunged as before collapsing FTX had heavily supported the Solana ecosystem and was heavily invested in a number of tokens on the network, including SOL itself. The collapse affected Solana by association, but the network has been steadily recovering.

Solana’s climb to prominence accelerated further with the launch of memecoins like BONK in December 2022 and dogwifhat (WIF) in November 2023. Solana’s ecosystem has been seeing growing adoption, with its Saga smartphone, which once faced sluggish sales, selling out recently over a lucrative 30 million BONK token airdrop for each new owner of the phone.

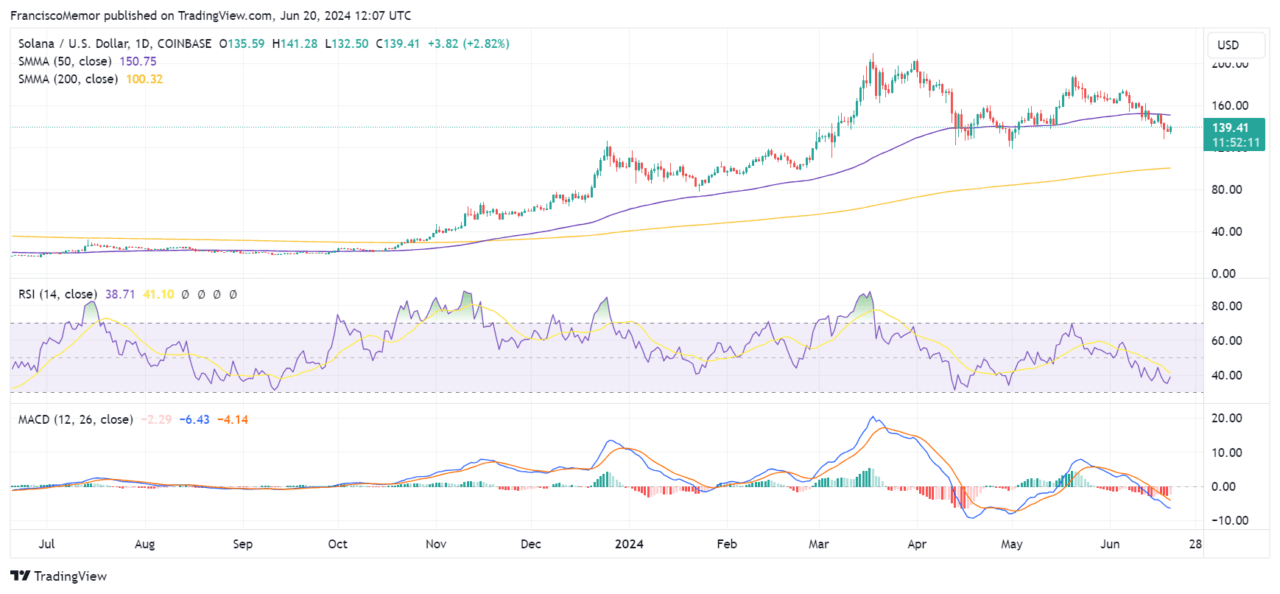

Solana Price Analysis

Solana is at the time of writing trading below the $140 mark after losing over 25% of its value over the last 30-day period, and more than 10% just in the past week. Year-to-date the cryptocurrency is up roughly 37%.

Technical analysis suggests that there’s ongoing bearish sentiment affecting Solana, as its price is below the 50-SMA and above the 200-SMA on the yearly chart, which also points to bullish long-term sentiment.

Its Relative Strength Index (RSI) is currently at around 39, in oversold territory, and is trending downwards as bearish momentum affects the cryptocurrency space as a whole. The Moving Average Convergence Divergence (MACD) line has crossed below the signal line in a bearish signal as well.

The chart also shows that Solana has a support level around the recent low seen near $132.5, and another support around its 200-SMA near the $100 mark. Resistance currently lies at $150.75, near the 50-SMA.

Featured image via Unsplash.