Billionaire venture capitalist Chamath Palihapitiya recently discussed the potential for countries to adopt Bitcoin (BTC) alongside their local currencies.

Chamath Palihapitiya is a Canadian-American venture capitalist, engineer, and the founder and CEO of Social Capital, a venture capital firm that invests in companies across various sectors including technology, healthcare, and education. Born in Sri Lanka in 1976, Palihapitiya moved to Canada with his family as a refugee. He graduated with a degree in electrical engineering from the University of Waterloo.

Palihapitiya’s career began at AOL, where he eventually became the youngest vice president in the company’s history. He later joined Facebook in 2007, where he played a significant role in expanding the social media giant’s user base and business operations, serving as the vice president of user growth. His tenure at Facebook significantly boosted his profile in Silicon Valley.

After leaving Facebook in 2011, Palihapitiya founded Social Capital with the goal of funding and mentoring innovative companies. Under his leadership, Social Capital has invested in a wide array of successful startups, including Slack, Yammer, and Box. Palihapitiya is known for his outspoken views on technology, investing, and social issues, often sharing his thoughts through various media platforms and speaking engagements.

In addition to his venture capital activities, Palihapitiya has made headlines through his involvement with SPACs (Special Purpose Acquisition Companies), using them to take companies like Virgin Galactic public. He is also known for his philanthropy, particularly in areas related to education and scientific research.

In the episode of the All-In Podcast that was released on May 31, Palihapitiya shared insights from his conversation with Wences Casares, a Silicon Valley entrepreneur who introduced him to Bitcoin back in 2010, when the cryptocurrency was trading at around $80.

Palihapitiya recounted a compelling concept presented by Casares, suggesting a path for the mass adoption of Bitcoin. According to Casares, while some countries may never fully endorse Bitcoin, there is a growing number that might adopt a dual-currency system. These countries would use their local currency for everyday transactions and Bitcoin for purchasing permanent assets with lasting value. Palihapitiya highlighted this dual-currency approach as a powerful idea, especially for countries grappling with economic instability.

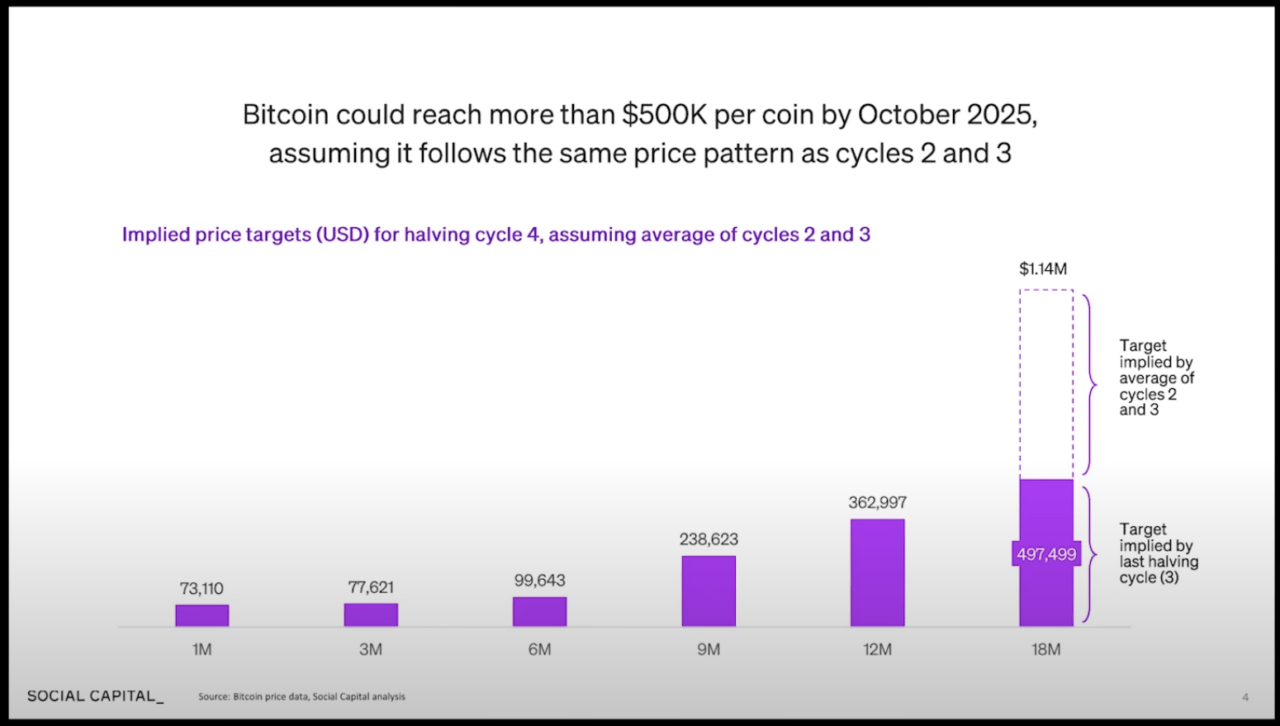

In their discussion, Casares urged Palihapitiya to examine Bitcoin’s performance following its halving events, which cut miners’ rewards in half. Historical data suggests that Bitcoin’s price tends to surge significantly after each halving. Palihapitiya shared a chart predicting that Bitcoin could soar to nearly $500,000 by October 2025 if it follows the same pattern observed in previous market cycles.

Palihapitiya elaborated on the potential for Bitcoin to replace gold as a store of value. He suggested that if Bitcoin reaches the predicted levels of appreciation, it could surpass gold and become a preferred asset for transactions involving hard assets. This scenario becomes even more plausible when considering concerns about the debasement of the U.S. dollar. Palihapitiya believes that such economic conditions could create significant opportunities for Bitcoin.

Featured Image via Pixabay