On 6 June 2024, the Industrial and Commercial Bank of China (ICBC) released an insightful research report titled “Macro Economy In-Depth Analysis: The Division and Integration of Digital Currency” that talked about the cryptocurrency space, particularly Bitcoin and Ethereum. The report was written by ICBC analysts Cheng Shi, Dorothy Zhou, and Andy Zhang.

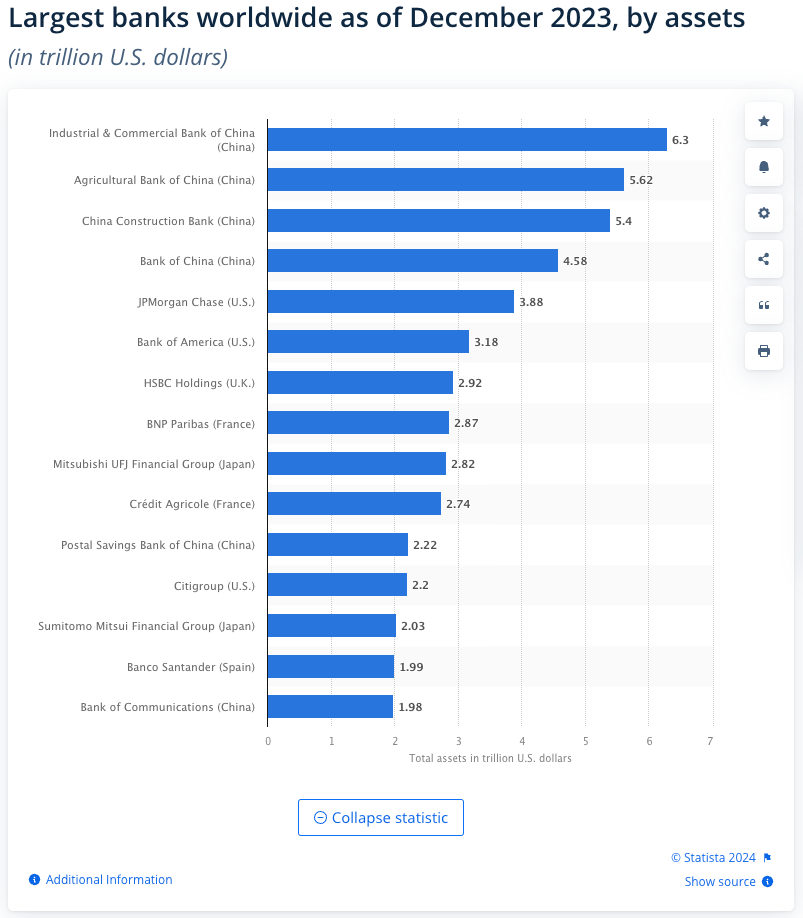

ICBC is the largest banks in the world by total assets (approximately 6.3 trillion U.S. dollars as of the end of 2023, according to Statista).

Founded in 1984 and headquartered in Beijing, ICBC is a state-owned commercial bank that offers a wide range of financial services. These services include retail and corporate banking, investment banking, asset management, insurance, and wealth management.

The bank has an extensive global network, with branches and subsidiaries in numerous countries, providing financial services to millions of personal and corporate clients worldwide. ICBC has built a strong reputation for its technological advancements and efficient customer service. It plays a crucial role in supporting China’s economic development through various financial products and services, including loans, credit cards, and international trade financing.

ICBC is known for its significant contributions to the Chinese economy, particularly in sectors such as infrastructure, manufacturing, and international trade. The bank’s ability to integrate innovative financial technologies and maintain robust risk management practices has helped it achieve a leading position in the global banking industry.

In their research report, ICBC’s analysts emphasize that Bitcoin, often referred to as digital gold, continues to dominate the cryptocurrency market. ICBC highlights Bitcoin’s scarcity, similar to gold, achieved through mathematical limitations, making it a valuable digital asset. However, ICBC notes that Bitcoin’s current attributes as a currency are diminishing due to its volatility, difficulty to authenticate, and inconvenience in transactions. Despite these challenges, ICBC points out that Bitcoin’s asset characteristics are increasingly solidifying, ensuring its relevance as a store of value.

ICBC says that Bitcoin’s role in the market is primarily driven by its established position as the first and most recognized cryptocurrency. ICBC underscores that its use as a speculative investment and a hedge against inflation contributes significantly to its demand. The report notes that Bitcoin’s market performance remains influenced by these factors, highlighting the ongoing need for clarity and stability in its regulatory environment.

ICBC gives considerable attention to Ethereum, describing it as the “digital oil” of the cryptocurrency ecosystem. ICBC states that unlike Bitcoin, Ethereum was designed as a versatile platform, enabling developers to build a wide array of decentralized applications (dApps) through its Turing-complete programming language, Solidity, and its virtual machine, EVM. ICBC emphasizes that this flexibility has allowed Ethereum to become a cornerstone in the decentralized finance (DeFi) sector and non-fungible tokens (NFTs).

ICBC explains that Ethereum’s ability to execute smart contracts securely, including both offensive and defensive code, significantly reduces vulnerabilities and enhances overall network security. ICBC states this attribute is crucial as it underpins the trust and reliability of the Ethereum network.

ICBC notes that the complexity of smart contracts requires substantial computational resources, which can limit transaction processing capacity and increase costs. ICBC highlights that the Ethereum network continuously seeks to overcome these limitations by implementing various scaling solutions. ICBC points out that the transition to Ethereum 2.0, which introduced the Proof of Stake (PoS) consensus mechanism, is a significant step towards improving scalability and energy efficiency.

ICBC’s report reflects a strong commitment to sustainability in Ethereum’s evolution. ICBC states that the PoS mechanism reduces energy consumption compared to the traditional Proof of Work (PoW) model. ICBC notes that ongoing developments in Layer 2 solutions, such as state channels and side chains, aim to further enhance the network’s scalability while maintaining a balance between sustainability, security, and efficiency.

Featured Image via Pixabay