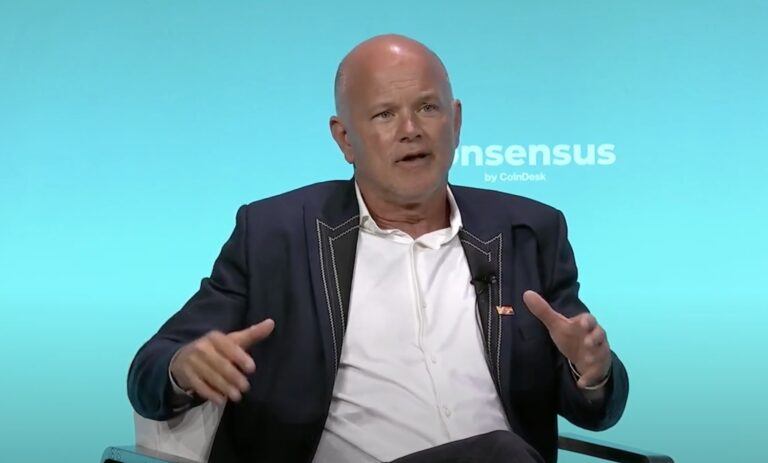

During a conversation with CNBC corrspondenant MacKenzie Sigalos at the recent Consensus 2024 conference (held May 29-31, 2024, in Auston, Texas) Galaxy Digital CEO Mike Novogratz shared his thoughts on the evolving landscape of institutional crypto, political shifts affecting the industry, and the future of digital assets.

Seismic Shifts in Crypto Politics

Novogratz highlighted the recent political upheavals that have significantly influenced the crypto market. He noted a pivotal moment when the White House announced President Biden’s intent to veto the overturn of SAB 121, an arcane accounting rule filed by the SEC. This action led to a political backlash, particularly from the Republican side, with figures like Donald Trump positioning themselves as pro-crypto. Novogratz emphasized that this move has mobilized the crypto community, making it a potent political force. He pointed out that there are now more crypto owners in America than dog owners, many of whom are single-issue voters.

Bipartisan Support and the Future of Regulation

Novogratz says that the political dynamics around crypto are shifting towards a more bipartisan approach. Novogratz mentioned that significant Democratic figures, such as Senators Schumer and Torres, have started to support crypto-friendly legislation, recognizing the substantial voter base. This bipartisan support was exemplified by the passing of FIT 21 in the House, which aims to bring regulatory clarity to the market.

Novogratz believes that the market infrastructure bill and the overturning of restrictive accounting rules are crucial for integrating traditional financial institutions into the crypto space. He anticipates that these changes will enable major custodians like Bank of New York and State Street to start custodying crypto assets, which will pave the way for a broader institutional adoption.

The Impact of Institutional Involvement

The conversation also touched upon the current state and potential future of spot Bitcoin and spot Ether ETFs. Despite the regulatory hurdles, Novogratz is optimistic about the institutional adoption of these products. He explained that institutions are slowly warming up to the idea of crypto, driven largely by client demand. However, he noted that regulatory clarity is essential for the full participation of major financial entities like Goldman Sachs and Morgan Stanley.

Novogratz highlighted that while the current involvement of institutions in crypto is still in its early stages, the potential for growth is immense. He predicts a significant influx of institutional investment once regulatory uncertainties are resolved.

The Role of Crypto in the Broader Economic Context

Novogratz provided a macroeconomic perspective, linking the crypto market’s resilience to broader economic trends. He pointed out that despite the Federal Reserve’s hawkish stance and the absence of expected rate cuts, the crypto market has remained strong. This resilience, according to Novogratz, is due to the U.S. government’s continued fiscal irresponsibility and the growing appeal of Bitcoin as a hedge against inflation and currency devaluation.

Galaxy Digital’s Strategic Direction

Discussing Galaxy Digital, Novogratz outlined the company’s future plans, emphasizing a shift towards on-chain initiatives. He acknowledged the challenges posed by the current regulatory environment but expressed confidence in the eventual resolution of these issues. He also touched on Galaxy’s involvement in the liquidation of the FTX estate, praising the efficiency of the U.S. bankruptcy system in resolving the crisis and returning value to creditors.

Tokenization and the Future of Finance

One of the most forward-looking aspects of Novogratz’s talk was his discussion on tokenization. He believes that the tokenization of assets is a game-changer that will slowly build momentum before rapidly transforming the financial landscape. Novogratz noted that major financial institutions are already preparing for this shift by investing in the necessary infrastructure.